Cap Table & Startups: Full Guide + Free Template

A cap table (short for “capitalization tables”) can easily be confusing for startups. Yet as a founder, you must be able to clearly understand how cap tables work, and how to manage yours. In this article we tell you everything you should about cap tables for startups, we’ve also included a free template to download below to follow along!

What is a cap table? What are the different terms and instruments you should know about? How to build yours? How does it impact your ownership and capital wealth? Let’s dive in!

What is a Cap Table?

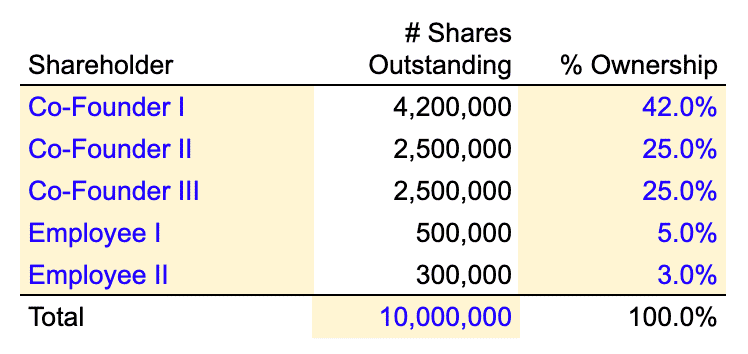

A cap table is a document, often in the form of a spreadsheet document (e.g. Excel or Google Sheets) that provides information on a company’s ownership. In other words, a cap table tells us who own the business, and how much.

A cap table lists, for each investor:

- The type of securities they own (stock, convertible notes, options, warrants, etc.)

- How much they paid for the securities

- What’s the value of these securities today (as per the latest fundraising round)

- What percentage of the business they own

Because it evolves with the different equity rounds a startup can raise over its lifetime, a startup cap table is kept up to date and maintained regularly. Therefore, for each new fundraising round you’ll need to update your capitalization table.

Cap Tables & Valuation

The first reason why you would need a cap table is to understand your business’ ownership structure. Equity ownership dictates how much interest you own (the value of your shares) and how much control you have over your business.

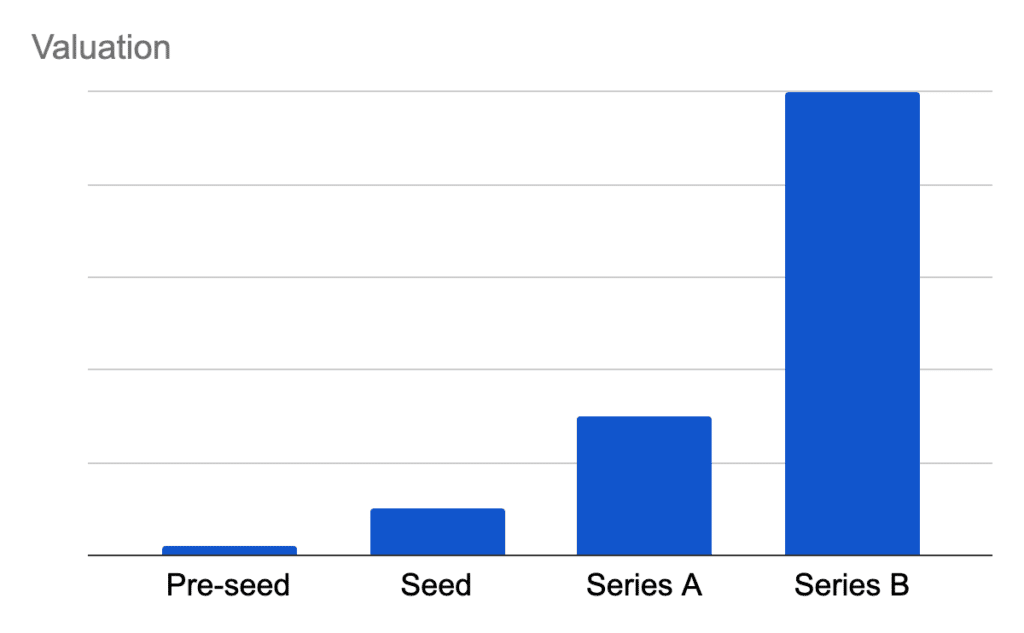

When calculating percentage ownership, we always need to assess a valuation for the business. The valuation investors would have agreed on as part of a funding round dictates how much ownership new investors get for their investment.

For example, assuming your startup pre-money is $10 million, and a new investor comes in with an additional $2 million investment, that investor would then own ~17% (= $2 / 12 million).

Pre-money vs. Post-money valuation

When looking at startup valuation and cap tables, it’s crucial to understand the difference between pre- and post-money valuation:

- Pre-money valuation: it’s the valuation of your business before a funding round

- Post-money valuation: the valuation of your business, adding up the new funding round investment

For example, if your startup is worth $10 million before its Series A, we’ll refer to it as pre-money valuation. Now, if you raise $2 million for your Series A, your post-money valuation will be $12 million.

Post-money valuation

= Pre-money valuation + Investment amount

Pre- and post-money valuation are very important to understand in the context of a capitalization table. Indeed, the percentage ownership a new investor gets is the result of the following equation:

Percentage ownership (Investor A)

= Investment amount (Investment A) / Post-money valuation

So, in our example above:

$2 million / $12 million = 16.7%

How to value a startup?

There’s a number of methods you can use to assess a fair valuation for your startup. All methods will require you to build financial projections for your business.

Whilst we won't discuss how to value startups as part of this article, make sure to check our free resources below: How Investors (Really) Value Startups: 4 Methodologies Explained Tech Startups Valuation: Case Study [Free template] How To Value A Pre-Revenue Startup? Pre vs. Post-Money Valuation: Definition & Example [Free Template]

Cap Tables & Securities

Cap tables can be either relatively simple, or very complex. The degree of complexity varies with the number of investors and the number of different securities included within a cap table.

