Capital Tacos Franchise FDD, Profits & Costs (2025)

Capital Tacos is a fast-casual Tex-Mex restaurant chain renowned for its scratch-made, innovative flavors. Established in 2013 in Land O’Lakes, Florida, the company has expanded its presence across the United States. The brand began offering franchise opportunities in 2022, aiming to share its unique culinary experience with a broader audience.

The menu at Capital Tacos features a variety of items, including tacos, burritos, bowls, and quesadillas, all crafted from scratch using high-quality ingredients. This commitment to freshness and flavor sets the brand apart from competitors in the Tex-Mex segment.

Additionally, Capital Tacos offers multiple business models for franchisees, such as brick-and-mortar restaurants, static trailers, and mobile event trailers, providing flexibility in investment and operations.

Initial Investment

How much does it cost to start a Capital Tacos franchise? It costs on average between $129,000 – $427,000 to start a Capital Tacos franchised restaurant, depending on the chosen business model.

This includes expenses such as equipment, signage, seating, and other essential costs. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property.

Average Revenue (AUV)

How much revenue can you make with a Capital Tacos franchise? A Capital Tacos franchise can generate varying levels of revenue depending on the business model.

A brick-and-mortar location averages $1,489,367 in annual revenue, with gross profits of $601,455. Static trailers generate an average annual revenue of $332,148, while event trailers bring in approximately $108,000 per year.

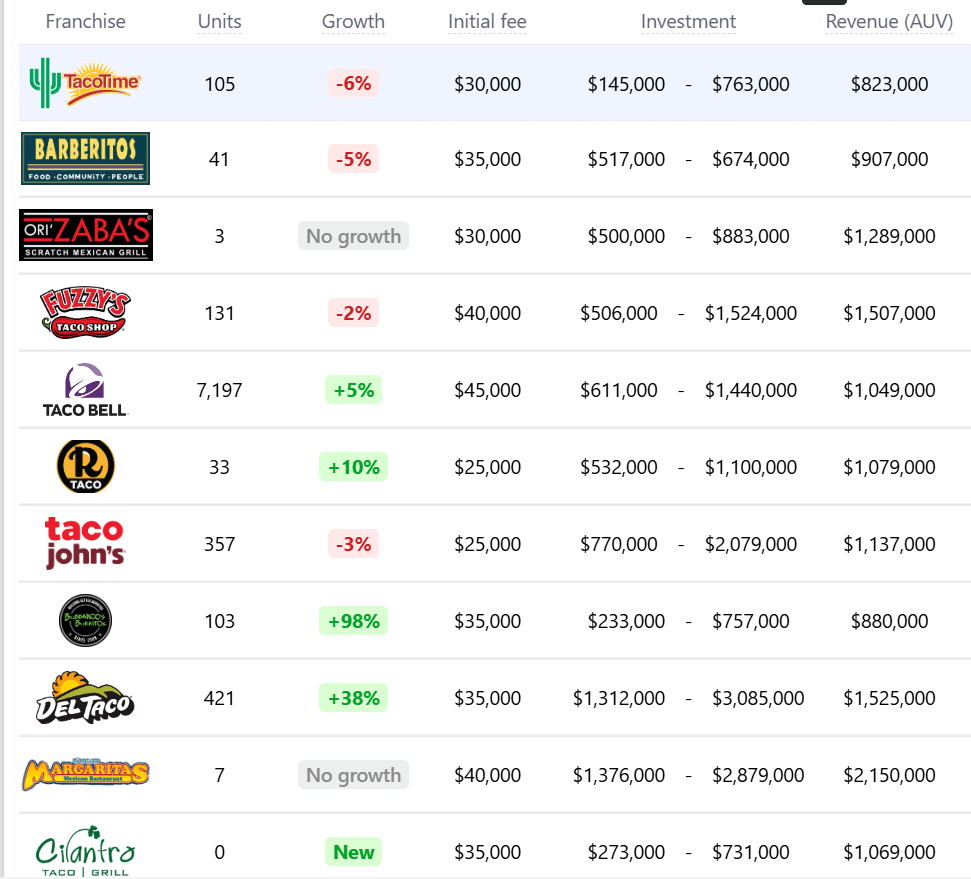

Below are a few Capital Tacos competitors as a comparison:

Frequently Asked Questions

How many Capital Tacos locations are there?

As of the latest data, Capital Tacos operates 11 locations across the United States. This includes both company-owned and franchise-owned establishments. The brand continues to expand, with new locations planned in various regions.

What is the total investment required to open a Capital Tacos franchise?

The total investment required to open a Capital Tacos franchise ranges from $129,000 to $427,000.

What are the ongoing fees for a Capital Tacos franchise?

A Capital Tacos franchise requires a 6% royalty fee and a 2.5% marketing fee, both based on monthly gross sales. These fees support brand operations and advertising efforts.

What are the financial requirements to become a Capital Tacos franchisee?

To qualify as a Capital Tacos franchisee, candidates should possess a minimum net worth of $350,000 and at least $100,000 in liquid assets.

These financial benchmarks ensure that franchisees have the necessary resources to establish and sustain their operations effectively. Additionally, prior experience in the restaurant industry is advantageous, though not mandatory.

How much can a Capital Tacos franchise owner expect to earn?

The average gross sales for a Capital Tacos franchise are approximately $01.59 million per location. Assuming a 15% operating profit margin, $1.59 million yearly revenue can result in $239,000 EBITDA annually.

Who owns Capital Tacos?

Capital Tacos is co-owned by operating partners Josh Luger and James Marcus. They have been instrumental in the brand’s expansion and success.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.