When creating financial forecasts for their business, entrepreneurs often face difficulties. Yet, there are 3 popular sales forecast examples you can use when creating yours. They work for the most popular revenue models, from restaurants, to retail shops, to software companies and other online businesses.

If you aren’t sure what are sales forecasts, read our article and follow these 5 simple steps to create accurate sales forecasts for your business. Looking for examples instead? In this article we explain what are the most popular 3 sales forecast examples for (almost) any type of business. Let’s dive in.

What is a sales forecast?

A sales forecast is the financial projection of a business’ sales (or revenues, turnover) over a given period. Therefore, sales forecasts are a must have of any financial forecast: by projecting sales and expenses we can then prepare the 4 financial statements which constitute a financial forecast.

Often, sales forecasts are included within a business plan as part of your projected financial statements. Indeed, investors will want to see your business’ financial projections over a given period. Sales forecasts often are 3 or 5-years projections.

For more information on sales forecasts for small businesses and why they are important, read our article here.

Let’s now dive into the 3 most popular sales forecast examples which work for any type of business, from restaurants, to retail shops, to software companies and other online businesses.

Why are sales forecasts important?

Because sales forecasts are part of your financial forecasts, and ultimately your business plan, it is very important to get it right.

Sales forecasts help you set goals for your business

Sales forecasts aren’t simply a requirement for your business plan. Instead, they also help you set goals for your business. The sales you expect to generate as per your sales forecast should be used as a guidance for your budget and your business decisions later on.

You show you understand your business

Showing investors you’re not only a great entrepreneur but also a well-rounded and omniscient founder is very important to get the best deal. A great sales forecast will help understand how your business generates revenues, what are the different drivers affecting revenue and the potential risks involved.

Investors will give more credit to financial plans based on verified assumptions and reasonable targets. Calculate expected revenue using market size, market share and/or user adoption rates for instance. The more you justify your plan with verified assumptions, the more credible it will be.

You know how much you need to raise

Many entrepreneurs and founders do not really know exactly how much they need to raise.

Sales also drive expenses, so forecasting sales plays a pretty important role when assessing things such as your breakeven or the amount of money you need to raise. Miss the mark and you may be in trouble.

How much cash do you need to cover your losses over the next 12-18 months? The amount of money you need to raise is the result of your financial projections. This is very important to accurately estimate your revenues and expenses.

How to do a sales forecast?

Before we dive into the specifics of creating a rock-solid sales forecast for your small business, let’s first explain which approach you should follow.

Many entrepreneurs make the same mistake when forecasting their sales: they use a top-down approach. So what is bottom-up and top-down sales forecasting? Let’s use an example below.

- Top-down sales forecasting: we forecast sales using from the top down. For example, you make $500k in revenue per year and you forecast the next 3 years revenue by assuming you will capture 3% of your market size (assuming it is $100 million). By following this approach, your annual revenue is 3 years time is $3 million, a 6x increase from today.

- Bottom-up sales forecasting: we forecast sales using operational drivers (from the bottom up). For example, if your $500k sales are a function of your website traffic, we will forecast revenues based on this metric instead. Assuming website traffic increase by 50% each year (as you invest in paid and content), your revenue in 3 years time is $1.7 million, a 3x increase from today.

Bottom-up sales forecasting is the best approach for 2 main reasons:

- It allows us to relate revenues to another metric, helping us making sense of the projection. Does $3 million really make sense given this would mean multiplying website traffic by 6x over the next 3 years?

- Top-down approach requires us to make assumptions on the market size, which is often inaccurate for lack of publicly available data. Instead, bottom-up uses your own business’ historical data

Sales forecasts: 3 popular examples

1. Location-based businesses

If you are running a businesses with a physical location, such as a hotel, a restaurant, a repair shop or a retail store for example, forecasting sales boils down to forecasting street traffic.

Indeed, sales (revenues) are a function of the sales volume you generate (the number of “units” or products you sell). The sales volume itself is a function of the number of people who enter your store, and, by extrapolation, the number of people who pass by your store.

When forecasting sales for a new business, you should look at the location where your business will be based first. Assess the approximate number of people who are passing by.

Note: when assessing traffic, be careful to exclude any external factors (e.g. Christmas day), cyclicality and seasonality. Ideally, your assessment should look at a full week and all work hours in the day.

Once we have established the approximate number of people who pass by the street in a day, we will need to apply conversion rates, in order:

- How many people enter the store?

- Out of the people who enter the store, how many make a purchase?

