If you’re about to meet investors for your startup, there are plenty of material online on what kind of questions you may receive. Yet, many entrepreneurs often misunderstand the questions, or worst, they overlook the importance of Q&As. So, in order to be best prepared when meeting investors, we have listed out below the top 18 deal & financial questions VCs will ask you.

But we don’t just list out questions of course. Instead, we explain you for each question, what investors actually mean, and what you should answer. Let’s dive in!

1. What is your burn rate?

“Burn rate” is a financial term used by VCs and investors alike worldwide that means one simple thing: the amount of money you spend (usually per month).

So if you hear a startup with a $60k burn rate for example, it means it spends (“burns”) $60k per month. Of course, this number varies depending on growth and profitability: the more you invest, the more you burn, and vice versa. The opposite is also true: the later stage startups tend to burn less and less as they get closer to profitability (they generate more revenues which decreases their burn).

There are actually 2 different “burn” terms:

- Gross burn: the total amount of expenses over a month

- Net burn: the total amount of expenses minus revenues, over a month

When investors use burn rate, they almost always refer to net burn. Unlike gross burn, net burn is the actual losses you are making per month.

So for instance, if the total expenses of your startup in a month are $100k (salaries and other expenses) but you earn $20k in revenue, net burn is $80k (and gross burn: $100k).

What you should say

“Our burn rate was $80k last month. We generated $20k in revenues (up +10% month-over-month) and spent $100k. We expect our burn rate to double after fundraising as we will make 5 hires and increase our marketing spend. We can provide our financial projections in Excel format to back these up”

2. How much are you raising?

This is probably one of the most important financial questions you will get from VCs, probably at the end of your pitch.

This is also a question you will not get if you have properly built your pitch deck, and more especially if you’ve already included the funding ask slide with all the necessary information.

Ideally, you should raise as much as you need to reach profitability, so that you will never have to raise again.

Unfortunately, most early stage startups cannot reach profitability only with one raise. This is especially true for early stage startups.

Instead, they usually need to raise additional round(s) in the future to reach profitability, and finally return money back to investors. That is why you should raise enough to meet specific milestone(s) you promised investors.

The amount you should raise is the total Net Cash Burn until you get to the target you agreed on with investors. Net Cash Burn, as explained above, is the amount of money you will spend, net of potential revenues.

Read more on how to assess how much you should raise in our article here.

3. Where will you spend the money?

This is an easy question. Yet, in order to get your answer ready, you will have to prepare solid financial projections for your startup beforehand.

As explained earlier, the amount you should raise is the product of your financial projections. By using the same financial projections, simply calculate the total amount of expenses you expect to incur over the next X months, by category.

The number of months (X) mentioned above is the number of months you expect to last until the next fundraising round, or profitability. As you would have guessed it, X simply is your expected runway (more on that below).

First, group the expenses into key categories. These categories will depend on the type of business you have. Usually, categories for tech startups can be:

- Product development (engineers salaries, 3rd party agency costs, hosting costs, etc.)

- Marketing (marketing team salaries, paid ads budget, content & SEO agency costs, etc.)

- Sales (sales team salaries & bonuses)

- COGS (payment processing fees, unit costs – if you manufacture or source products, etc.)

- Other salaries (administrative, support function roles, management)

- Other expenses (rent, subscriptions, office supplies, etc.)

After you have grouped expenses into 3/5 categories, simply use their portion as a percentage of total costs over your expected runway.

What you should say

“We are raising $15 million which we expect to spend in product development costs (10 engineers) for ~30%; marketing for ~15%(customer acquisition costs – mostly inbound acquisition) and other team salaries and expenses for ~50%.”

