Ecommerce Valuation: How To Value Your Ecommerce Business?

Are you looking to sell your online shop or raising funds from investors? Or are you simply interested in knowing what’s a fair valuation for your ecommerce business?

In this article we explain you how to assess an accurate valuation for your ecommerce business, whether you have a Shopify store, Amazon FBA business, or any type of ecommerce.

Use a multiple valuation methodology

The most commonly used methodology when assessing a e-commerce valuation is using a multiple approach: your business worth is calculated using your financials and a multiple. Financials are either revenues, or EBITDA, and taken over the last twelve months.

Let’s first take a look at the revenue multiple approach to determine your ecommerce valuation.

Example:

Let’s assume we are in September 2022, and we value a Shopify store with $1,250k sales over the last twelve months (October 2021 to September 2022) and a 3x revenue multiple, valuation is:

Valuation = LTM Revenues x Revenue multiple

Valuation = 1,250 x 3 = $3.8M

Whilst revenue is the easiest way to obtain an indicative valuation for your online shop, EBITDA is the most accurate and should be used instead in most cases (we will see in the next section when to use revenue vs. EBITDA).

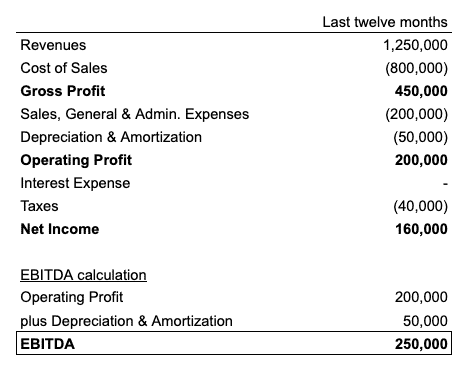

But first, what is EBITDA? EBITDA stands for Earnings Before Interests and Depreciation and Amortization. If you need a refresher, have a look at the definition here.

In short, EBITDA is a measure of profitability of your business. Let’s assume the profit-and-loss of our online shop example above, this is how we would get to EBITDA:

Therefore, applying the same logic as for revenue multiple valuation, an indicative valuation of the business using EBITDA could be:

Example:

LTM sales are $1,250k and LTM EBITDA is $250k. Assuming we are using a 15x multiple, valuation is:

Valuation = LTM EBITDA x EBITDA multiple

Valuation = $250k x 15 = $3.8M

Naturally, revenue multiples will always be lower vs. EBITDA multiples for the same business (3x vs. 15x in our example above).

Ecommerce valuation: Revenue vs. EBITDA

Whilst we used both methodologies in our example above, each approach has its advantages and drawbacks. As such, the methodology you should use depends on your business. Let’s review in which cases you should use one of the other.

1. EBITDA multiple valuation

EBITDA multiple is the most accurate methodology as it takes into account the profitability of your business: a $10M sales business with 2% EBITDA margin has the same EBITDA vs. a $1M sales with 20% margin. Yet, using revenue multiple alone, we would obtain significantly different valuations.

Whilst EBITDA multiple is the most accurate, it should be used only for mature businesses (growing at single digits and/or flat growth). Indeed, unlike high-growth startups, mature businesses have steady EBITDA numbers, therefore their EBITDA is a reliable metric to use to assess valuation.

2. Revenue multiple valuation

In comparison, revenue multiple valuations should be used for high-growth ecommerce businesses and/or businesses investing substantially in their operations and/or R&D.

That’s why most ecommerce startups use a revenue-based multiple valuation methodology. Startups and high-growth businesses indeed have very volatile EBITDA numbers.

Let’s have a look at an example below and see why revenue multiple is most commonly used by high-growth ecommerce startups:

Let’s assume we run an online shop with $500,000 sales at September 2022 (last 12 months):

– $400,000 variable costs (inventory, marketing, etc.)

– $80,000 variable costs (salaries, bookkeeping, etc.)

The business therefore only has a $20,000 EBITDA (4% sales). Yet, it also has operating leverage: because part of its expenses are fixed ($80,000), a +10% increase in revenue (+$50,000) result in an increase of $30,000 in profits (EBITDA).

So, for example, in October 2022 the business will have: $550,000 in sales and $50,000 EBITDA (9% sales).

