Pre-Seed vs. Seed Fundraising Round: What’s the Difference?

A question we often get from founders is the following: should we raise a pre-seed or seed round? Is there any difference between the two? Well, there are clear differences. Luckily you won’t have to choose between them. The type of financing round you should raise depends on the stage your startup is in.

Without any prior experience in venture capital nor finance in general, certain financial terms can seem a little bit unclear at first. In this article we explain you clearly what pre-seed and seed are and which one is best for you. Read on.

What is pre-seed financing?

In short, a pre-seed financing is the first fundraising round you will ever raise. It does not include any institutional investors (such as venture capital firms) yet but friends & family and angel investors.

A pre-seed ranges typically from $50k to $500k. It’s usually used either right from the start (at idea origination) or after a period of bootstrapping.

Therefore, a pre-seed concern any startup which need a starting amount of capital to get the ball rolling. You would typically use pre-seed in one of the 2 following scenarios, either you have:

- An idea and need to develop a minimal viable product (MVP) to find product-market fit

- A MVP but needs additional capital to market your product and find product-market fit

In any case, you are raising capital as you need to spend more to grow. Spending can include a few hires including the co-founding team, increased spending in maintenance costs (e.g. AWS hosting) and/or additional firepower for lead acquisition (paid ads).

Often, a pre-seed will take the form of a convertible note instead of straight equity. A convertible note is a form of debt which can convert into equity at a later stage. Indeed, equity typically takes some time to raise because of the documentation and can be especially costly in lawyers fees: something you would typically avoid in the beginning.

For a reminder on debt vs. equity funding and what is best for your startup, read our article here.

What is seed financing?

In comparison, a seed round usually ranges from $500k to $3M depending on your industry and the stage you are in.

Capex intensive businesses then to raise large rounds to purchase equipment (e.g. mobility startups). Instead, fully digital business models (e.g. SaaS, marketplaces, ecommerce, mobile app, etc.) tend to raise less as most financing goes into hiring instead.

A seed round, unlike a pre-seed, can include institutional investors such as early-stage venture capital firms. Often, unlike Series A+ VC funds, seed venture capital funds specialise in seed only: their investment strategy includes many small equity tickets in high-risk early stage startups.

A seed round, like pre-seed, can still include a number of angel investors. Yet, angels are usually not the lead investors anymore: they invest smaller tickets along a venture capital firm which typically lead the round.

Because you raise a bigger amount of capital from institutional investors, typically you would already have: a MVP and/or proven product-market fix and/or some early traction and a complete founding team.

Which one is best for you?

Whether you need to raise pre-seed or seed funding rarely is a choice to make. Either you should raise one or the other depending on the stage your startup is in.

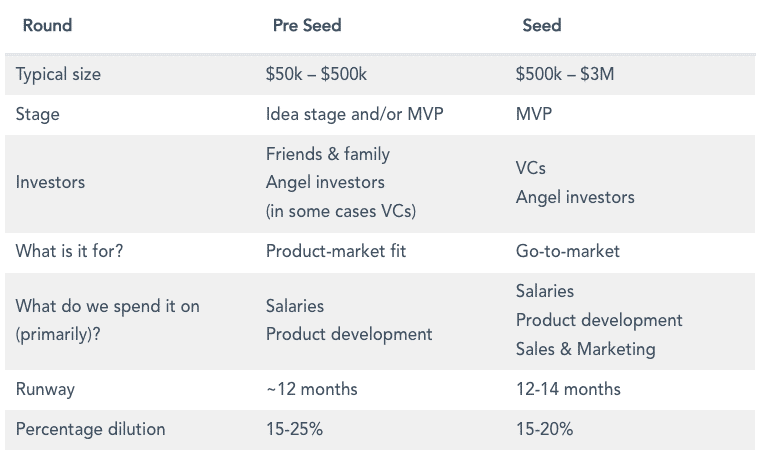

| Round | Pre Seed | Seed |

|---|---|---|

| Typical size | $50k – $500k | $500k – $3M |

| Stage | Idea stage and/or MVP | MVP |

| Investors | Friends & family Angel investors (in some cases VCs) | VCs Angel investors |

| What is it for? | Product-market fit | Go-to-market |

| What do we spend it on (primarily)? | Salaries Product development | Salaries Product development Sales & Marketing |

| Runway | ~12 months | 12-14 months |

| Percentage dilution | 15-25% | 15-20% |

There are some exceptions though. For example, some founders raise sizeable seed funding from institutional investors without a MVP. This is especially the case when the founders already have credentials (either they have a strong experience in the field and/or already successfully founded a startup and made an exit)

VC funds that do invest in these seed rounds only invest in the co-founding team: the team already has proven they could make it and need to raise seed capital to develop the product and find product-market fit right away.

Remember that seed and pre-seed only are terminologies: some might think your startup round is pre-seed and some seed instead. At the end of the day, you are raising capital from investors, and the term sheet terminology doesn’t really matter: only the terms do.

Still, knowing the difference between the two will allow you to make better decisions on what amount of capital you need to raise, to do what and from whom.

As explained in our article here the amount of capital you should raise is highly important to figure out upfront: too much is not necessarily better.

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support