Of course, if you already have some historical data (if you already run a store and are opening a new one), use your existing conversion rates. Else, make assumptions.

When making assumptions, you should use the data you have collected when making your own observations earlier. Use similar stores to yours, in a different street for example.

For example:

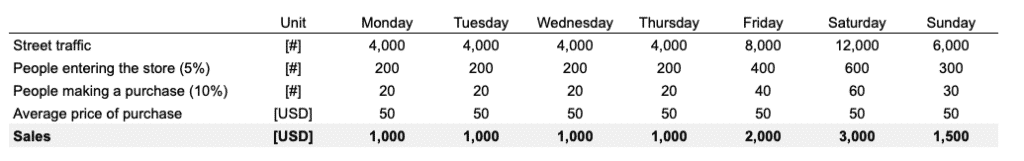

- 5% of people passing by your store enter

- 10% of people entering the store make a purchase

We can now create a simple sales forecast over a week, adding up the average traffic over a typical week:

2. Online businesses

Online businesses often acquire their customers via their website, or any type of online presence.

As such, unlike location-based businesses, sales (revenues) are a function of visitors (and not street traffic). The visitors can be visitors on a website, on a Appstore page (mobile apps) or any type of online lead acquisition page.

We often refer this type of acquisition as inbound acquisition. The traffic is two fold: paid and organic:

- Paid traffic: all visitors coming from paid marketing channels (Google Search, Facebook Ads, etc.). You are either paying for clicks, or impressions.

- Organic traffic: all visitors landing on your landing page(s) organically (either via a referral link, direct search, social media post, blog article, etc.)

Paid marketing is the easiest way to generate traffic. Yet, because you are paying for each paid visitor, you will need to monitor your Return on Ad Spend (ROAS) to make sure your paid marketing campaigns are profitable.

In comparison, whilst you do not directly pay for each organic visitor, organic traffic is not free. Organic traffic is earned from investment into SEO and content. Whilst investing into your SEO for instance does not pay immediately, the returns can far outweigh those of your paid marketing in the long run.

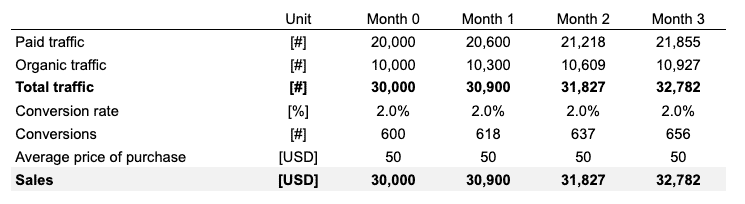

So, when forecasting sales for online businesses, we should make assumptions on traffic. For example assuming:

- 30,000 visitors last month: 20,000 paid and 10,000 organic

- 3% monthly increase

- 2% conversion rate

- $50 average purchase price

This is how could look like a simplified sales forecast example for an online business:

3. Lead-acquisition businesses

Lead-acquisition businesses are companies that make sales through their sales teams efforts. This is also known as outbound acquisition (vs. inbound discussed above).

With outbound acquisition, a business acquires customers through its sales team. Whether it is via phone, email, Linkedin or even in-person, the number of acquired customers is a function of the number of sales people.

Outbound acquisition is very common for business-to-business (B2B) companies. For example, Enterprise SaaS and B2B marketplaces use outbound acquisition to acquire their customers.

Outbound customer acquisition is therefore easier to forecast vs. inbound. The simple formula to estimate new customers over time is:

The number of closings per sales person is also referred to as the efficiency of your sales team = the number of customer one sales person acquire (or “close”) each month, in average.

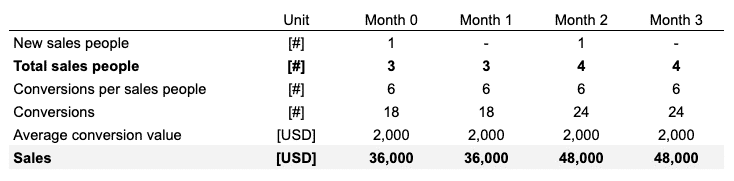

For example, lets’ assume you have 20 sales people. Historically, your sales team has closed (“acquired”) in average 2 B2B clients per month per sales person. Assuming you have the same number of sales persons and the same sales efficiency in the future, we can reasonably expect 40 new customers per month.

Now, assuming 1 new hire every 2 months, a sales forecast example for a lead-acquisition business could look like this:

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support