5 Ways to Limit Equity Dilution for Startups

Whilst raising equity is already challenging for startups, avoiding too much equity dilution needs a lot of attention from founders when negotiating term sheets. Equity dilution can happen very quickly and might be disastrous for founders and early stage investors.

To avoid losing control of your business or money altogether, limiting equity dilution should be one of your key focus when raising capital from investors.

In this article we will go through the 5 takeaways you should seriously consider when raising money for your startup. If done correctly, you will make sure to get the best deal out of your fundraising round. Let’s dive in!

What exactly is equity dilution for startups?

Equity dilution (or “stock dilution”) occurs when a company issues new shares (to investors or employees). As a result, the ownership percentage of existing investors gets reduced: they are “diluted”.

Therefore, dilution is inevitable. More importantly, dilution is absolutely normal for any startup: the more you grow, the more likely you will need to raise additional capital from new investors, the more dilution you will be subject to as a founder.

What are the 2 most common causes of stock dilution?

There are 2 scenarios where equity dilution happens for a startup:

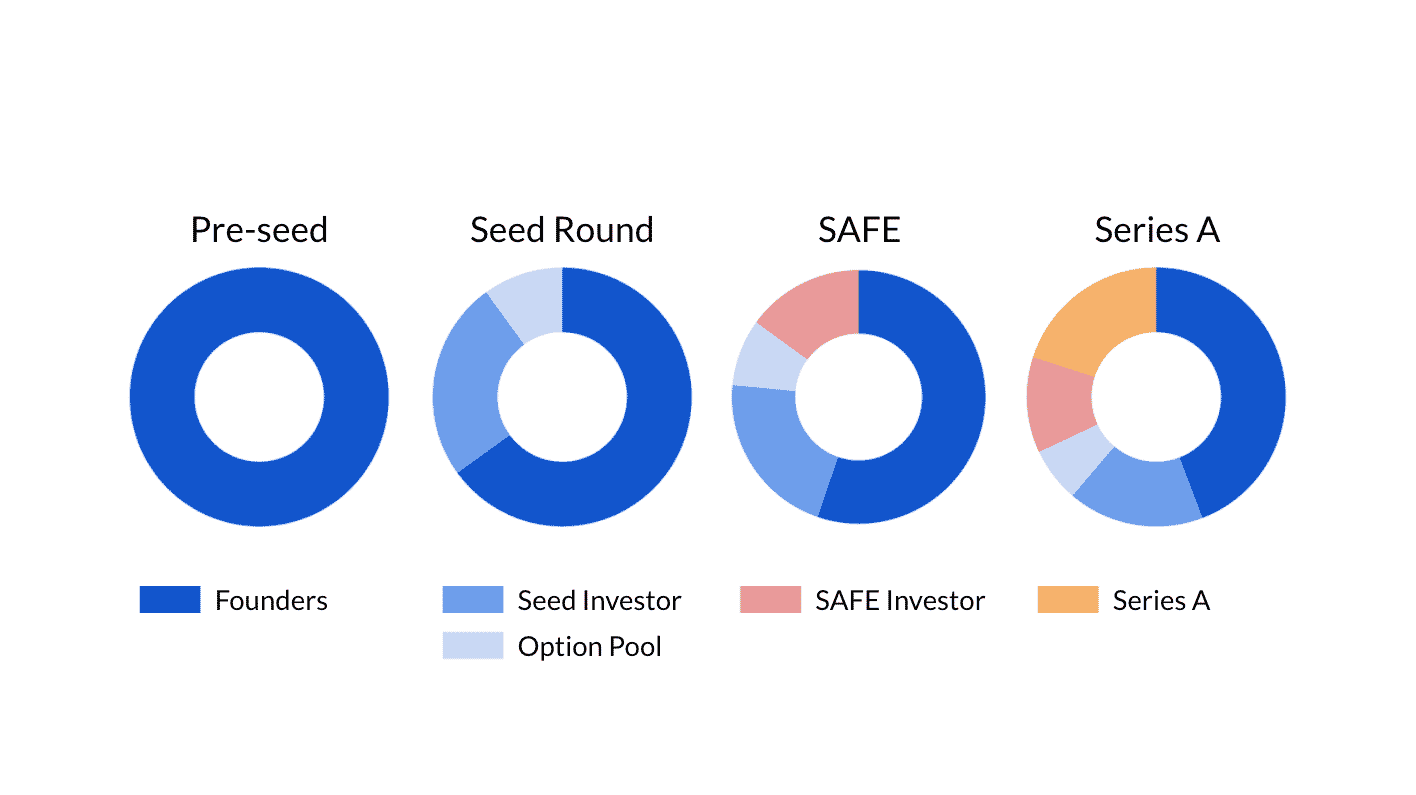

- Fundraising rounds. When a startup raise equity from investors, it issues new shares to new investors in return for their investment. Startups can also issue convertible notes (or SAFE) that are a form of debt which can convert into equity at a given price. When they convert, startups need to issue new shares which dilutes existing investors.

