This article was updated with the 2023 Franchise Disclosure Document

Goodcents is a fast-casual restaurant franchise that specializes in subs, pasta, and other comfort foods. With over 80 locations across the US, it’s an attractive sandwich chain for customers seeking quality food at a reasonable price.

It’s also affordable for franchisees: the initial investment required to open a new Goodcents is $421,000 on average. What about profits? With an Average Unit Volume of $760,000 it does seem like a profitable investment. Is it really?

In this article we’re looking at Goodcents and its Franchise Disclosure Document to find out how much it (really) costs and how profitable it is. Let’s dive in!

Key stats

| Franchise fee | $30,000 |

| Royalty fee | 6.00% |

| Marketing fee | 6.50% |

| Investment (mid-point) | $421,000 |

| Average sales | $760,000 |

| Sales to investment ratio | - |

| Payback period | [franchise_value_investment_payback] |

| Minimum net worth | |

| Minimum liquid capital |

Find the most profitable franchises on

Compare 1,000+ franchises and download unlimited FDDs

| Goodcents Deli Fresh Subs |

| FRANCHISE FEE | $30,000 |

| ROYALTY FEE | 6.00% |

| INITIAL INVESTMENT | $333,000 – $509,000 |

| AVERAGE REVENUE | $760,000 |

About Goodcents

Goodcents (formerly “Goodcents Deli Fresh Subs”) is a quick-service restaurant chain that strives to give the highest quality sandwich for every client visit.

It was founded in 1989 in Lenexa, Kansas, by Joseph Bisogno after years of experience with the McDonald’s Corp.

The sub sandwich and restaurant franchising company offers drive-through, dine-in, carry-out, and delivery of sandwiches, pasta and soup.

It brings freshness to every meal prep, including its delicious cheeses, baked bread and meats.The first Goodcents franchise was opened in 1991, and today there are over 64 franchised restaurants worldwide, with over 60 active units in the US.

How much does a Goodcents franchise cost?

You would need to invest on average $421,000 to open a Goodcents franchise.

Startup costs

Here’s the full breakdown of costs:

| Type of Expenditure | Low | High |

|---|---|---|

| Initial Franchise Fee | $15,000 | $30,000 |

| Formation Costs | $282,800 | $421,300 |

| Initial Marketing | $7,500 | $15,000 |

| Operating Costs | $28,000 | $42,800 |

| Total | $333,300 | $509,100 |

What’s the franchise fee?

The initial franchise fee for a Goodcents Deli Fresh Subs franchise is $30,000

In addition to the initial franchise fee, you must pay to the franchisor a royalty fee of 6.00% of revenues, as well as a variable marketing fee of 6.50% of revenues.

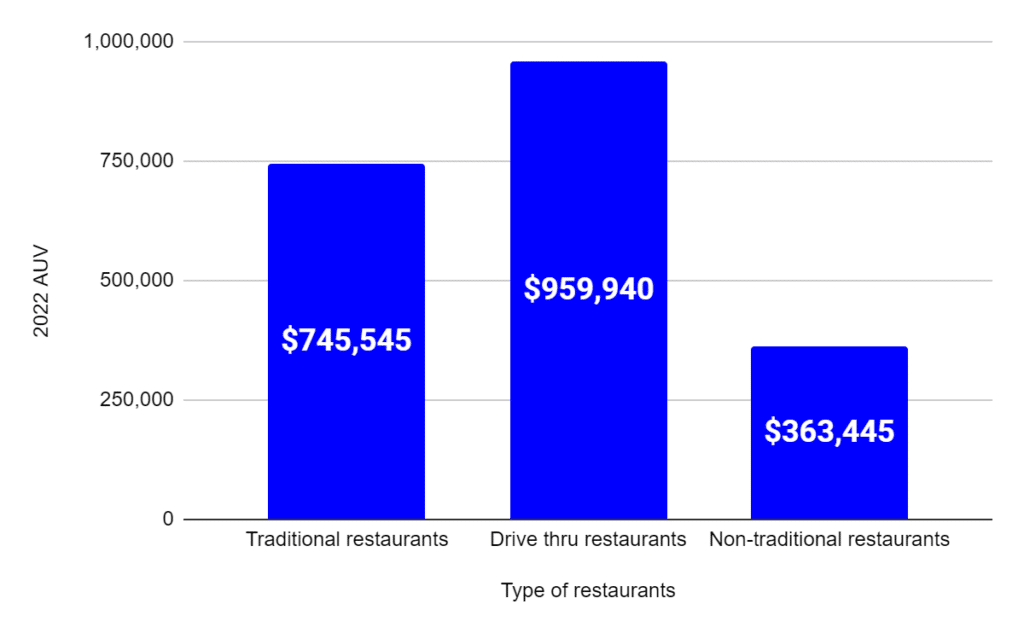

What’s the AUV of a Goodcents franchise?

On average, a Goodcents franchise generates $760,000 in revenue per year.

How profitable is a Goodcents franchise?

A Goodcents restaurant makes $121,000 in profits per year on average. This corresponds to a 11% EBITDA margin.

Note that this comes right from the latest Franchise Disclosure Document: we didn’t invent anything. Indeed, Goodcents provides detailed information on the profitability of its restaurants, which we are summarizing below.

| Profit and loss | Amount | % Net Sales |

|---|---|---|

| Net Sales | $1,077,230 | 100% |

| COGS | $380,478 | 35.3% |

| Labor | $282,019 | 26.2% |

| Controllable Expenses | $117,741 | 10.9% |

| Non-Controllable Expenses | $176,235 | 16.4% |

| EBITDA | $120,650 | 11.2% |

Find the most profitable franchises on

Compare 1,000+ franchises and download unlimited FDDs

| Goodcents Deli Fresh Subs |

| FRANCHISE FEE | $30,000 |

| ROYALTY FEE | 6.00% |

| INITIAL INVESTMENT | $333,000 – $509,000 |

| AVERAGE REVENUE | $760,000 |

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.