Squeeze In Franchise FDD, Profits & Costs (2025)

Squeeze In is a daytime dining concept that traces its roots back to 1974, when it first opened in Truckee, California. The restaurant became popular for its large omelettes, generous brunch portions, and energetic, family-oriented vibe.

The Young family took over the original location in 2004 and began refining the operation, creating clearer systems and transforming it into a model that could be replicated through franchising. Today, the company is based in Reno, Nevada.

The brand introduced its franchise program in 2014, driven by rising interest in its straightforward daytime schedule and memorable, personality-driven brand. Its appeal lies in an easy-to-manage operating model, predictable hours, and a loyal customer base that embraces the upbeat breakfast and brunch experience.

Squeeze In offers a broad selection of morning and midday meals, from omelettes and pancakes to burritos, eggs Benedict, burgers, and options for guests seeking gluten-free or plant-based dishes.

Initial Investment

How much does it cost to start a Squeeze In franchise? It costs on average between $202,000 – $522,000 to start a Squeeze In franchised restaurant.

This covers the expenses required to build out a Squeeze In restaurant, including construction, equipment purchases, initial inventory, and early operating costs. The total investment varies based on several elements, such as the size and configuration of the restaurant, the market where it will operate, and whether the franchisee decides to lease or buy the space.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $40,000 |

| Real Property / Site Lease | $5,250 to $18,900 |

| Design / Planning | $1,575 to $8,400 |

| Leasehold Improvements | $21,000 to $236,670 |

| Furniture, Fixtures, and Equipment | $63,000 to $84,000 |

| Smallwares and Opening Inventory | $7,035 to $11,550 |

| Signage | $7,350 to $13,650 |

| Soft Costs | $2,625 to $5,250 |

| Insurance | $2,520 to $5,250 |

| Computer System and Software | $8,400 to $13,650 |

| Initial Training and Opening Assistance | $23,625 to $34,125 |

| Security and Utility Deposits | $262.50 to $3,675 |

| Business Licenses | $1,050 to $15,750 |

| Grand Opening Advertising | $2,625 to $10,000 |

| Additional Funds – 3 Months | $15,575 to $21,000 |

| Total for a Single Franchise Agreement | $201,893 to $521,870 |

Average Revenue (AUV)

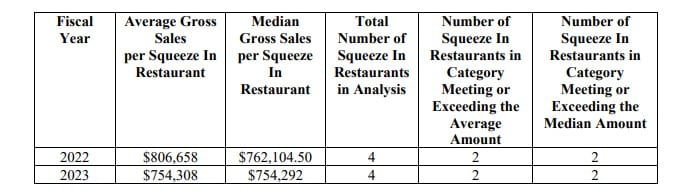

How much revenue can you make with a Squeeze In franchise? A Squeeze In franchised business makes on average $754,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Franchise Disclosure Document

Frequently Asked Questions

How many Squeeze In locations are there?

As of the latest data, Squeeze In operates nine locations across three U.S. states, of which four are franchised.

What is the total investment required to open a Squeeze In franchise?

The total investment required to open a Squeeze In franchise ranges from $202,000 to $522,000.

What are the ongoing fees for a Squeeze In franchise?

Ongoing fees for a Squeeze In franchise include a royalty fee of 5% of net sales, which franchisees pay to access the brand, its systems, and ongoing support. Franchisees also contribute 3% of net sales to the system’s marketing fund, which covers national and brand-level advertising efforts.

Who owns Squeeze In?

Squeeze In is owned by the Young family — sisters Shila Morris and Kay Young (and the broader Young family) are the controlling owners

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.