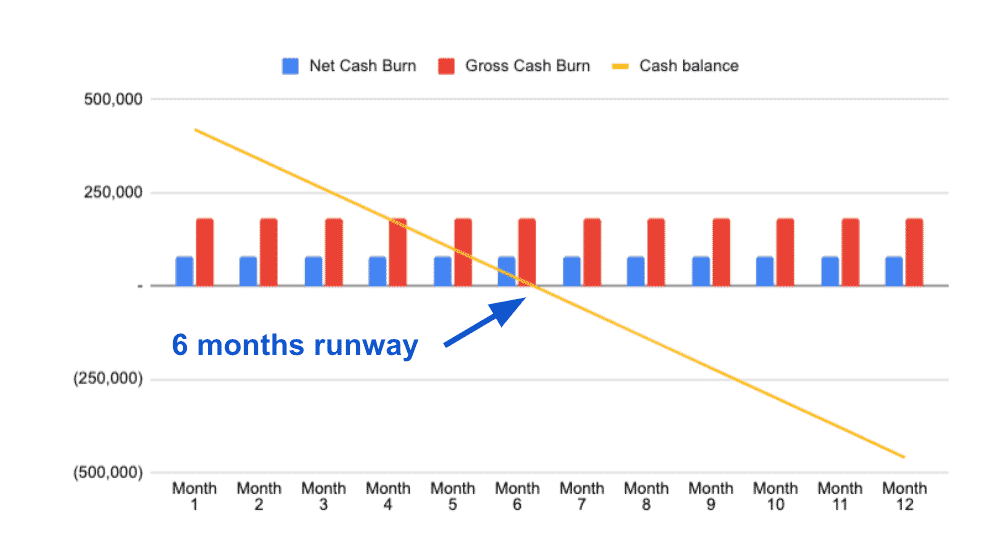

4. What is your runway?

The runway is the number of months a business can survive with the cash on hand. Because it only refers to loss-making businesses (such as startups in their early days), runway is never used for profitable businesses.

When investors ask about your runway, they can mean two different things:

- Your current runway: how many months do you still have with your current cash balance?

- Your expected runway: how many months do you expect to last with the amount of funds you are asking investors as part of this round?

So in doubt, clarify with VCs what they actually mean. Yet, most often, by “runway” investors refer to your expected runway.

In short, runway is calculated by taking the expected capital raise amount by your net cash burn. If you want a refresher on what is cash burn, as well as the difference between gross and net cash burn, read our article here.

What you should say

“Assuming a fundraising of $4 million as part of this round, we expect to last 24 months.

Indeed, we expect our net cash burn for the next 24 months to range between $100-200k. Our current net cash burn is $100k today, and we plan to make future hires post round which will increase our burn to $200k. Over time, we expect to increase our monthly revenue from $40k today to $140k in 2 years, which will reduce our burn at $100k at that point.”

5. When will you raise your next round?

This deal question is very similar to the runway question mentioned earlier. This question also assume you will need to raise a further round after the one you are speaking to investors for today.

When you should raise your next round is simply the result of your expected runway: the number of months, post round, your startup will last based on the funds you are expecting to raise. For more information on runway and what it is, see answer to the previous question of this list.

Yet, this is one of these deal questions VCs might ask where you will need to go a bit deeper, and don’t simply limit yourself to your expected runway.

Instead, you should explain to investors why you did choose to raise this amount. In other words, what milestone(s) are you trying to achieve as part of this round and when do you expect to achieve them?

Remember: the amount you need to raise is the amount of capital you need to get to your next milestone.

So, when asking when do you expect to raise your next round, what VCs really want to understand is whether you are likely to achieve these milestones in time. For example:

- Will you be able to get to 10,000 customers within 24 months?

- Can you ship these 5 product features by the time you raise your next round?

- Will your social mobile app achieve network effects by the time the current round is depleted?

- Etc.

What you should say

“With a $5 million Series A round, we aim to launch 2 product features of which our subscription package. This will allow us to generate recurring revenue and a stronger business overall.

With this round, we expect to have 10,000 customers ($200k monthly revenue) in 24 months. That’s when we will need to raise a Series B round to invest in other markets as part of our long term expansion strategy”

6. What KPI are you focusing on?

This question is related to the previous one. We mentioned “milestones” when assessing how much you should raise, right?