So assuming we used a 10x EBITDA multiple in September 2022 would give us a $200,000 valuation but $500,000 in October..!

In comparison, using a 0.4x Revenue multiple would result in $200,000 valuation in September and $220,000 in October, which makes more sense.

In addition, e-commerce businesses which invest heavily into R&D and Operations (i.e. more than they would if they were mature) typically have lower margins they would if they did not invest as much.

Yet, good investment brings profits in the future, that is the reason we would not use EBITDA for such businesses as their valuation would suffer from low EBITDA numbers, whilst they are actually investing to increase it in the future.

How to find your ecommerce valuation multiple

Once you have chosen the most suitable metric for your business (Revenues or EBITDA), it is time to assess the multiple.

Let’s start with revenues multiples: because of the availability of public information, benchmarks for revenues multiples are the easiest to find. Indeed, ecommerce businesses on the sale are usually publicly share their (suggested) sale price and last twelve months revenues (EBITDA, in comparison, is very rarely disclosed publicly).

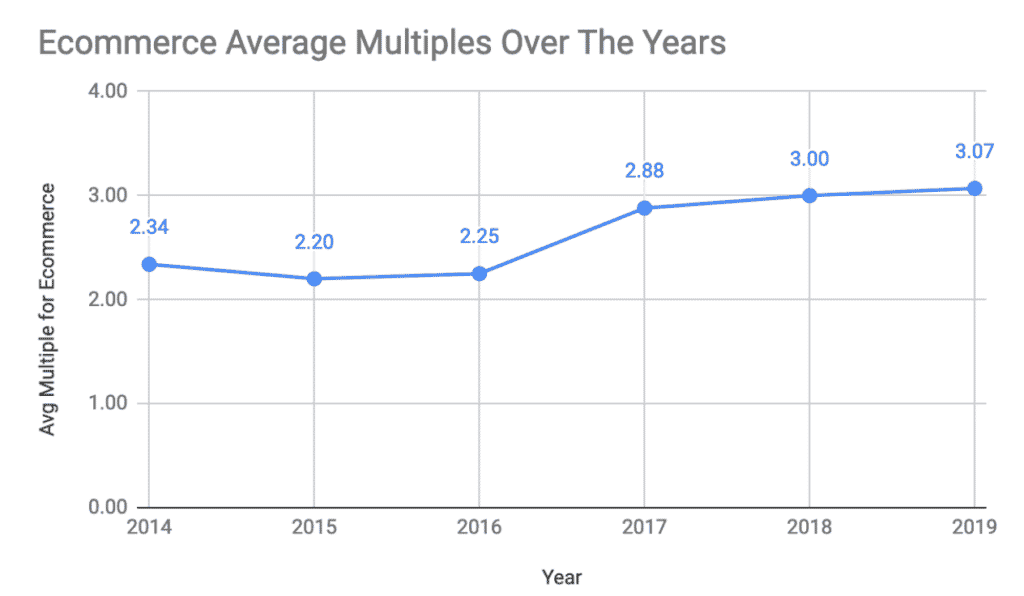

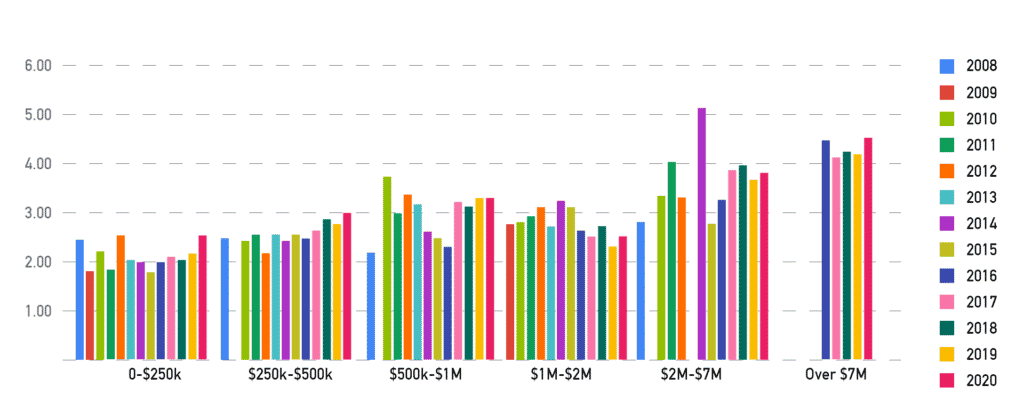

Industry average revenue multiples for e-commerce businesses and online shops of all types typically range from 2x to 4x, and the average has been increasing recently.

