Every business needs a budget. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your manufacturing company, you’ve come the right way.

Whether you manufacture spare parts, home appliances, bikes, plastic bottles, etc. in this article we’ll explain you how to create powerful and accurate financial projections for a manufacturing business. Let’s dive in!

1. Forecast Production

The first thing you should do when building a financial model for a manufacturing company is to forecast production. Production is the number of units you produce over time.

For simplicity, we assume that all units produced are sold. In other words:

Production = Sales volume

This is something we can easily do by creating a table like the one below:

In the example here, we have a number of product categories (it can be cars, bikes, spare parts, etc.) each with a number of sold units per year (the sales volume).

This allows us to easily forecast production as shown in the chart below:

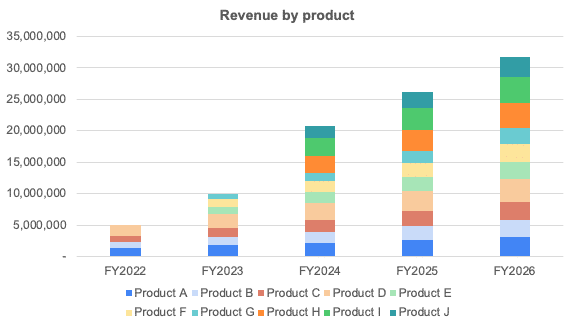

2. Calculate Revenue

Once we have forecasted production, it’s easy to calculate revenue. For each product line:

Revenue = Sales volume x Unit price

There’s 2 things you must do:

- Add a unit price for each product line

- Add a price increase percentage (per year for instance). Indeed, you’ll likely have to adjust prices to cost inflation in the future (or simply charge more to increase profitability)

Once done, you can obtain revenue per product line as shown below:

3. Forecast Cost of Goods Sold

The next step on our list is to forecast COGS. Depending on the product, COGS may include:

- Unit costs (the total costs to supply the parts, ingredients, input that go into the final product)

- Packaging

- Shipping

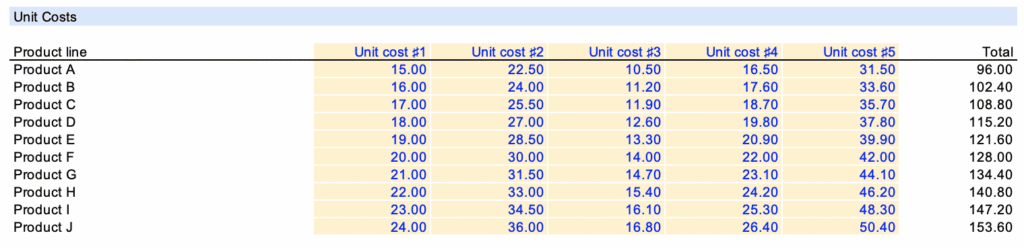

Unit costs

Unit costs can be set per product line. You can either use a total unit cost, or break it down by different unit costs as shown below. For example, for a car you could have windshield, wheels, motor, etc.

Packaging

Packaging can either be per product line or an average cost per product instead (e.g. $50 per product).

Shipping

Shipping is another important part for COGS.

Usually, shipping for a manufacturer includes the cost to ship the products you pay for from your own suppliers. Instead, the shipping cost to send your products to the client (or a reseller) is usually borne by the client.

Usually prices are per pallet. That’s something that can be set as shown in the example below:

- We can fit 50 Product A items on a pallet, 100 Product B, etc.

- The cost per pallet is $150

4. Calculate Expenses

Once we have worked out COGS, we can forecast operating expenses. These can be anything: marketing, rent, janitorial services, logistics, office supplies, salaries, etc.

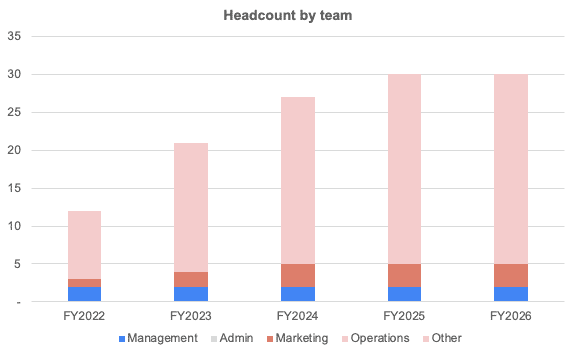

Salaries

For salaries, we recommend using a Hiring plan forecast. List out all the roles you hire as well as their:

- Annual gross salary

- Starting date

- Any taxes & benefits on top of annual gross salary (health insurance, social security, etc.)

- Any leaving date (if you hire contractors for instance)

- Any annual percentage increase for salaries

Other Operating Expenses

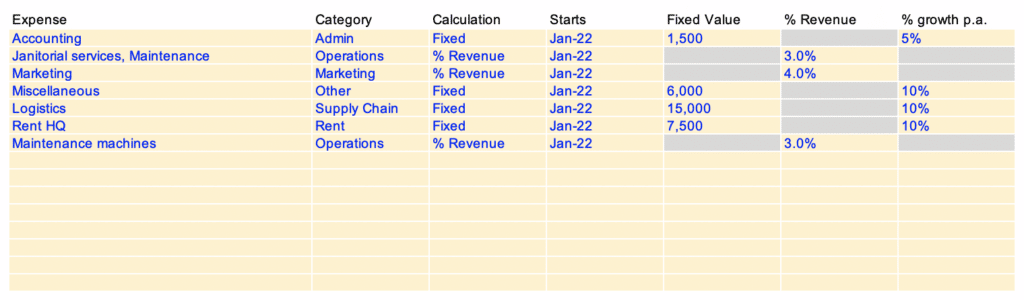

For all other expenses, either forecast as a percentage of revenue or a fixed value. You can use a table as shown below:

4. Build your P&L And Cash flow

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit.

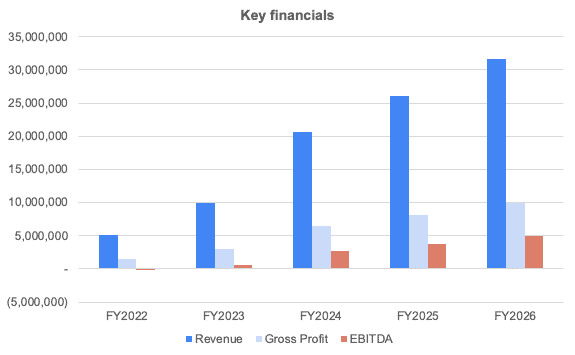

This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your manufacturing business.

In the chart below, we’re showing you an example of what a typical cost structure a manufacturing company could have. Unsurprisingly, COGS, capex (the cost to buy the machines and equipment) and salaries represent about 90% of total expenses.