Milestones are targets for the KPI you are focusing on. In our example above, the milestone is 10,000 customers (or $100k MRR) in 18 months. So here, the KPI would simply be the number of customers.

Let’s backtrack a little bit.

The reason why startups don’t necessarily focus on revenue or some profit margins like most mature companies do is because they are early stage. As such, they don’t necessarily turn a profit today, nor they will in 18 months. Also, they might not generate any revenue today, nor they will tomorrow.

Even startups that generate revenue today do not necessarily focus on growing revenues, at least not today. Instead, they might prefer growth which can be the number of users they have, the total time spent on their mobile app, the total volume of transactions through their payment infrastructure, etc.

Investors understand that, and often prefer startups that focus on scale in terms of users, instead of revenues. This is especially true for businesses that benefits from network effects (e.g. marketplaces).

What you should say

“At the moment, our focus is on the number of customers we have. We do invest a lot of effort into minimising churn and improving our customer experience. Also, we are aggressively trying to increase our scale by offering a freemium.

As such, whilst we generate healthy increasing revenues ($20k MRR as of last month, growing +5% month-over-month), we do not focus on revenues at this point but scale instead”

7. What are your milestones for the next round?

This question follows the previous one. As such, the answer is very similar to what we just suggested above.

Indeed, the milestone(s) of the next funding round are a metric (or a number of metrics) you are targeting by the time you raise you next funding round.

Whether you plan to raise this round to get to a number of customers, an amount of revenues, or even profitability depends on the stage your business is in (early or later stage) and your strategy (are you focusing on growth or profitability?).

For more information the KPI (or milestone) you should be focusing on, read our article here.

What you should say

“At this stage, we focus about growth over profitability. That is why, with this round, we expect to have 10,000 customers ($200k monthly revenue) in 24 months. That’s when we will need to raise a Series B round to invest in other markets as part of our long term expansion strategy.”

8. What are your unit economics?

Unit economics are by definition a company’s revenues and costs related to an individual unit of production. In plain english, for startups it means a revenue per user (ARPU) for example, or Gross Profit per user even.

The famous Customer Acquisition Cost metric (CAC) also is part of a startups’ unit economics. Indeed CAC is the total acquisition costs (sales & marketing) divided by the number of new users.

When an investor ask about your unit economics, you need to be prepared to give investors an idea of at least:

- the revenue you generate per customer (over a month for instance)

- the gross profit margin, after acquisition costs, per customer

- CAC

- Customer Lifetime Value (“LTV” or “CLV”)

- Any other relevant metric you feel brings value to an investor and show either the profitability or the value added of your company / product

What you should say

“We sell subscriptions to our customers, our average revenue per user (ARPU) is $15 per month. Our users have a lifetime of 3 years in average, hence a $540 LTV (calculated on revenues).

We spend in average $200 in customer acquisition cost so far, which we expect to decrease to $150 in the next 12 months. Hence our LTV:CAC ratio is approximately 2x today”

9. What is your breakeven?

The breakeven of any business is the point in time when it starts to turn a profit. This is a very common question from VCs of course as startups almost always make a loss for the first few months / years before they can turn a profit.

What you should say

“Based on our financial projections which we can provide to you, we expect to be profitable in 18 months. By that time, we expect to generate $100k in monthly revenue”

10. Walk us through your model

It goes without saying that you should always prepare a financial model when pitching investors.

The financial projections within your model (short for “financial model”) are the only way for you to answer key questions we already discussed above, such as:

- How much are you raising?

- What’s your startup valuation?

- What’s your breakeven?

- Etc.

Now that we made that clear, by asking such question investors expect you to explain, high-level, how you came up with your financial projections. They want to understand how you came up with this 10,000 customers you target in 18 months time, or the $1 million capital you need to raise to get there, etc.

