Pre vs. Post-Money Valuation: Examples [Free Template]

Valuing a startup is a challenging exercise, and an important one too. The result of a negotiation between founders, existing investors and new ones, setting a valuation for your startup will define the level of ownership you will keep after your fundraising. Yet, many entrepreneurs get confused by the difference between pre vs. post-money valuation.

Understanding these 2 terms is paramount when starting negotiations with potential investors. In this article we clarify pre and post-money valuation.

What is Pre-money valuation?

Pre-money valuation is the valuation of a company before it raises capital.

By establishing this pre-money valuation, it allows new investors to set the amount of equity they will receive in exchange for their capital. In parallel, it allows existing investors and founders to understand their dilution of ownership by selling part of the capital to the new investors.

Think of pre-money valuation as the “true” value of a company today. it represents the value of a business before it receives (and therefore spends) new capital. If you were to calculate the ownership of an investor in a private company which is not going through a fundraising, you would calculate its valuation: this valuation essentially is a pre-money valuation.

What is Post-money valuation?

Post-money valuation is the valuation of a business after the capital has been raised. As such, post-money valuation is the sum of pre-money valuation plus the additional capital raised.

Let’s assume we agreed with new investors, after negotiations, on a pre-money valuation of $7m for our startup. We are raising $2m as part of this round. Therefore, post-money valuation is:

Post-money valuation = $7m + $2m

Post-money valuation = $9m

Now, we can calculate the equity stake to new investors by dividing the raised capital by the post-money valuation:

Equity stake to new investors = $2m / $9m

Equity stake to new investors = 22%

Logically it is in the existing investors’ interest to steer a valuation upwards. The higher the pre-money valuation, the lower the percentage of dilution they will have to accept.

In comparison, new investors will try to agree on a pre-money valuation as low as possible so the resulting stake they will own is the largest.

Pre vs. Post-money valuation: Example

Let’s see with an example what happens in the financial statements before and after a fundraising to understand clearly the difference between pre and post-money valuation for startups.

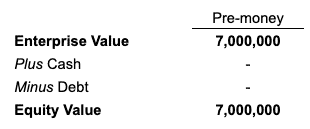

Let’s use our $7m pre-money valuation example above. This means the Enterprise Value (as defined in Corporate Finance) is $7m. Now, assuming the company does not have any debt nor cash to keep things simple, we have the following simplified balance sheet:

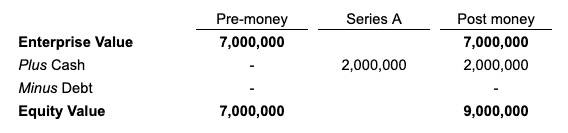

Now, when raising $2m capital from new investors, the company actually receives the $2m as cash in its bank account, and therefore in its balance sheet. Logically, Equity Value now is $9m (post-money valuation).

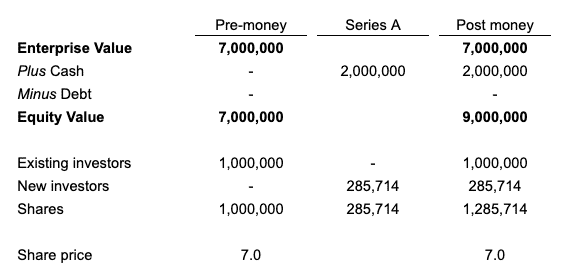

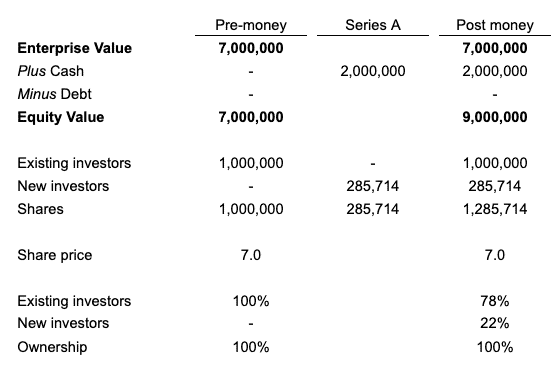

As explained above, we can infer the equity ownership stake which new investors are acquiring via their $2m investment. Because the company needs to issue new shares for the new investors, the total number of shares increases as well. Assuming there are 1,000,000 shares outstanding before the round, in order to keep the same share price, we need to raise 285,714 shares.

Finally we can calculate the percentages of ownership as follows:

Download our pre vs. post-money valuation calculator template for free below:

A simple formula to calculate valuation

Investors and entrepreneurs alike commonly use a simple formula to assess a high-level pre-money valuation for a startup. Indeed, post-money can be calculated by using the raised capital amount and the dilution percentage new investors will own.

Let’s assume a startup is asking investors $2m as part of its Series A. Post-money valuation can be calculated as follows:

Post-money valuation = Raised capital / Ownership percentage

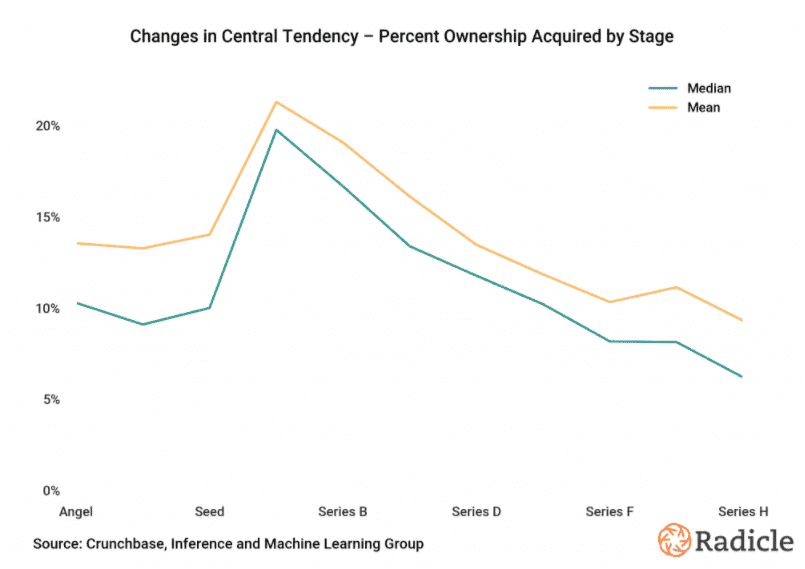

Now, knowing that most startup rounds represent a dilution percentage of 20% in average, we can assume post-money valuation will be in a similar range:

Post-money valuation = $2m / 20%

Post-money valuation = $10m

As rule of thumb, the more early stage the startup is, the larger the stake to new investors will be, as shown in the chart below from Crunchbase.

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support