How Profitable is a Gym? Gym Profits & Breakeven

If you are planning to open a gym and fitness club, it’s important to first understand how to turn gym revenues into profits. In other words: how much do you need to run a gym and break even? What is the average profit margin for a gym?

Statista research revealed that 52% of the gyms and fitness clubs that were operational for less than 3 years were profitable in 2020. Also, 68% of gyms and fitness clubs that were operational for 8 years were profitable.

As far as the profit margins are concerned, the 2017 IHRSA Profile of Success reported that the median margin for all clubs in the Pro-Shop/Retail category was 16.5%. Multipurpose clubs had a median margin of 15.5%, while the fitness-only clubs registered a profit margin of 20%.

Of course, the profit margin for your gym and fitness club will depend on factors like location, facility size, type of gym, and various other factors.

How does a gym make money?

Gym businesses makes money from multiple sources. Whether you are looking for ways to increase gym revenue or make your gym more profitable, here are a few ideas:

Membership fees

Gym memberships are the first source of revenue by far for most fitness clubs. It’s estimated that membership fees represent 60% of total fitness clubs revenue.

Whilst most gyms only offer one membership plan that gives access to the amenities for members to use freely, gyms increasingly offer multiple-tier pricing instead. Indeed, most expensive plans may include extra service such as free training classes or nutrition planning (see more on that below).

Training classes

In order to increase revenues and customer retention, gyms increasingly resort to personal trainers that offer personal or group classes.

Whilst these classes may be included in the price of the membership (for example you would have access to 5 classes per month with your $100 subscription), they also often are offered as an extra service.

It’s worth noting that recently gyms have increasingly switched to a all-class business model, meaning they only offer group classes (e.g. HIT or spin classes) which they also often sell as a subscription.

Online classes

While gym memberships may get additional members to your business, you can increase the earning potential by targeting those who prefer training at home or do not live within the target communities. With online subscription plans, you extend the reach and potentially increase earnings over time.

Nutrition planning

In addition to personal trainer classes, fitness clubs can also offer nutrition planning services to those who want help and advice on healthy nutrition plans. Introducing nutrition classes and consultation services can significantly help your subscribers if you are offering fitness classes. You have the option to provide separate nutrition classes or even a combination at an extra fee.

Merchandising

Another way gym owners can make extra income is by selling fitness and activewear products online or on-site. Target the existing gym members and introduce an online shop to expand the reach.

What is the average turnover for a gym?

According to RunRepeat, the average annual revenue per gym in the US was $846,827 in 2019.

Yet, you must understand that this is an average value. The annual revenue for individual gyms and fitness clubs can vary significantly depending on multiple factors like:

- Services offered

- Location

- Facility size

- Cost of operation, etc.

ZipRecruiter says that the annual average salary of a gym owner in the US is $69,794. Of course, since every gym & fitness club is different, the annual salary of individual gym owners can differ dramatically.

What is the average profit margin for a gym?

According to the 2017 IHRSA Profile of Success, the median profit margin for all clubs is 16.5%, 20% for fitness-only clubs, and 15.5% for multipurpose clubs.

To accurately assess the profit margin of a gym, you must take into account all costs required to run the business.

How much it costs to run a gym?

There are several recurring costs involved in running a fitness club and they include:

- Salaries: You must pay salary to your staff (trainers, reception, etc.)

- Rent: the rental costs (if you rent) or the mortgage payments (if you bought the real estate)

- Leasing costs: the cost to lease the fitness machines (only if you decided to lease the machines vs. buying them)

- Capex: the costs to acquire the machines upfront (if you decided to buy them vs. leasing)

- Marketing: You must set aside a monthly budget for marketing and advertising your gym & fitness club to continually attract new customers

- Utilities, janitorial services: You need to pay for utilities like electricity and water. You will also need to hire janitorial services to keep the facility clean and hygienic

- Bookkeeping: You will need an accountant (or an accounting software) to maintain your finances

- Insurance: You need to have a business insurance along with worker’s compensation insurance, property insurance, and other relevant insurance

It costs on average $37,000 – $49,500 per month to run a gym with 12 employees (incl. part time trainers). See more on how much it costs to open and run a gym in our complete guide here.

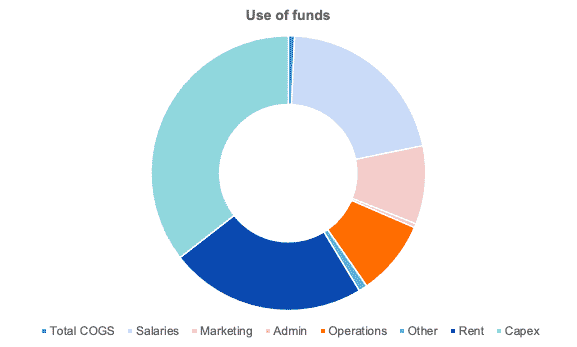

See below an example of a cost breakdown for a gym. Unsurprisingly, excluding the costs to acquire the machines, salaries and rent represents ~70% of total operating expenses.