- Stock options pools. Startups often create stock options pool for employees (ESOPs for Employee Stock Option Pools). These pools of options can be exercised at a later stage and convert into shares. When options convert, startups need to issue additional shares in return for the corresponding cancelled options.

Other (less common) dilution scenarios

In addition with the 2 most common causes above, there are some cases where startups are forced to issue additional shares. This, in turn, further dilutes existing investors, especially founders.

These are rare situations. Yet they can be destructive for existing founders as they can trigger significant equity dilution for founders and other common stockholders, to the benefit of preferred shareholders.

The most common examples of such situations are anti-dilution clauses.

Originally designed to protect preferred investors in the case of a down-round, excessive anti-dilution clauses can reduce significantly founders’ share ownership (see Full Ratchet Anti-Dilution clause in our top 5 red flags to look out for in your term sheet).

1. Do not raise too much

The first takeaway to limit your startup’s equity dilution isn’t necessarily is the most obvious.

When you raise capital from investors, it’s important you do not raise too much for a number of reasons which we’ve discussed in detail in our article here.

One of these reasons is dilution.

Many startup founders think more is always better. It is not. Raising too much can bring serious problems down the road. There are 2 sides to this problem:

The more you raise, the more shares you will need to issue

This follows what we just discussed earlier in this article. For example, if you need $2 million to get to profitability, why would you raise $5 million?

To accommodate a large round, investors need to adjust valuation, which can be disastrous

This can be a very big problem if things do go well in the future. Let’s use an example:

Say you raise $1.5M from an investor at a $1M pre-money valuation. This means you theoretically should sell 60% of your company’s shares to this investor. Your post money valuation is $2.5M, and the $1.5M raise represents 60% share equity.

Unless you are willing to leave 60% to an investor (which you likely will not), you will have to set a higher ‘artificial’ valuation of your business so the percentage you sell to the investor is lower. Assuming you want to leave 20% instead, this means your pre-money valuation is not $1M but $6M!

Unfortunately, the inflated valuation you would have agreed on with your seed investor may put a lot of strain on a startup if things don’t go well.

Indeed, if your startup don’t perform as well as you promised investors, you’ll likely need to raise money again, and it will be very difficult to justify a higher valuation at that time, leading to a “down-round“.

Let’s now use the same example but assume you need to raise again in the future.

Growth has not been as expected, and you need to use the same $6M pre-money valuation. You need $5M Series A this time which means you are leaving 50% off the table to new Series A investors. Bad news: you only own 30% of your company now. You could have owned much more if you would have set a realistic valuation when raising your seed round.

The impact of down-rounds can be disastrous, especially in light of pref investors’ anti-dilution clauses discussed above.

2. Use SAFE and convertible notes cautiously

SAFE and convertible notes are a form of debt that converts into equity at a pre-agreed price. These types of securities are very attractive for startups as access to funds is quicker.

For example, there is no need to agree on a startup valuation when creating SAFE or convertible notes. Instead, these instruments rely on a future round to set valuation, and therefore, to set the number of shares that need to be issued.

Yet, these types of securities also have some drawbacks. One of the disadvantages of convertible debt and SAFE is that the conversion from debt to shares can sometimes lead to substantial dilution. This is due to 2 reasons:

Convertible debt convert into shares at a discount

Convertible notes (and SAFE) investors typically get a discount on the price of the shares they have a right to convert to. The discount compensate them for the risk they took by investing earlier.

Let’s assume:

A $200k convertible note with a 20% discount rate

The company raises money at $1 per share at the next equity funding round (Series A)

Therefore, instead of getting 200,000 shares like any Series A investor, convertible debt investors get 250,000 ($200k / $0.80 per share).

So, to limit equity dilution from convertible debt, make sure you limit the discount rate to 20% maximum.

Also, don’t rely on it for too long either. Indeed, convertible debt sometimes carries an accruing interest rate which increase dilution when converted to equity.

Convertible debt comes with valuation caps

Valuation caps set the maximum price at which a convertible debt will convert into equity. Caps are designed to protect convertible debt investors from excessive dilution. Indeed, if valuation at the next round is too high, convertible debt investors risk getting less shares than what they expected when they first invested. See more on that in our article here.

