Whether you are about to launch a new marketplace or fundraising for your existing business, building a solid marketplace financial model is a key step every founder must go through.

Whilst early-stage startups, having a high inherent level of risk, are likely not to have fully accurate financial projections, building a rock-solid financial model will definitely give you a clear advantage in understanding your business. In this article we guide you through all the key steps you need to follow to build your own.

Looking for a template instead? Check out our template and save yourself hours of work!

What is a marketplace financial model?

The number of marketplaces, a newer form of ecommerce, has exploded in the past 10 years and is expected to continue doing so: the online marketplace industry is expected to grow from $2Tr today up to $7Tr by 2024 (see article here). Whilst the general public mostly know the larger firms (Amazon and the like), new types of marketplaces, both B2C and B2B, have emerged and specialize in specific audiences and/or product and services.

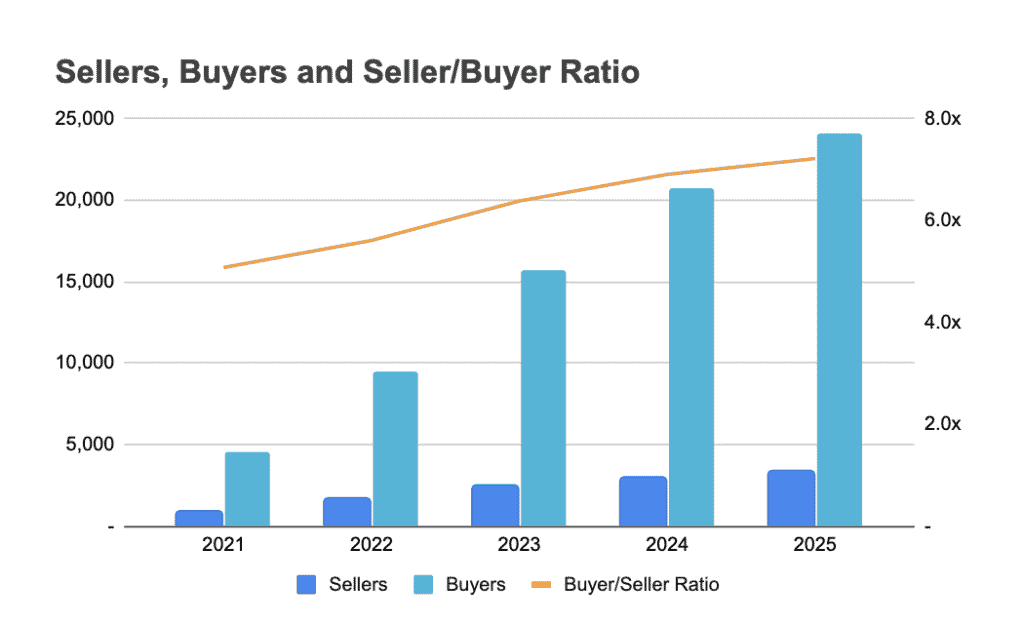

Because of their two-sided nature (supply and demand), marketplaces are especially intricate business models, and therefore have specific revenue models and metrics of their own (think buyers:seller ratio and buyers repeat rate to name a few).

The keys to growth for marketplace businesses is to demonstrate retention: the more buyers come back and the more frequent they do, the higher the customer (or buyer) lifetime value, therefore the more valuable your business will be.

Want to know more about the 10 most important marketplace key metrics and you should include in your pitch deck? Read our article here.

Why is it important to build a financial model for your marketplace startup?

Marketplaces startups usually build financial plans when fundraising. Yet, raising funds is not the only reason why you would create your own financial model: communicating to investors, estimating a valuation for your business, or simply elaborating a well-thought business strategy are some of the many reasons why any entrepreneur or founder would look into forecasting their business.

Whilst financial models are likely not to be fully accurate due to the inherent nature of startups, building a rock-solid financial plan is very important for 2 reasons:

- Understanding better your revenue model, growth and its impact on cash flows allows you to make better, informed decisions

- Investors will get more confidence in a well-thought financial model with verified assumptions, benchmarks and calculations

Step 1: Forecast supply and demand

Marketplaces, whether they are two or three-sided, are generating value through the interaction of supply (sellers) and demand (buyers). In order for a marketplace to be successful and create network effects, it needs to effectively acquire both sides and maintain a healthy seller:buyer ratio so supply & demand is balanced (think about a marketplace where you would have too few sellers, and too many buyers, this wouldn’t work because of sellers’ bargaining power right? Same thing goes vice versa).

Let’s start with sellers, these can be estimated in 3 ways:

- Sellers are a function of the number of visitors (to your website for instance) and a conversion rate. This approach is very common for marketplaces where sellers are B2C

- Sellers are a function of the number of Sales Reps you have and their efficiency (the number of users they convert per month). This approach is used by most marketplaces where sellers are B2B

- Sellers are an input from you: this is the easiest approach, yet far less accurate and flexible.

Buyers, instead can be estimated in 2 ways, they are either:

- A function of the number of visitors (to your website for instance) and a conversion rate

- An input from you

Step 2: Forecast the number of orders

Because we just calculated the number of buyers you “acquire” over time, we know how many orders they generate (1 buyer makes 1 order). The difficulty comes when assessing the numbers of orders coming from repeat buyers instead. Indeed, marketplaces are more valuable when they create retention: repeat buyers are by definition buyers who make a purchase (or a conversion) at least twice in their lifetime.

