SEIS Application: 11 Slides To Ace Your Business Plan [Full Guide]

If you are a UK early-stage startup, chances are you have already heard of the Seed Enterprise Investment Scheme (SEIS). If you haven’t yet, you should seriously consider applying. To apply, you will need a solid business plan.

Successful applicants to the SEIS scheme will be able to provide individual investors with significant tax breaks, making your startup even more attractive from an investment standpoint, and maximising your chances of fundraising.

Yet, SEIS application isn’t straightforward. From the drafting of your business plan (or pitch deck) to building your financial projections, HMRC has a strict set of requirements you need to follow.

In this article, we explain you what are the 11 slides you should include in your business plan for your SEIS application. For a guide on how to build great financial forecasts for your SEIS application instead, read our article here.

Note: whilst HMRC refers to “business plan”, they do not specifically require a word document (common for business plans). Instead, we recommend to prepare a pitch deck (a shorter Powerpoint document). For a clear explanation of the key differences between business plans and pitch decks and which one you should prepare, read our article here.

What is SEIS?

The Seed Enterprise Investment Scheme (SEIS) was introduced in April 2012 by HMRC to help small businesses and startup to raise capital. It provides a series of tax breaks for individual investors who wish to invest into qualifying companies.

The SEIS is an addition to the Enterprise Investment Scheme (EIS) that was launched in 1994. For those who were wondering, whilst SEIS focuses on small businesses and early-stage startups, EIS targets medium-sized businesses instead (up to 250 employees). For a detailed list of the differences between SEIS and EIS, refer to this article here.

What are the tax benefits of SEIS?

The SEIS scheme offers a number of tax breaks to individual investors, from automatic reductions to loss relief and capital gains avoidance. In order to benefit from these tax breaks, investors need to hold qualifying shares for at least 3 years.

The tax breaks included within the schema are:

- 50% Individual Income Tax relief (of the amount invested)

- Exemption from Capital Gains on earnings from shares

- Exemption from Capital Gains on profits realised within 3 years if reinvested in the SEIS

- Loss relief if the company fails (even within the 3-year hold period)

The positive impact of these tax reliefs are significant for investors. That’s why investors often ask upfront founders raising capital if they are SEIS compliant.

Note that the maximum lifetime amount that can be raised on under the SEIS scheme for a startup is £150,000. This means that for a given fundraising round, you will only be eligible for up to £150,000 in tax breaks under the SEIS scheme.

SEIS tax breaks: 3 examples

Let’s see how the SEIS impacts individual investors’ taxes in 3 different scenarios: when the startup goes bankrupt, breaks even and double in value within 3 years.

Let’s assume an individual investors makes a £1,000 investment in a startup who is eligible for SEIS.

Because of the 50% Individual Income Tax relief, the investor gets £500 in income tax relief. Assuming a 45% income tax rate, the income taxes from the 3 scenarios above are:

Startup goes bankrupt

Income = – £1,000 (the shares are worth £0)

Tax relief = + £500

Loss relief = + £225 (40% x £500)

The investor makes a loss of £275 (instead of £550 without SEIS)

Startup breaks even

Income = £0 (the shares are worth £1,000)

Tax relief = + £500

The investor makes a gain of £500 tax free (instead of £0 without SEIS)

Startup doubles in values

Income = £1,000 (the shares are worth £2,000)

Tax relief = + £500

The investor makes a gain of £1,500 tax free (instead of £1,000 without SEIS)

How to apply?

To know whether your startup (or more precisely, the investment round you intend to raise) is eligible to SEIS, you should first check HMRC’s list of eligibility criteria. If you think your startup is eligible, you should now apply.

The application to SEIS is also referred to as Advanced Assurance: you ask HMRC whether your proposed investment may qualify for the SEIS scheme. You can then use this to show your potential investors that your proposed investment is eligible to SEIS, so they may be able to save income taxes.

Beware: the Advanced Assurance does not fully guarantee an investment will be eligible for the SEIS for any investor. Instead, startups apply for the SEIS Advanced Assurance to give a provisional indication of whether it may be eligible to apply for tax relief for potential investors.

Amongst the list of documents you will have to provide as part of your application are your business plan and 3-year financial forecasts. Below we will cover what are the 11 slides you should include in your SEIS application.

