Tim Hortons Franchises Costs $927K (+ 2023 AUV & Profits)

This article was updated with the 2023 Franchise Disclosure Document

Even though from Canada originally, Tim Hortons franchises has expanded over the years: there are now 5,352 locations in 15 countries worldwide. It’s also popular among entrepreneurs and franchisees for a number of reasons (brand name, training, support, etc.).

What about the costs and profits? Is Tim Hortons a good investment?

With an investment cost of $927,000 on average, including the hefty $50,000 initial franchise fee, you must do your research before you can open a Tim Hortons franchise.

For us to answer these questions, we must look at the Franchise Disclosure Document which we discuss below. Especially, we will see how much you can make with this business and how much you need to invest as the franchisee. Let’s dive in!

Key stats

| Franchise fee | $50,000 |

| Royalty fee | 6.00% |

| Marketing fee | 4.00% |

| Investment (mid-point) | $927,000 |

| Average sales | $999,000 |

| Sales to investment ratio | 4.0x |

| Payback period | [franchise_value_investment_payback] |

| Minimum net worth | $500,000 |

| Minimum liquid capital | $100,000 |

Find the most profitable franchises on

Compare 1,000+ franchises and download unlimited FDDs

| Tim Hortons |

| FRANCHISE FEE | $50,000 |

| ROYALTY FEE | 6.00% |

| INITIAL INVESTMENT | $124,000 – $2,138,000 |

| AVERAGE REVENUE | $999,000 |

About Tim Hortons

Tim Hortons is a leading Canadian restaurant chain founded in 1964 in Hamilton, Canada. Headquartered in Toronto, its menu is synonymous with coffee, doughnuts, baked goods, soups, and sandwiches.

It was founded by Canadian ice hockey defenseman, Tim Horton, and Montreal-born businessman, Jim Charade. One year later, in 1965, Tim Hortons began to franchise its coffee shops.

Wendy’s, an American fast-food restaurant chain, acquired Tim Hortons in 1995 in a partnership that lasted a decade. In 2014, 3G Capital, a Brazilian private equity firm, purchased the Canadian fast food chain.

Today, Tim Hortons has 5,352 locations in 15 countries around the world.

Tim Hortons franchises pros and cons

Pros

- Third-party financing: the brand has built strong relationships with 3rd party financing institutions to provide funding to its franchisees

- World-class support: the brand’s 6-decade experience goes into supporting new restaurant owners. The chain offers ongoing support to help franchisees run and manage their businesses. This includes site selection, field operations, online support, security and safety procedures, and lease negotiation

- Franchise training: the brand offers comprehensive training to help its franchisees launch successful businesses. This begins with a 7-week training program at Oakville’s Tim Hortons University. The training emphasizes food handling, hygiene, equipment maintenance, security systems, and team member relations. Upon completing this training, new restaurant owners get 179 hours of on-the-job training from a full-service Tim Hortons

- Marketing support: the brand provides its franchisees with detailed and useful marketing support to promote their businesses. To maximize growth and attract potential customers, franchisees get access to regional advertising, national media, email marketing promotions, ad templates, website development, and social media

- Growth potential: the restaurant chain presents lots of growth opportunities to franchisees looking to tap into the local and international markets

Cons

- No exclusive territory: the brand doesn’t provide exclusive territorial protection to its franchisees. This exposes the franchises to stiff competition from other fast-food chains

- No absentee ownership: Tim Hortons doesn’t provide passive investment opportunities. Franchises must be actively involved in the day-to-day running of the business operations

- It can’t be run from home or as a mobile unit: franchisees must run the restaurant either from a retail facility (ie no food truck) or an office space if administrative functions are run remotely

- Can’t be run part-time: Tim Hortons doesn’t offer part-time business opportunities to its franchisees. The brand carefully selects hands-on owners who can commit to running their restaurants on a full-time basis.

- Competition: Tim Hortons faces stiff competition from other coffee chains: Dunkin’ Donuts, Krispy Kreme or even Cinnabon just to name a few

How much does a Tim Hortons franchise cost?