The most accurate forecast for repeat buyers orders typically uses a cohort model (for more information around what a cohort model is, see a great article here). We would assume, for each new buyers cohort:

- A given percentage of these new buyers will be repeat (let’s assume 50% of all new buyers will come back and buy at some point in the future)

- A purchase frequency (let’s assume repeat buyers purchase once every year)

- A churn: it is quite common to assume that your repeat buyers will churn over time, meaning not all of them will keep buying forever

Step 3: Calculate Gross Merchandise Value and revenue

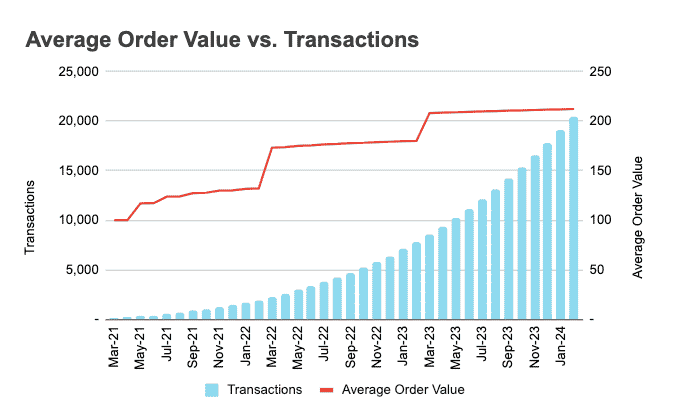

Revenue is obtained by calculating first Gross Merchandise Value (GMV). GMV is calculated using the number of orders, every month, and applying an average order value (AOV).

GMV = orders x AOV

Note: for maximum accuracy, we recommend setting a different AOV for new and repeat buyers. Indeed, it is quite common for repeat buyers to have higher conversion rates and AOV.

Once you have the number of orders and the GMV, calculating Revenue is easy, depending on what is your pricing model, it can be either or a combination of:

- Fixed fee per transaction (for instance $10 per order)

- Commission rate (for example 15% of GMV)

- Subscription fees (for example $30 a month to be a seller on the platform)

The sum of all revenue streams, divided by the GMV is commonly referred to as Take Rate (or “Rake”).

Revenue = Take Rate x GMV

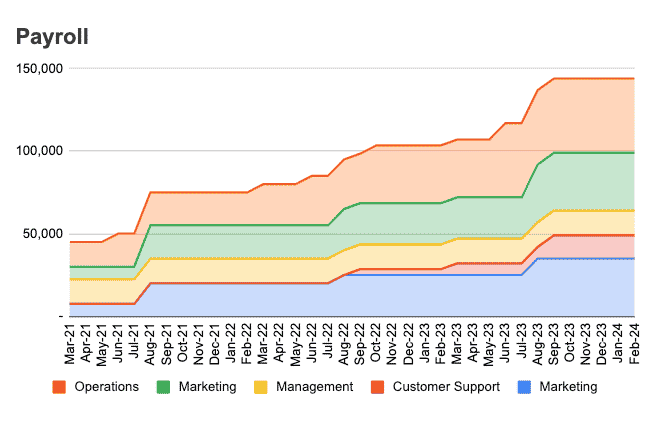

Step 4: List all your roles in the Hiring plan

Salaries are often the most important expense category for subscription and SaaS businesses. That is why building an accurate and flexible hiring plan is key:

- Accurate because you will need to list all the roles, their salaries and starting dates as accurately as possible in the foreseeable future (12 to 24 months usually)

- Flexible because you will need to easily scale up roles in the future

For more information around how to build your hiring plan, please refer to our article here.

Step 5: Build your expenses

For expenses other than salaries, list them and try to bundle them into categories. Usual expenses categories for ecommerce businesses include:

Under Cost of Goods Sold (COGS):

- Payment processing expenses

- Hosting (and other tech infrastructure costs)

- Customer service (whether in-house or outsourced)

- Fulfillment costs: shipping, packaging, warehousing, and fulfillment itself (salaries of the operators who prepare the orders)

Under Sales, General & Administrative expenses (SG&A):

- Marketing: paid media, offline marketing, agencies fees, etc.

- Other operating expenses: subscriptions, travel costs, office supplies, rent, etc.

- Other expenses: legal advisory, bank fees, miscellaneous, etc.

Note: we recommend adding relevant salaries to their respective expense category (for instance marketing team salaries under Marketing) for more clarity in your forecasts.

When forecasting expenses, you have 2 options, they can be either:

- Dynamically calculated: suitable for variable expenses (they will grow in line with a given metric, such as users, or revenue). It can be as simple as a given % of revenues for instance (payment processing fees), or more complicated (for instance, customer service can be estimated by using the number of customer service tickets, your customer service team efficiency and their hourly rate); or

- An input from you: suitable for fixed expenses (they don’t vary based on growth). They can be expenses such as bank fees, rent, etc.

Step 6: Wrap it up

Once you have built your revenue and your expenses (including all the salaries in the hiring plan), you can easily build your profit-and-loss, cash flow statement and balance sheet. You can also calculate key metrics such as cost of acquisition, customer lifetime value, etc. For more information around the 10 most important metrics for marketplace businesses, see our article here.