The problem for other investors (especially founders) is that the lower the cap, the better for the investor.

Therefore, to protect yourself vs. excessive dilution, make sure the valuation cap isn’t too low.

3. Limit the stock option pool

Stock options are a specific type of equity security. They give an investor the right to purchase shares (common or preferred stock) at a pre-agreed share price.

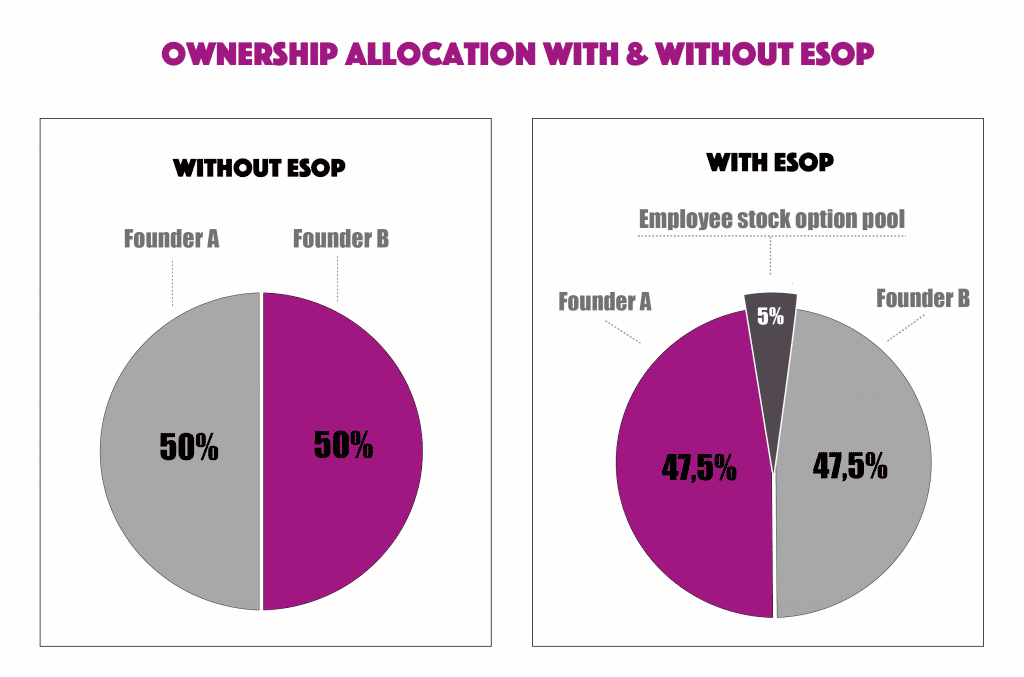

ESOP (short for “Employee Share Ownership Plan“) is the most common type of stock option. ESOP is a pool of options a startup reserve to issue to its employees (or some of its employees) in the future.

Before each fundraising round, investors will ask you to either create an ESOP (for the first round) or increase that pool. Most startups typically have 10-15% of total shares as the ESOP pool.

The problem with ESOPs and stock options in general is that they are created out of the pre-money valuation. This means only existing investors get diluted as part of the creation (or increase of the existing ESOP).

Therefore, to limit equity dilution, you will need to make the ESOP large enough to make sure all new hires get the ESOPs they deserve, yet not too much to get too diluted either.

In order to decide what ESOP you should create for your employees, we strongly recommend creating a solid hiring plan forecast for your future hires. If you haven’t done so already, see our article with a free template here.

4. Avoid excessive preferred investors clauses

Startups can suffer from significant equity dilution due to excessive clauses in their term sheets. These clauses are originally designed to protect preferred investors yet can be detrimental for other investors, especially founders.

There are 2 clauses you should be careful not to agree on. If they come across in your term sheet negotiations, push back as they aren’t market standard anymore:

If you want to learn more about these clauses and why they are red flags for startups, see our article on the top red flags you should avoid in your term sheet.

5. Model cap table scenarios

The major problem of equity dilutions for startups is that whenever you realise the impact of dilution, it’s already too late. Indeed, dilution is due to terms and clauses you’ve already agreed on in the past as part of your term sheet and binding investor agreements.

Therefore, to avoid costly mistakes for you as a founder (or investor), make sure to forecast and model different scenarios for your cap table. This will allow you to understand the worst case scenarios that may happen down the road if you agree to certain terms.

For a complete guide on cap tables for startups (+ a free template), see our article here. Also, for an example of exit waterfall and the impact of liquidation preference clauses on exit proceeds for founders and investors, read our article here.

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support