How to forecast gym profits?

In order to calculate profits for a gym, you must first forecast revenues and expenses.

Profits = Revenue – Expenses

Forecasting gym revenues

Revenues can easily be obtained by multiplying the number of gym members by the average subscription fee (monthly membership).

Membership revenues = Members x Membership fee

For example, if you have 300 members paying on average $100 per month, membership revenue is $30,000 per month.

Yet, many gyms also offer classes. If they are part of the membership, no need to add them to your revenues of course. Yet, if they are additional (like bike group classes or personal training classes), add them to your total revenue. For example, if 30% of your members pay for 10 classes a month each worth $20, “Classes revenues” is worth:

Classes revenues = Classes x Average class price

In this example, classes revenues is:

Classes revenues = 100 x 10 x $20 = $20,000

So total revenue (membership + classes) is $50,000 per month.

Forecasting gym expenses

There are 2 types of expenses for a gym:

- Variable expenses: these are the COGS as explained earlier. They grow in line with your revenue: if your turnover increases by 10%, variable expenses grow by 10% as well

- Fixed expenses: most salaries, rental costs and all the other costs listed above

Calculating gym profits

When we refer to profits, we usually refer to EBITDA (Earnings before interests, taxes, depreciation and amortization) as it represents the core profitability of the business, excluding things such as debt interests, non cash expenses and other non-core expenses.

In order to get to EBITDA, we use the following formula:

EBITDA = Revenue – Operating Expenses

To make it clearer, we’ve included below the profit-and-loss of a fitness club (from our financial model template for gyms).

Whilst gross margin (after variable costs) is close to 100% (mostly payment fees), EBITDA margin can go up to 15-20% depending on the gym.

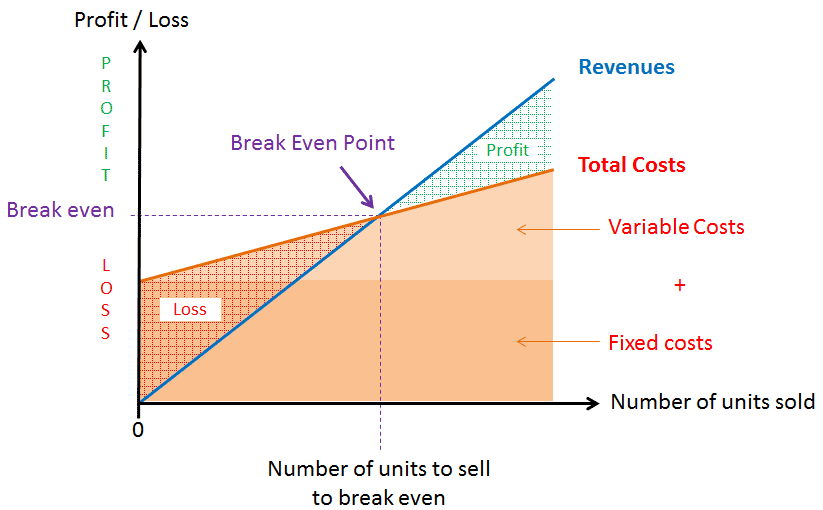

What is the break-even point for a gym?

Break-even is the point at which total costs and total revenue are equal. In other words, the breakeven point is the amount of revenue you must generate to turn a profit.

Because you must at least cover all fixed costs (that aren’t a function of revenue) to turn a profit, the break-even point is at least superior to the sum of your fixed costs.

Yet, you also need to spend a certain amount for every $1 of sales to pay for the variable costs. As we just saw, gyms have very high gross margins. That’s because almost all expenses for a gym are actually fixed costs (mostly salaries, rent and potentially leasing costs for the machines if you decided to lease).

The break-even point can easily be obtained by using the following formula:

Break-even point = Fixed costs / Gross margin

Using the same example earlier, let’s assume your gym makes $50,000 in turnover per month and has the following cost structure (from our article here)

| Operating cost | Variable vs. fixed | Amount |

|---|---|---|

| Staff | Fixed cost | $30,000 |

| Rent | Fixed cost | $6,000 |

| Marketing | Fixed cost | $2,500 |

| Utility, janitorial services | Fixed cost | $5,000 |

| Bookkeeping, other | Fixed cost | $1,000 |

| Total | $44,500 |

The break-even point would then be:

Break-even point = Fixed costs / 97% = $46,000

In other words, you need to make at least $46,000 in sales to turn a profit.

How to increase gym profits?

There are a few options for you to increase the profits of your fitness club and they include:

- Selling advertising space

- Hosting bootcamps

- Offering nutrition and health coaching services

- Starting a clothing line

- Hosting outdoor obstacle courses

- Offering private training sessions

- Selling home fitness equipment

- Introducing message therapy

- Starting a YouTube channel

- Offering personal training classes