Mobile apps are continuing their impressive steady growth globally: app installs were up 31% year-on-year in the first quarter of 2021. Gaming, health, social, ecommerce and fintech are a few examples of the many industries that are shaken by mobile applications.

Most mobile apps aren’t boostrapped yet: due to the level of upfront investment in product development, most mobile apps need to raise multiple funding rounds from investors.

Whilst every business is unique, we strongly recommend to follow a clear structure vetted by dozens of high-profile VC firms globally. Having a powerful and clear pitch deck will maximise your chances of raising capital from potential investors.

In this article we walk you through the 14 slides you must have in your Mobile app pitch deck and what they should include. Read on.

Which slides should you include?

Every business is unique. Yet, venture capital firms and investors alike all agree on a common structure which we have laid out opposite.

Your Mobile App pitch deck will likely be slightly different depending on whether you are pre-seed, seed or Series A+. Indeed, if you are pre-revenue for instance, you might not have early traction at all.

Another example is for pre-seed startups which haven’t yet found product-market fit: they might not have a clear roadmap nor a tech stack.

As rule of thumb, the more advanced your startup is the more content you should have in your pitch deck.

Beware of endless, repetitive presentations: have clear titles, separate slides for each different topic.

We have laid out below a verified, clear structure you should follow for your Mobile App pitch deck. The structure is valid for any type of Mobile App startup: pre-seed to Series A+.

Slide 1: Title

This is the front page of your presentation.

Make sure your product or value proposition is clear from the outset: use a screenshot of your mobile application for instance.

Slide 2: The Problem

This is the “why” of your business.

The greatest businesses are solving big problems, yet they aren’t necessarily obvious. For instance, if your mobile app aims to connect sports enthusiasts with athletes so they can watch dedicated short training videos, make it clear here. Your mobile app is breaking the ice wall between inaccessible and famous athletes and their fans.

Ideally you would list the 2/3 friction points you aim to fix. For instance, digitalisation usually fixes multiple problems at once: it is fast, seamless and accessible (vs. slow, prone to errors and non-readily available / accessible solutions).

Slide 3: The Solution

Your startup builds and commercialises a product and/or a service which solves the problem laid out on slide 2. This slide should not explain in detail your product nor how it works. Instead, focus on the benefits for your customers.

Ideally, you should compare the pain points explained on slide 2 (the problem) to the benefits your solution brings to your customers. That way, it is crystal clear to investors your solution really adds value to potential customers.

Following our mobile app example above, the benefits could be:

- Accessibility to world-class athletes tricks and trainings

- Engage with like-minded sports communities (you would share experiences and tips between fans)

- Monetisation opportunity for tier 2 athletes who can give dedicated paid lessons for instance

Slide 4: Market Opportunity

Here, you need to clearly identify 2 very important metrics:

- Market size: how big is your market?

- Market growth: how fast does your market grow?

If you are operating in a niche market, chances are that you will face some challenges: the information might not be publicly available. In any case, you should be able to make a high-level estimation of your market. Read our article on market sizing and how to estimate TAM, SAM and SOM for your startup.

When looking for these metrics, you have multiple sources of information: public reports, specialised press, etc. Even public companies publish press releases and annual reports including some of their proprietary market estimates so be sure to look there too.

Slide 5: Competition

This slide must show 2 different things:

How fragmented is your market?

Are there 3 big players sharing 90% market share or thousands of small players? Here, refer to public market reports and your own understanding of the competitive landscape.

A few questions you could ask yourself, among others:

- Who are your competitors?

- Are they local, regional, national or global?

- Do they have mobile and/or desktop applications?

Where do you position yourself vs. competition?

Is your solution a game changer other competitors don’t have (yet)? Do you have competitors with similar products/services?

Ideally, you would create a small table with, for each type of competitors (e.g. mobile apps, web apps players, etc.) the main characteristics they share or not. For instance, do they all a global presence? Do they cover all the products you offer? Do they offer both a desktop and mobile app, or just mobile app? What is their relative price positioning (expensive vs. accessible)?

Slide 6: Product

Explain what your product is and how it works. For instance: is the registration / onboarding seamless or needs approval (e.g. KYC for fintech apps)? Is your app collaborative (e.g. chatbox, messaging) or not?

What about your tech stack?

If you are a tech startup, it’s always good to include details about your tech stack.

Be careful not to go into too many specifics though: investors aren’t always engineer by training. Do not put things like the programming language you have chosen (e.g. React Native, Python) or the database provider (Firebase, MongoDB). Save it for the voice-over or the appendix instead.

Instead, include things such as:

- whether you have a white-labelled solution or a proprietary back-end / database

- how many full time front/back-end engineers you have

- how much you invested already in your tech

Slide 7: Revenue Model

This slide is very important. Now that we have clearly identified the problem you are solving and the benefits of your solution, let’s have a closer look at how you generate revenue.

Mobile app are generating revenues from a number of sources, usually there are 3 main sources:

- Subscription revenue: you offer a tiered system, freemium or not (free plan) users need to pay for (monthly or annual billing cycle)

- Ads revenue: you display ads on your app (e.g. gaming) and earn revenue for each “impression“. For example, you could entice users to subscribe to a paid plan to get rid of ads. As such, you would only earn ads revenue for selected subscription plan(s).

