DCF is one of the most common methodology used by investors worldwide to value businesses. Indeed, DCF gives an intrinsic valuation by using a business’ expected cash flows. Yet, venture capital investors very rarely use DCF to value startup. Why is that?

In this article we explain everything you should know about the Discounted Cash Flow (DCF) and whether you should use it for your startup valuation.

What is a DCF valuation?

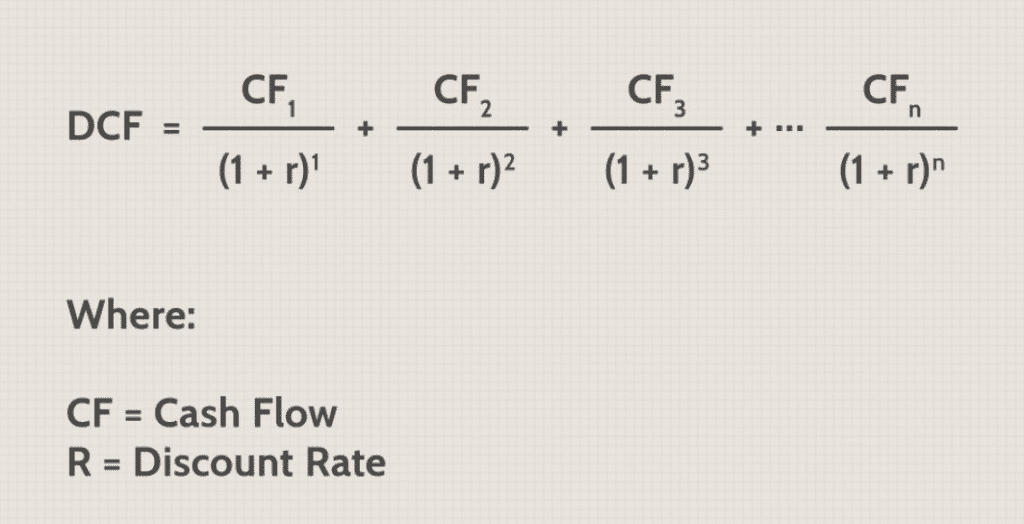

Discounted Cash Flow (DCF) is one of the most common valuation methodologies. When using DCF, we estimate a business’ valuation by summing up all its expected future cash flows.

We typically discount the expected future cash flows with a discount rate to determine their present value:

We estimate the cash flows by building financial projections. In a fundraising, existing and new investors will typically discuss the assumptions behind the financial projections to agree on a DCF valuation.

The discount rate typically is the cost of capital of the business: the weighted average cost of debt and equity. Usually, discount rate ranges from 10 to 15%.

DCF valuation: pros and cons

The Pros

- It is the result of a mathematical equation. Therefore, as long as both parties agree on the financial plan, there is limited room for negotiation

- It gives an intrinsic valuation of a business. Because we calculate the valuation as a function of the business’ future cash flows, the only parameter which can be argued are the cash flows themselves. As such, the more predictable the future cash flows can be, the less room for negotiation there is. Therefore DCF gives a relatively accurate valuation for most mature companies

The Cons

- DCF isn’t suited for business with volatile cash flows. Indeed, one can argue the projected cash flows aren’t realistic and the valuation therefore wrong

- DCF heavily relies on the terminal value, and especially the terminal growth rate. The terminal growth rate is the rate at which your cash flows will grow in perpetuity. It isn’t uncommon to have the terminal value represent 75% of the total valuation. As such, small changes in the terminal growth rate, or exit multiple, can lead to significant changes in your valuation

Should you use DCF to value your startup?

Startups have by nature an inherent significant level of risk and limited historical performance. That’s why their expected cash flows are usually difficult to predict and the resulting DCF valuation likely inaccurate.

Also, because most startups are loss-making in their first years, using DCF does not make much sense. Indeed, DCF sums up all the future expected cash flows to come up to a valuation. Assuming a startup with losses for the next 3 years, a DCF would rely only on the cash flows generated post that 3 years period, which leaves ample room for errors and inaccuracy…

That’s why we usually do not recommend using DCF to value high-growth, loss-making startups with limited historical financial performance.

Instead, if your business is fairly stable and/or easily predictable (think Enterprise SaaS for instance due to the nature of recurring revenues), you may want to consider DCF.

In any case, one must not use DCF as a standalone valuation methodology.

Indeed, your valuation always is a negotiation between existing and new investors. DCF or multiple-based valuation methodologies should serve as a basis for negotiation instead.

Download a template

Do you want to calculate a valuation for your business using DCF? You will first need to calculate accurate financial projections for your business. Get help and build investor-friendly, rock-solid financial projections with our financial model templates.

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support