The best approach here is to literally open the model (in Excel or Google Sheets) and summarise in a few sentences how you built up your P&L. To get you started, explain:

- How you acquire your customers (is this a paid acquisition dependent upon your marketing budget, or a B2B acquisition which in turn is a function of the B2B sales people you hire?)

- What is your revenue model (see above) and pricing

- What are the key variable costs and fixed costs of your business

For more information on how to build accurate financial projections for your startup, read our article here.

In short, investors need to see that you understand clearly what are the major drivers to your business.: both the drivers impacting your revenue and your costs.

What you should say

“We built our model by assuming the following:

- ARPU of $100 per month

- A B2B sales person close in average 10 clients a month

- 20% annual churn (conservative)

- $500 CAC (from our past 3 months data, decreasing to $300 by next year)

From there, factoring in new B2B sales hires (approx. 1 every 3 months), we consistently grow our user base to 500 customers by end of next year. This represents a $50,000 MRR by end of next year.

Factoring in salaries (5 developers, 8 sales, 4 other), we land at an EBITDA of approx. -$50,000 by that time. We expect to breakeven in 24 months.”

11. What is your revenue model?

This is one of the most common financial questions VCs ask. It’s another way of asking how your business makes money.

There are number of revenue models, and a startup can very well combine multiple revenue models as explained in our article on the 8 most popular revenue models.

This question should in any case answered upfront in your revenue model slide. So if you haven’t do so already, craft a solid slide explaining:

- What is your revenue model

- If you have different revenue streams

- What is your pricing strategy

What you should say

“Our business is a marketplace. As such we combine 3 separate revenue streams:

- we sell subscriptions to the sellers on our marketplace, at an average $20 per month

- we charge a transaction fee off the volume of transactions (Gross Merchandise Value) to the buyers

- we generate revenues from the sale of ads

As of last month, the split between the 3 was 40%, 55% and 5% of total revenue. We expect this breakdown to be stable over the next few months”

12. What are the key drivers to your business?

This one of the most common financial questions VCs ask startups. It follows the question about walking investors through your financial model.

If you prepare a solid yet flexible financial model with a limited number of key inputs (the “drivers”), this question is actually very easy to answer. The inputs (or “drivers”) are assumptions that impact your revenues and expenses, they can be:

- The price of your product/subscriptions

- The commission rate you are charging

- The number of new customers you onboard each month

- The churn rate

- Your marketing budget

- Your conversion rate

- Etc.

As you would have guessed it, and as the question actually puts it, there is no single answer. Instead, financial models are the function of various inputs, of which some have larger impacts than others.

Ideally, you would pick the 2/3 largest drivers to your financial model and explain how they impact revenues, or expenses, or both.

What you should say

“Because we are a B2B SaaS business, the main drivers of your revenues are:

- the efficiency of our B2B sales people (customer acquisition), which drives the number of customers we onboard every month. We expect 15 closings per month per sales people, in line with our past performance

- our churn rate, which drives the total number of customers at any point in time. We have conservatively assumed 20% annual churn, in line with historical performance, even if we expect to improve it

- The price we charge our customers, with is stable at $10 per month”

13. What are the terms of this round?

When VCs ask this question, they want to know whether you are doing a standard priced equity round or a convertible note.

So what’s a convertible note?

A convertible note (or “convertible debt”) is a type of short term debt that converts into equity. Convertible notes are typically used by early stage equity investors for a number of reasons which we are discussing below.

As it converts into equity later on, a convertible note does not specify the valuation of a startup as of yet (when you raise convertible note).

Instead, the valuation (which defines how much ownership you will sell to new investors – aka dilution), is defined at the later funding round (the “qualifying financing”). Yet, logically convertible notes investors get a preferred treatment as they come earlier in the deal: that’s why convertible notes convert into equity at a discount.

If you want to know more about convertible debt for startups, read our full guide here.

So what’s a priced equity round?

A priced equity round (vs. convertible note) is a standard equity round whereby new investors who come into the deal get shares based on a valuation that has been agreed between both parties (new and existing investors).