- Affiliate revenue: if your mobile app allows transactions between sellers and buyers (e.g. gaming, marketplace), you earn a commission every time a product is being transacted. The commission can be 100% (“credits” in game apps) or a lower percentage (if you act as intermediary between a external seller and one of your user)

Slide 8: Go-to-market

This slide explains how you acquire users (or downloads). Typically, acquisition for mobile apps is 2 fold:

- Paid marketing: any paid digital marketing campaigns (pay-per-click or per-impressions), whether it is search to your landing page (e.g. Google Ads), social media (e.g. Facebook Ads), referrals or simply pay-per-click on Appstore (e.g. Apple Search Ads)

- Organic growth: you generate downloads without paying for it. For mobile apps, we typically use the term “virality” instead (refer to our article here on the most important metrics for mobile app businesses for a refresher). In other words, people download your application because of network effects (friends recommendations, invitations) hence these downloads are “free”

Once you have clearly explained your acquisition strategy and what tools you are using (e.g. Apple Search Ads for paid search, social media and content for organic growth), ideally you can show, among others:

- Your average Customer Acquisition Cost

- Cost-per-Install

- Your monthly paid ads budget

- The number of followers you have on social media

- Your newsletter count

Slide 9: Traction

Only include this slide if you already have some early traction. Traction can be revenues for instance, but not necessarily (e.g. if you have sign-ups, free users, etc.).

As rule of thumb, the more historical performance you have, the more details you should give. For instance, if you start generating revenues 12 months ago and experienced a steady growth until then, include a bar chart of your revenues over the past 12 months.

Instead, if you have limited financial performance and/or numbers have been quite volatile, include today’s numbers instead. For instance, how many active users do you have today? What’s your month-over-month user growth? What is your MAU rate as a percentage of total users? Etc.

For a complete list of the 9 most important metrics for Mobile App businesses, refer to our article here.

Slide 10: Team

This slide is one of the most important: investors invest in great teams before anything else.

The slide can either include the co-founding team only, but can also include key professionals and/or advisors as well.

Include key team members if they add real value.

Likewise, only include advisors only if they are relevant to your industry. Do you have angel investors with significant experience who advise you on strategy? Do you have a PhD who acts as advisor to your Health Tech mobile app startup (on regulation and market access matters for instance)?

For the team members’ details, keep it simple: name, position, years of experience and/or previous companies is more than enough.

Note: add a clickable link to the respective Linkedin profiles so investors can refer to a more exhaustive resume for your team members (if relevant)

Slide 11: Roadmap

The roadmap slide tells investors where you are going and how is product going to evolve in the future. You can either keep it high-level (e.g. your long-term strategy) or more detailed (e.g. the pipeline of the near-future product features).

Investors do not just invest in your product as it is today. For example, you might only have developed a MVP with limited features for early-adopters while your product could be tweaked and serve a much larger customer base in the future.

Note: if you choose to include your product pipeline, keep it very simple. Your mobile app pitch deck isn’t your product manager’s presentation to engineers. Instead of features, focus on the additional benefits and customer segments you might target as such. For instance, if you plan to launch a messaging feature, focus on the fact it will open new growth opportunities (e.g. network effects).

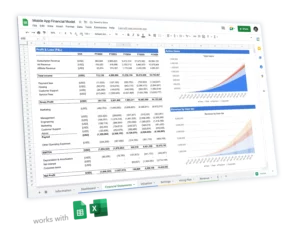

Slide 12: Financial Plan

Along with your product and the team, this slide is highly important. Unfortunately, many startups overlook the importance of financial projections in their Mobile App pitch deck.

Think about your audience: investors (venture capital firms or angel investors) are financially literate individuals. As such, they invest in your business to generate returns. Logically, they care a lot about your financials and more especially, the expected financial performance of your business.

Do not expect investors to make up their own plan for your startup if you haven’t. As CEO, founder or entrepreneur alike, you should have a clear idea of where you are going.

Note: you might be wondering how much it actually cost to build a mobile app. For more information on how much app development actually costs, read our article here.

As rule of thumb, the more advanced your startup is, the more granularity you should include here. Pre-seed startups might keep it short (1 slide) yet we recommend seed and Series A+ startups to include 2 slides instead.

Common mobile app metrics you should include in your financial plan slide are:

- Revenue

- Active users (e.g. MAUs for instance)

- Churn rate

- ARPU and ARPPU

- LTV and CAC

For a complete list of the 9 most important metrics for Mobile App businesses, refer to our article here.

Note: when presenting your financials, we recommend for pre-seed startup to show 3 years. Instead, seed and Series A+ startups should include 5 years projections as investors will likely ask for it for their own return analyses purposes.

Slide 13: Funding Ask

All pitch decks have a clear goal: raising capital from investors.

This slide is where you clearly state your ask: how much are you raising?

Read our article on how to determine how much you should raise for you startup. Disclaimer: while raising too little creates obvious problems, raising too much isn’t necessarily better.

On top of the amount, a good practice is to include a pie chart of where you will spend that money over a given period (your runway). Will you spend the bulk of it in product development to build your MVP? Or will you use a large portion in sales & marketing to commercialise your product and find product-market fit?

Our financial model templates all include a cash burn dashboard where you can easily assess how much you should raise, and where you will spend your money. We also included charts ready to be pasted onto your Mobile App pitch deck. See how to use our cash burn dashboard here.

Slide 14: Contact

The last slide of your presentation. It has 2 main goals, this is where:

- You open the floor to questions from your audience when you are pitching

- You provide contacts (email and telephone) for investors who would only receive the PDF version of your presentation

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support