Franchise Disclosure Document: Item 7

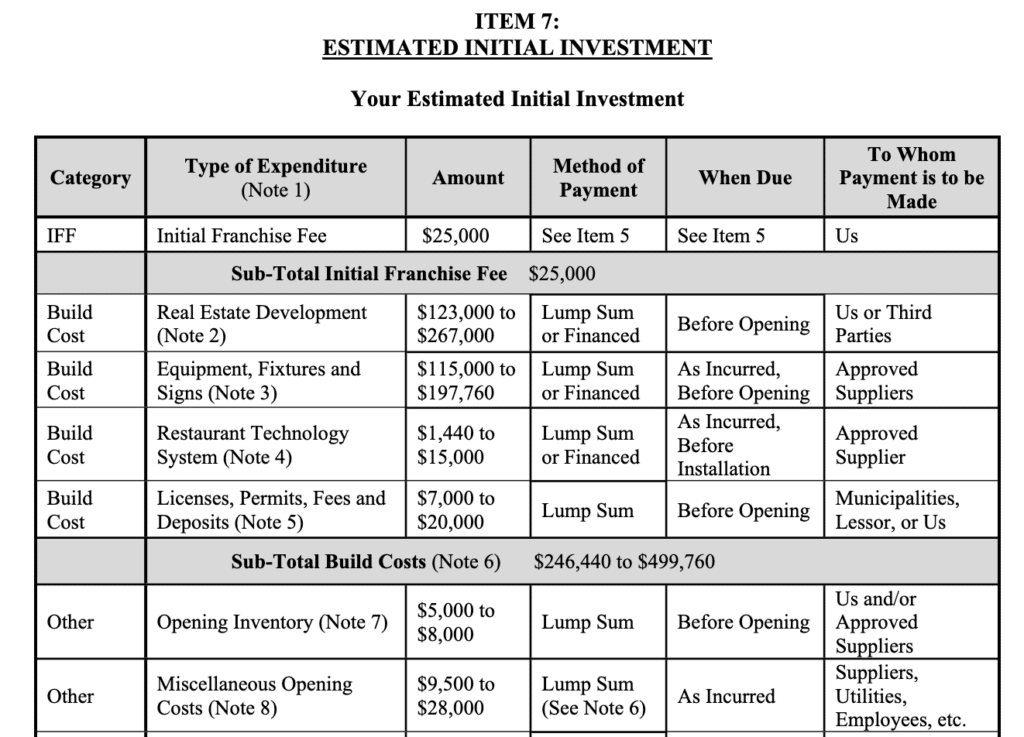

Item 7 of the Franchise Disclosure Document (FDD), also referred as “Estimated Initial Investment“, is a section that provides franchisees detailed information about the costs associated with starting and operating a franchise.

As such, Item 7 of the FDD is critical for potential franchisees to understand the financial obligations and startup costs they will undertake when they sign the franchise agreement.

These costs, which we provide a few examples further below, can include anything from the lease deposit, building costs, equipment, supplies and working capital for the first few months of operations.

What information is presented in Item 7 in a FDD?

The information is codified and included in a 5-column format table including:

- The Type of the Expenditure

- The Amount

- The Method of Payment (lump sum or as incurred)

- When Payment is Due (at signing, before a certain event e.g. training, as incurred, etc.)

- To Whom Payment is Due (the franchisor, the supplier, utilities, banks, etc.)

Here is an extract of the Item 7 section of the 2022 Baskin Robbins Franchise Disclosure Document as an example of what a Item 7 looks like:

What Types of Expenses are Included in Item 7?A

As explained earlier, Item 7 of the FDD is where franchisors provide detailed information on the costs associated with starting and operating a franchise. In other words, these are estimated costs the franchisee would have to pay if she/he were to buy a franchise and open a new location (like a restaurant, a fitness club, a salon, etc.).

Item 7 typically includes the following types of expenditures:

- Initial Franchise Fee: This is the upfront fee paid by the franchisee to the franchisor upon signing the franchise agreement. This fee grants the franchisee the right to use the franchisor’s trademark, operating system, and any initial training and support provided by the franchisor.

- Leasehold Improvements: Franchisees may be required to pay for the cost of any improvements required to meet the franchisor’s standards in the building where they will operate their business.

- Lease Deposit: typically franchisees will need to secure a location to operate their business. If they choose to rent (instead of buying), they will have to pay a refundable upfront deposit, usually equivalent to 3 months worth of rent. The franchisor then includes an estimate of the lease deposit cost making some assumptions (the standard size of the restaurant/gym/salon/etc. and the price per square feet its franchises typically pay)

- Equipment and Supplies: Franchisees are typically responsible for purchasing or leasing equipment and supplies required to operate the franchise unit, such as point-of-sale systems, furniture, and inventory. These equipments are either purchased from the franchisor itself, or through its supplier, or in some cases via third-parties.

- Starting Inventory: many franchises are required to stock up inventory before they actually start doing business. These businesses include for example restaurants, coffee shops, hotels or even car repairs.

- Grand Opening / Marketing: Franchisees may be required to pay some costs upfront for marketing and advertising expenses. In Item 7, these startup costs typically include grand opening expenses (like organising soft-launch events, billboards, etc.)

- Insurance: Franchisees must often purchase certain types of insurance coverage, such as liability insurance, to protect the franchisor and themselves from potential risks.

- Training Expenses: most franchisors, if not all, provide a training for their franchisees. It can either be a week long training program for the managers alone, or a more extensive training for the employees themselves. This is a startup cost that must be paid for to the franchisor.

- Additional Funds for First (3) Months of Operation: also referred to as working capital, any business must fund a certain amount of money to cover for the first few months of operations. In addition to one-time capital expenditures (building costs, renovations, etc.) and other prepaid expenses (inventory, deposit, etc.), businesses must pay for the first few months losses. This includes anything from employee salaries, to rent, and any other operating and non-operating expenses that may arise before the business becomes profitable and/or get subsequent funding. In our experience, almost all franchisors require at least a fund to cover the first 3 months of operations.