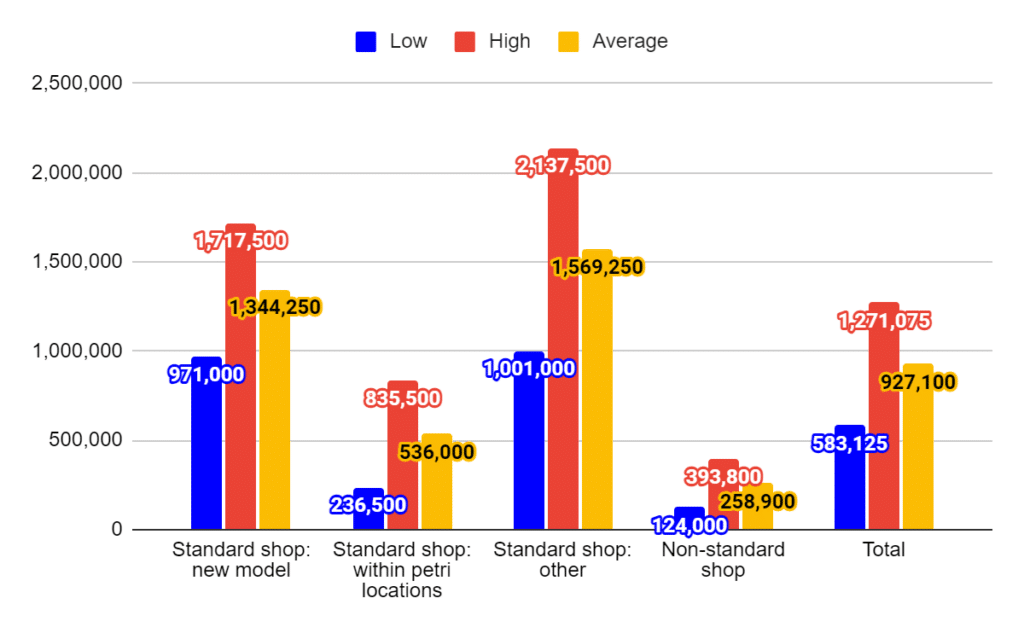

You would have to invest on average $927,000 to open a new Tim Hortons franchise restaurant.

Note this is the investment for a standard shop. Indeed, there are 2 formats of restaurants you can choose from:

- Standard shop ($1,150,000 investment cost): this is the most common format (86% of the 633 franchised-owned restaurants in 2021). The standard Tim Hortons shop ranges in size from 1,000 to 2,300 sq. ft. and contains an area for customers as well as a drive-thru facility

- Non-standard shop ($258,900 investment cost): either a built-in kiosk or a full service cart, non-standard shops are typically much smaller and vary in size to adapt to the space where they are located. They may also have a limited menu to accommodate space and customer demand in its location

The investment amount is an average: indeed, it varies based on many factors such as land and building size, location and development needs; construction, equipment specifications etc.

Here’s the full breakdown of costs for a standard Tim Hortons shop:

| Type of Expenditure | Low | High |

|---|---|---|

| Initial franchise fee | $50,000 | $50,000 |

| Formation costs | $586,500 | $1,197,000 |

| Equipment | $300,000 | $410,000 |

| Additional Fund | $25,000 | $25,000 |

| Operating expenses | $9,500 | $35,500 |

| Total | $971,000 | $1,717,500 |

Find the most profitable franchises on

Compare 1,000+ franchises and download unlimited FDDs

| Tim Hortons |

| FRANCHISE FEE | $50,000 |

| ROYALTY FEE | 6.00% |

| INITIAL INVESTMENT | $124,000 – $2,138,000 |

| AVERAGE REVENUE | $999,000 |

How much sales can you make with a Tim Hortons franchise?

On average, Tim Hortons franchises make each $999,000 in sales per year.

To obtain this number, we annualized the average monthly gross sales of $83,231 in 2022 as per the latest Franchise Disclosure Document. Note that this is the average sales for a standard restaurant (calculated based on 558 standard restaurants in 2022).

How profitable are Tim Hortons franchises?

Luckily, Tim Hortons provides some information on the profitability of its restaurants. This allows us to estimate profits.

On average, we estimate that a Tim Hortons standard restaurant makes $120,000 in profits per year. This represents a 12% EBITDA margin.

| Profit and loss | Amount | % Sales |

|---|---|---|

| Sales | $998,772 | 100% |

| COGS | $(289,644) | 29% |

| Gross Profit | $709,128 | 71% |

| Labor | $(279,656) | 28% |

| Marketing and royalty costs | $(99,877) | 10% |

| Occupancy | $(89,889) | 9% |

| Other OpEx | $(119,853) | 12% |

| EBITDA | $119,853 | 12% |

Is a Tim Hortons franchise a good investment?

Now that we know how much revenue you can make on average and the profitability of the business, we can easily calculate the investment payback.

The payback is a metric used by investors to assess the profitability of an investment. By dividing the investment costs by the annual profits, it tells us how many years an investment takes to repay itself.

We estimate that the payback period for a Tim Hortons franchise is 6 years on average.

This is a good payback for a restaurant franchise. This means you would have to wait 6 years on average to recoup your initial investment ($927,000 in this case).

But again, keep in mind this is an average, and your franchise restaurant may turn out to be less (or more) profitable depending on a number of factors.

Find the most profitable franchises on

Compare 1,000+ franchises and download unlimited FDDs

| Tim Hortons |

| FRANCHISE FEE | $50,000 |

| ROYALTY FEE | 6.00% |

| INITIAL INVESTMENT | $124,000 – $2,138,000 |

| AVERAGE REVENUE | $999,000 |

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.