In general, the larger your business, the more it is worth: indeed it is safe to assume a larger business has fewer risks than a early-stage, smaller startup (therefore more valuable).

Whilst most businesses trade at 2-4x revenue multiples, EBITDA multiples typically range from 10-20x. Indeed, most e-commerce businesses have lower margins vs. other tech businesses (for instance, Peloton EBITDA margin was -2% in 2020), their EBITDA multiple are therefore much higher.

If your e-commerce business is mature (growth is coming to a plateau) and/or growing steadily but not double digits growth either, choose EBITDA. Otherwise, choose a revenue multiple instead.

What are the drivers affecting your ecommerce valuation mutliple?

You have chosen your metric (say revenues) and have an indicative range for your multiple (say 2 – 4x revenue multiple). Yet, you aren’t sure where your multiple fit within the 2 – 4x industry average. Let’s see how you can assess a suitable multiple, within the range, that suits your business.

Whether you are at the low or high-end of the industry average range is a function of where your business is positioned in regards to the following factors:

1. Age of business

As rule of thumb, e-commerce businesses that has shown steady growth for a long period of time (3-5+ years) will tend to fetch a premium multiple vs. businesses that have been operating for less than 3 years.

Most buyers and investors will not even consider an e-commerce business that has been operating for less than a year.

The reason is simple: the longer you have been around, the less risks is your business exposed to: your scale is larger, your brand is stronger, etc. All in all, you have higher barriers to entry, increasing your valuation.

2. Growth

In general, the higher revenue growth, the higher the multiple. This is especially true for businesses with more than 3 years of operations because, as explained above, they have high barriers to entry but still show they can still grow and capture larger parts of their market.

3. Revenue concentration

Online stores which sell a limited number of SKUs are inherently subject to some competition or market risk: what if a new entrants comes with a significantly better and/or lower price product? What if people switch to another provider or brand because your product is now obsolete?

E-commerce businesses that show strong diversification of revenues will tend to have a premium multiple over competitors which only offer a limited set of SKUs.

4. Traffic quality

Are you orders coming from paid marketing or organic traffic? Do you generate leads organically via SEO, content, social media? Or do you only make sales via paid ads (Google Ads, Facebook/Instagram, etc.)?

As a general rule, the higher the proportion of revenues that come from organic sources (vs. paid), the higher the multiple. This is true for 2 reasons:

- By definition paid ads incur costs (you pay per click or per impression). Therefore, unlike organic traffic, a minimum level of sales is required to be profitable with paid acquisition. Your return on investment is lower

- Organic traffic, unlike paid marketing, creates barriers to entry. Imagine having a competitor with 1,000 articles and top rankings on Google Search: this is extremely challenging to replicate. Organic traffic takes more time to produce results, yet they can be far more important and lasting vs. paid acquisition

5. Inventory vs. no inventory

Ecommerce businesses either have inventory or not (think dropshipping). In most cases, having no inventory will reduce your risks (underselling, bad goods, etc.). It will also reduce the capital required to operate your own warehousing operations (warehouse, fulfilment centres, etc.) which have their own risks (maintenance, depreciation, insurance, etc.).

Operating a online shop without any inventory will likely reduce these risks and result in a higher multiple.

6. Customer Retention

Like any other business, demonstrating you can generate repeat sales and customer stickiness will result in a premium multiple.

Apart from being a proof of customer satisfaction, repeat sales are very positive from a valuation standpoint:

- A repeat sale mean you acquired one customer who purchased multiple times (at least two) over his/her lifetime. Therefore your cost of acquisition is lower, and your return on investment higher

- Repeat sales can also be the product of a great customer retention strategy (your community on social media for instance). It increases the likelihood of you upselling other services / products in the future. Let’s use our Peloton example again: they acquire most of their customers via the sale of bikes and treads, yet they upsell to the same customers accessories, classes, and apparel later on