Whilst convertible note deals have become more and more popular recently, priced equity rounds are the most common deal structure when startup raise capital.

Remember: because convertible notes convert into equity at a future (priced equity) round, they are dependent upon “standard” priced equity rounds. As such, you can’t just raise convertible notes. Instead, convertible notes should be seen as a “bridge” between 2 priced equity rounds.

What you should say

- If you are raising a convertible note:

“We are raising a convertible note of $1 million, which will convert into equity at a 20% discount, within 18 months maximum when we expect to raise our Series A. We also set a valuation cap at $10 million for our next round”

Note: if you need a refresher on convertible notes key terms (cap, maturity, discount, etc.) read our article here.

- If you are raising a priced equity round:

“We are raising a $1 million Series A with a pre-money valuation of $6 million, hence a ~14% dilution.”

14. When are you expecting to close this round?

This is one of the deal questions VCs might ask when you need to be careful. Indeed, VCs want to know 2 different things:

How far ahead are you in your fundraising process?

Have you just started out reaching out to VCs last week? Or are you closing the round within the next 2 weeks as you already have 80% of your fundraising covered?

This is important for VCs to know, as they might have to reconsider investing if they don’t have enough time to complete their due diligence. Alternatively, if they’re really interested, they need to know if they should speed up their process to get into the deal.

Are you desperate / unrealistic?

Some entrepreneurs unfortunately don’t realise how long (equity) fundraising usually takes. Preparing your pitch deck, meeting investors, negotiating terms, answering due diligence questions, etc: the whole process can easily take up to 3 months.

Therefore, if you’re looking to raise $1 million and have no committed funds so far (see more on that below) and just started meeting investors, don’t expect closing next month, let alone next week.

- Are you desperate (you only have a few weeks of runway)?

If so, never look desperate in front of investors. Find alternatives instead (e.g. a small convertible note round which can be raised under a week or 2).

- Are you realistic?

If not, VCs may assume you aren’t realistic for a number of other things (e.g. your financial projections, roadmap, etc.). This is a big turn off for any investor, no matter how revolutionary your product is.

What you should say

“We have started meeting investors 4 weeks ago, and are getting good traction so far. We have started negotiations with 3 of them. Therefore, we expect to close our round within 6 or 8 weeks maximum.”

15. Do you have a lead investor?

When asking questions about the deal, VCs might ask if you already have a lead investor in.

A lead investor is the largest investor within a deal. Often, the lead investor completes most of the due diligence and negotiate the terms. That way, smaller investors typically rely on the lead investor for its due diligence and agree to the terms the lead negotiated with you.

There is always a lead investor, whether you are raising a priced equity round or a convertible note.

Unfortunately, most investors out there are followers (and not leads). Lead investors are usually institutional investors (VC funds) and followers smaller VCs funds and angel investors alike.

As such, fundraising almost always requires to confirm the lead investor (who “commit” to invest its share into the deal) to bring all the remaining followers into the deal and close the round. In other words, you can’t close a deal if you haven’t found your lead investor.

What if you don’t have a lead investor?

Investors who ask the question are almost always followers. Indeed, they want to know if they can already commit the funds, or not (if they are interested).

Instead, lead investors (VC funds) might not ask the question. They can do so to gauge whether they have competition. Yet, if you are speaking to them, they are assuming you want them to lead the deal, so they assume you haven’t yet found your lead.

So if you haven’t yet found a lead, don’t panic. It’s absolutely normal. Be transparent with followers (non-lead investors) but gauge whether they are interested and how quickly they could commit funds once you found the lead.

For the leads, if they don’t ask, simply don’t say anything. As said earlier: if you have pitching to them, it’s very likely you want them to lead and you haven’t found the lead yet.

16. Any committed capital?

Committed capital is another term for “confirmed interest” of an investor into the deal.

There are 2 forms of commitment:

- Soft commitment: an investor is interested to invest, but at a condition (minimum valuation, a lead investor coming into the deal, etc.)