SEIS/EIS application: the 11 slides you need for your business plan

When applying to the SEIS Advance Assurance, HMRC requires companies to provide their business plan (along with a financial plan).

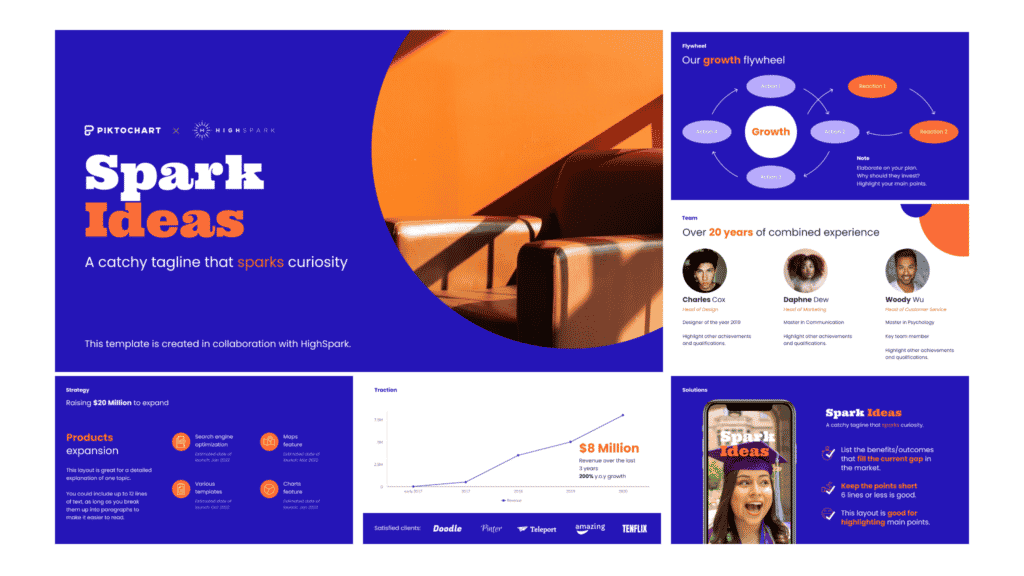

If you have already prepared some sort of investor presentation (pitch deck or business plan), no need to reinvent the wheel. You can re-use your presentation for the purpose of SEIS, with some minor edits.

Instead, if you haven’t yet prepared such presentation, now is the time to do so. Be sure not to forget any of the 11 slides below: they are the must have slides you should have in your business plan for your SEIS application.

Note: whilst HMRC refers to “business plan”, they do not specifically require a word document (common for business plans). Instead, we recommend to prepare a pitch deck (a shorter Powerpoint document). For a clear explanation of the key differences between business plans and pitch decks and which one you should prepare, read our article here.

Slide 1: The Problem

This is the “why” of your business.

The greatest businesses are solving big problems, yet they aren’t necessarily obvious. So make it clear for investors by focusing on the pain point you are trying to solve for your customers.

Ideally you would list the 2/3 pain points you aim to fix. For instance, digitalisation usually fixes multiple problems at once: it is fast, seamless and accessible (vs. slow, prone to errors and non-readily available / accessible solutions).

Slide 2: The Solution

Your startup builds and commercialises a product and/or a service which solves the problem laid out on the problem slide. This page should not explain in detail your product nor how it works. Instead, focus on the benefits for your customers.

Ideally, you should compare the pain points to the benefits your solution brings to your customers. That way, it is crystal clear to investors your solution really adds value to potential customers.

Slide 3: Market Opportunity

Here, you need to clearly identify 2 very important things:

- Market size: how big is your market?

- Market growth: how fast does your market grow?

If you are operating in a niche market, chances are that you will face some challenges: the information might not be publicly available. In any case, you should be able to make a high-level estimation of your market. Read our article on market sizing and how to estimate TAM, SAM and SOM for your startup.

When looking for these metrics, you have multiple sources of information: public reports, specialised press, etc. Even public companies publish press releases and annual reports including some of their proprietary market estimates so be sure to look there too.

Slide 4: Competitive Landscape

This slide must show 2 different things:

How fragmented is your market?