Securities are financial instruments that defines investors equity ownership and level of control over a business. By oversimplification we sometimes refer any type of security as “shares”. Unfortunately, this is wrong, and can easily lead to misunderstanding amongst founders.

Not all securities are shares, and not all types of securities bear the same characteristics. See below a glossary of all the different type securities you might encounter when reading a startup cap table:

Common stock

Common stock (or “common shares”) is the most common form of equity. It is also the type of security that is created when your company is formed, and is usually granted to founders and employees at the beginning.

Preferred stock

Preferred stock (or “preferred shares”) is the type of equity investors purchase most often.

Unlike common stock, preferred shares come with preferential treatment clauses over common stock. All of these clauses are negotiated as part of the term sheet and can include: liquidation preference, anti-dilution, conversion rights, etc.

For more information on what preferred shares are and the specific clauses they include, read our article here.

Options

Stock options are a specific type of equity security. They give an investor the right to purchase shares (common or preferred stock) at a pre-agreed share price.

ESOP (short for “Employee Share Ownership Plan“) is the most common type of stock option. ESOP is a pool of options a startup reserve to issue to its employees (or some of its employees) in the future.

Companies use ESOP shares to align the interests of their employees with those of their shareholders (the founders, VCs and angel investors for startups).

When an employee (or investor) exercise a stock option and buy shares, the number of stock options left in the pool reduces by the same amount.

Outstanding vs. Fully diluted shares: what is the difference?

When dealing with options, it’s very important to understand the difference between outstanding and fully diluted shares:

- Outstanding shares are the sum of all of a company’s issued common and preferred stock. Shares that aren’t been issued yet are excluded from outstanding shares

- Fully diluted shares are the sum of all security types: common and preferred stock, stock options, any convertible notes and SAFE (more on that below).

Whilst outstanding shares give a clear view of all issued shares, the number of fully diluted shares assumes all securities that can be converted to equity are converted as such. That’s why options that aren’t yet exercised aren’t included in outstanding shares but in fully diluted shares count instead.

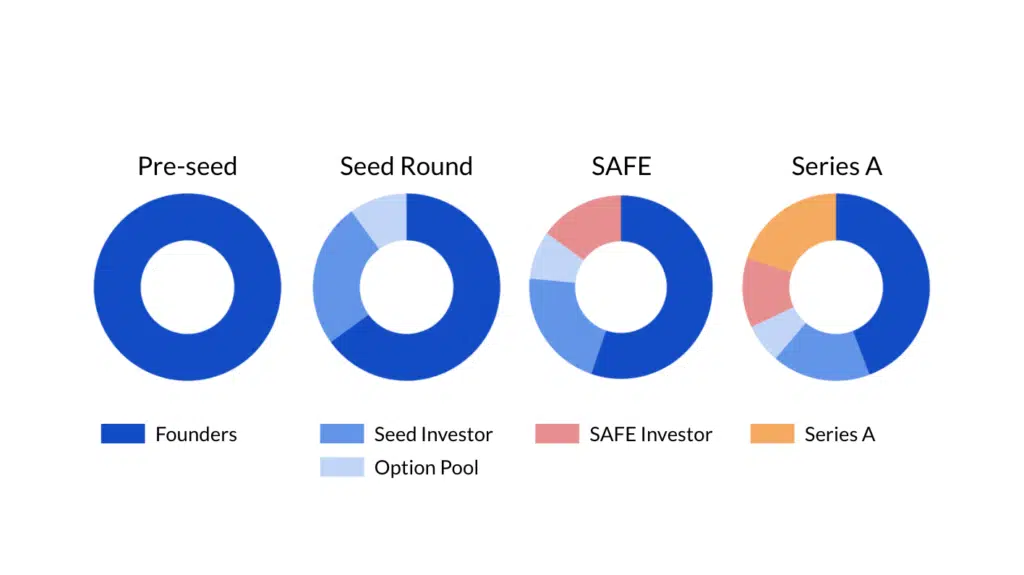

Convertible notes

Convertible notes (or “convertible debt”) are a form of debt that can convert into equity at a pre-agreed price. It has become increasingly common recently as it allows early-stage startups to raise money more easily vs. standard form of equity (e.g. common and preferred shares).

Read our article on convertible debt for startups for more information on how convertible notes work, and how they can impact your cap table.

SAFE

SAFE (short for “Simple Agreement for Future Equity”) is a type of convertible debt. Unlike standard convertible debt though, SAFE doesn’t have a maturity date nor carry any interest.

Therefore, investors often use SAFE to “bridge” the gap between 2 funding rounds. Indeed, it allows startups to raise money quickly, without the risk of accrued interest nor maturity dates.

Warrants

Warrants are very similar to stock options. Indeed, like options, they give an investor the right to purchase shares at a pre-agreed price within a specific time period.

Yet, unlike stock options, warrants are usually one-off transactions. Therefore, there isn’t any pool of warrants made available to be granted to future employees for instance. Instead, warrants are issued to investors. For a detailed list of differences between warrants and stock options, see this article here.

Our Startup Cap Table Template

If you’re raising your first round, you must understand how cap tables work.

It’s very important that you get it right to avoid (costly) mistakes down the road. Indeed, unnecessary complex and/or imbalanced cap tables in the earliest funding rounds can create significant problems for future rounds, for you as a founder, or potential future investors.

That’s why we’ve built this cap table template for startups and founders to better understand cap tables and their mechanics.

Whilst you can very well maintain this cap table template updated in the future, we strongly recommend to use an online cap table management platform instead as it will save you time, and avoid mistakes.