- Hard commitment: an investor is interested to invest (has already signed the term sheet) and/or has already invested (sent the funds to your bank account)

This question is the ultimate proof of how serious you are, and how successful your fundraising actually is. Think about it: you might have the best pitch deck and paint a perfect picture of how well your fundraising is going. Yet, if you haven’t a single investor committed yet (nor soft or hard commitment) whilst you have been trying to raise for a few weeks now, this doesn’t sound good for a potential investor.

Remember: Investors rely on other investors to assess their investment opportunities. We all do this, including when investing in the stock market (we rely on a company’s valuation resulting from the publicly traded shares when trading a stock).

Unfortunately, you can’t fake committed capital and investors know this. If they ask the question, be as transparent as possible. There is no shame in having none yet if you’re just starting. And if you haven’t any but it’s been a few weeks already, you might want to draw some conclusions already.

What you should say

“We have been fundraising for 6 weeks already now and have 3 soft commitments from angel investors for 25% of the total fund. Yet we are looking for a lead for them to invest (hard commitment).

We are confident to close our $2 million round within 6 weeks assuming we close a lead investor with 40%+ of committed funds.”

17. What’s your valuation?

This question is one of the most important deal questions VCs typically ask. Indeed, it can either be a deal killer or a green light, so be sure to be prepared when answering such question.

Why is valuation crucial for VCs?

First, remember that investors invest in your startup to generate a return. And not any return: venture capital returns are amongst the highest of all finance assets and instruments. Indeed, VCs typically invest in a number of startups, expecting to lose money on most of them yet making at least 20x returns on the successful investments. A basic investment diversification like any other you could say.

All in all, factoring losing and winning deals, top quartile VC funds reported average annual return ranging from 15% to 27% over the past 10 years. No wonder that VCs always invest with an expectation to realise a return of at least 20x their original investment (25-35% annual return as per Harvard Business Review).

That being said, you now clearly understand why your expected valuation has a massive impact on VCs’ expected return on investment (ROI).

Be prepared and ask for a reasonable valuation

When you answer this question, you should be prepared. The valuation of your business is the result of your financial projections. There are many ways to approach your startup valuation, so if you haven’t it yet, be sure to read our articles on valuation here.

Your valuation is very important, and it shouldn’t be too low nor too high. Why?

If your valuation is too low

It can be positive as investors may see your startup as “cheap” i.e. they will expect higher returns when they exit.

Yet, if your valuation is too low, the dilution you will suffer from will be important and you might lost ownership (at this round or at a future one). Read more on ownership dilution here.

If your valuation is too high

If you ask a crazy number out of thin air, investors won’t be able to generate their expected 20x return but (maybe) 5-10x instead. This isn’t sufficient for VCs, so they’ll likely won’t be interested. Whilst they might not be upfront about it, instead they’ll say they’ll come back to you shortly (with a negative answer by email a few days later).

What you should say

“We are raising a $5 million Series A round at a $15-20 million pre-money valuation, resulting in a 20-25% dilution. Our valuation range has been calculated using a number of methodologies, using our financial projections. We believe our valuation is also in line with comparable deals closed recently.”

18. How large is your ESOP?

ESOP (short for “Employee Share Ownership Plan“) is a pool of options you reserve to issue to your employees (or some of your employees) in the future.

Companies use ESOP shares to align the interests of their employees with those of their shareholders (the founders, VCs and angel investors for startups).

Before each fundraising round, investors will ask you to either create an ESOP (for the first round) or increase that pool. Most startups typically have 10-15% of total shares as the ESOP pool.

Because the ESOP is created out of the pre-money valuation, only existing investors get diluted as part of the creation (or increase of the existing ESOP). You want to make the ESOP large enough to make sure all new hires get the ESOPs they deserve, yet not too much to get too diluted either.

What you should say

“We set up an ESOP of 10% in the last round and have issued already 6% so there is 4% left. According to our expected hiring plan, we shall give another 6% to future hires, so we need to increase our ESOP to 12% as part of this round.”

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support