Are there 3 big players sharing 90% market share or thousands of small players? Here, refer to public market reports and your own understanding of the competitive landscape.

A few questions you could ask yourself, among others:

- Who are your competitors?

- Are they local, regional, national or global?

- What products/services are they selling?

- What IP / technology do they have?

- Which customers are they serving?

Where do you position yourself vs. competition?

Is your solution a game changer other competitors don’t have (yet)? Do you have competitors with similar products/services?

Ideally, you would create a small table with, for each type of competitors (e.g. large companies, startups, local players, etc.) the main characteristics they share or not. For instance, do they all have a global presence? Do they cover all the products you offer? What is their relative price positioning (expensive vs. accessible)?

Slide 5: Business Model

This slide is very important. Now that we have clearly identified the problem you are solving and the benefits of your solution, let’s have a closer look at your business model.

This section should cover HMRC’s requirement to include “details of all trading or other activities to be carried on by the company” (source).

Here you should explain how your business generates revenue. A few examples that you need to include are:

- What is your revenue model?

- Which products / services do you sell?

- Who are your customers?

- What is your pricing strategy?

Slide 6: Intellectual Property (optional)

If your business has any intellectual property (IP) rights or patents, explain in plain English what they are, who own it, and how defendable they are. If you are a tech company, this is where you should include an overview of your tech stack, and MVP (if any).

What HMRC wants to understand here is whether your business has strong barriers to entry, protecting it from competition and market forces. For example, if you are using a technology, explain whether you own it, or if it is white labelled, if you license it (and if so, to whom).

Slide 7: Traction (optional)

Only include this slide if you already have some early traction. Traction can be revenues for instance, but not necessarily (e.g. if you have sign-ups and/or users). When it comes to traction, the more the better.

As rule of thumb, the more historical performance you have, the more details you should give. For example, if you start generating revenues 12 months ago and experienced a steady growth until then, include a bar chart of your revenues over the past 12 months.

Instead, if you have limited financial performance and/or numbers have been quite volatile, include today’s numbers instead. For instance, how many customers/users do you have today? How much revenues did you generate up to today? Etc.

Slide 8: Team

Whilst the team slide is often the most important one for investors, it isn’t so important for HMRC’s SEIS Advance Application purpose.

Simply include here the management / co-founding team. No need to add anyone else from outside the company (such as key professionals and/or external advisors).

Also, keep it simple: name, position, years of experience and/or previous companies is more than enough.

Slide 9: Roadmap

The roadmap slide is highly important for HMRC.

Usually the roadmap in a pitch deck tells investors how your company (and product) is going to evolve in the future. Indeed, investors invest in growing businesses to generate returns.

Instead, HMRC cares a great deal about companies’ roadmaps to see whether they are eligible under the SEIS scheme. In order to qualify for SEIS, you will have to prove money will be spent to develop and grow the business (e.g. research and development). That’s why roadmaps are paramount: here you show HMRC what you intend to do in the next few years (3-5 years is enough) with the money you intend to raise.

Slide 10: Financial Plan

HMRC requires at a minimum financial projections over a 3-year period for your profit-and-loss (P&L) and your cash flow statement. Often, companies provide their financial plan in Excel format, along with a one page summary in their business plan for their SEIS application.

For a full guide on how to build rock-solid financial plan for your SEIS application, read our article here.

Slide 11: Funding Ask

You are applying to SEIS so you can advertise your company as a SEIS eligible investment opportunity to potential investors. The funding ask slide is where you explain to HMRC what this investment round is.

Here you will need to answer a few questions:

- How much are you trying to raise?

- What is your expected runway?

- Any expected valuation

- What investors are you targeting? Any minimum ticket?

- Do you have any commitments from investors already?

Read our article on how to determine how much you should raise for you business. Whilst raising too little creates obvious problems, raising too much isn’t necessarily better.

On top of the amount, a good practice is to include a pie chart of where you will spend that money over a given period (your runway). Will you spend the bulk of it in product development to build your MVP? Or will you use a large portion in sales & marketing to commercialise your product?

Our financial model templates all include a cash burn dashboard where you can easily assess how much you should raise, and where you will spend your money. We also included charts ready to be pasted onto your marketplace pitch deck. See how to use our cash burn dashboard here.

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support