Expert-built financial and business plan templates

Download the template for your business. Customise it. Get funded.

[wd_asp id=1]

Trusted by 12,000+ entrepreneurs, consultants and investors

Vetted by professionals at leading organizations

BuSINESS PLANS

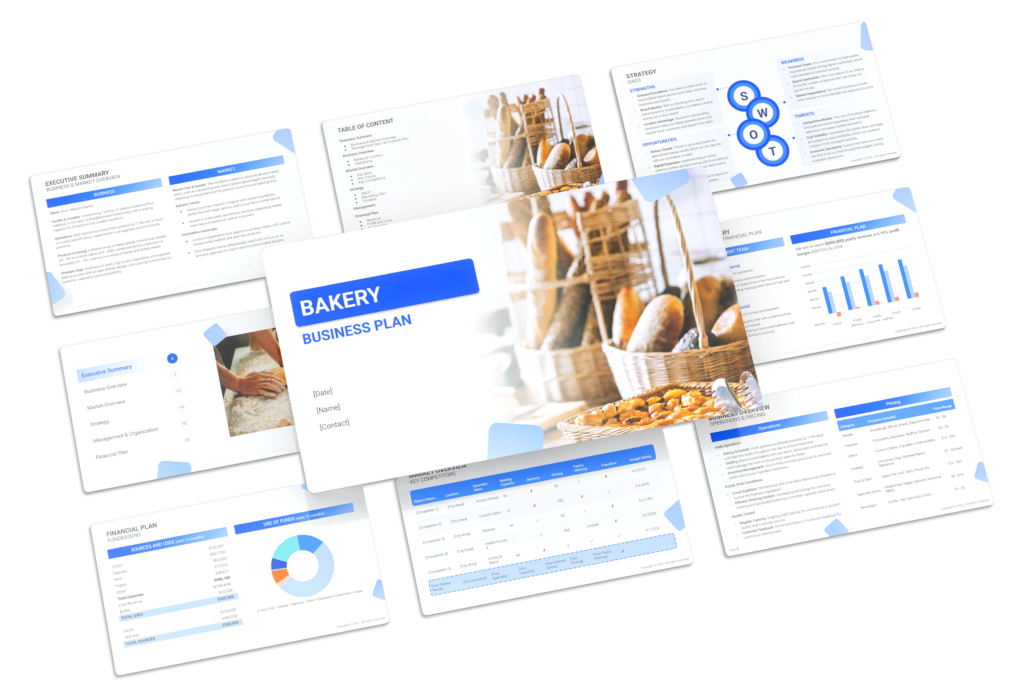

Professional Powerpoint business plan templates to raise funding

- 30+ slides already completed

- Business overview

- Updated market research

- Sales & marketing plan

- SWOT, competitive landscape

Financial models

Easy-to-use Excel financial models for serious entrepreneurs

- Profit and loss

- Cash flow statement

- Balance sheet

- Business valuation (DCF)

- 20+ charts and metrics

Trusted by 12,000+ entrepreneurs, consultants and investors

Costs 10x less than what you'd pay a CPAViviane M.

We found this website as we were looking for a financial modeling expert. After some discussions w Remi via email we purchased a template that cost us probably 10 times less what we would have paid to a CPA in the first place.

We found this website as we were looking for a financial modeling expert. After some discussions w Remi via email we purchased a template that cost us probably 10 times less what we would have paid to a CPA in the first place.

Excellent product. The best customer service. I hold an MBA and a JD and I know quality work when I see it. This product meets the demands required for fund raising and would easily stand up in court if needed. Don't hesitate on the purchase, the cost value cannot be beat or duplicated.

This template is the greatest thing ever. It saves me so much time and is far more accurate and thought through than any financial model I have built on my own so far. You can’t be better prepared than this when you’re talking to investors.

Looking for something more than a template?

Hire us.

From complex SaaS to brick-and-mortar businesses to franchises, we can prepare financial projections for a variety of businesses.

01

Book a free call

Book a free consultation with us.

We will ask you questions to understand your business model, the scope of the project, and answer any questions you may have.

02

Receive a quote

Our team will send you a free quote for your project.

The quote is sent by email. Our team will detail the suggested scope of work as well as the suggested timeline and quote.

03

We do the work

We send you the final financial model after all your comments have been processed.

We can send you work-in-progress versions throughout at your request.

04

Pay at project end

We charge a fixed deposit upfront, and the remainder at project end.

We send you redacted versions throughout the project so you only pay when you are happy with your deliverable.