Startup Pitch Deck: the Financial Plan Slide [+ Examples]

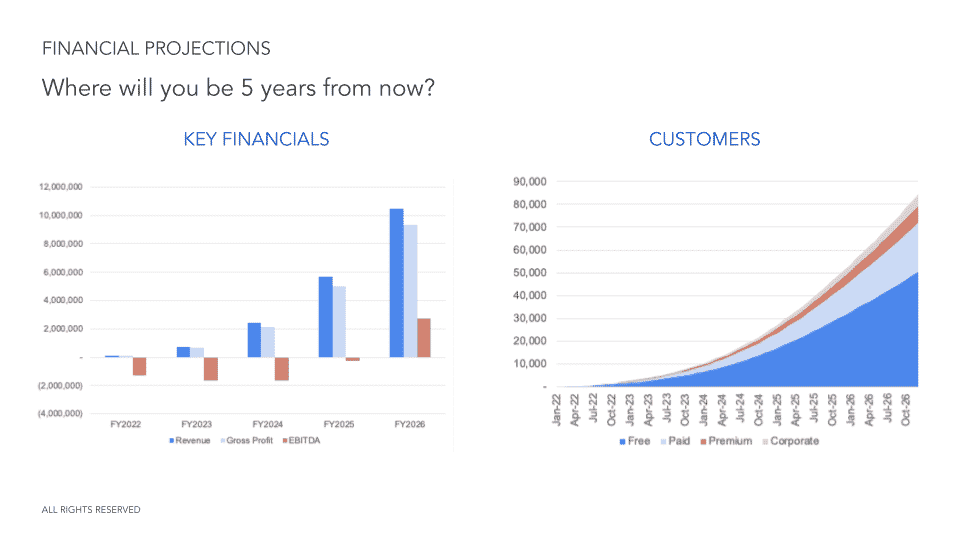

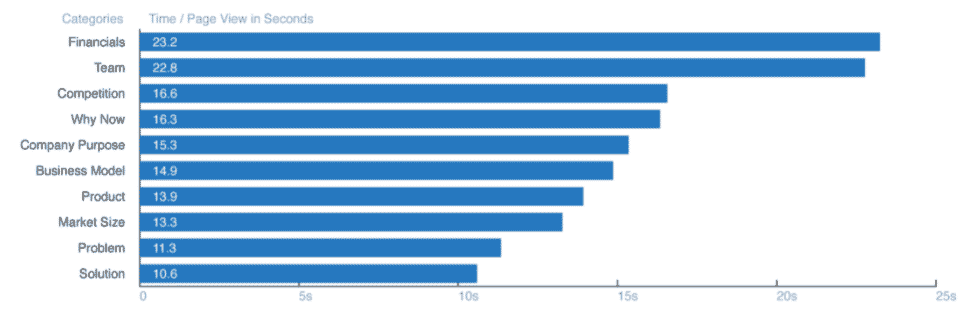

Did you know that the financial plan slide is where investors spend the more time when looking at a pitch deck? So make sure to include in your pitch deck a strong financial plan slide to show investors how big and profitable your business will be. Let’s dive in!

In this series of articles we show you how to create a stunning pitch deck for your startup.

The Financial plan slide explained

Along with your product and the team slide, this slide is undeniably in the top 3 of the most important slides. Unfortunately, many startups overlook the importance of financial projections in their pitch deck.

Interestingly, the financial plan slide is where investors spend the more time. And there is a good reason for that: they are looking for a 10x to 20x return on investment.

Your projected financials are the first step for an investor to create their own financial projections of your business, and eventually decide whether investing in your startup is worth it or not.

The lack of financial projections is a big turn off for 2 reasons:

- Investors don’t have time to create projections from scratch when they review your pitch deck for the first time (as you’re probably not the only pitch deck they’re reviewing)

- Do not expect investors to make up their own plan for your startup if you haven’t. As CEO, founder or entrepreneur alike, you should have a clear idea of where you are going. If you don’t, how can investors be confident you know what you’re doing?

What level of detail should I include in my financial plan slide?

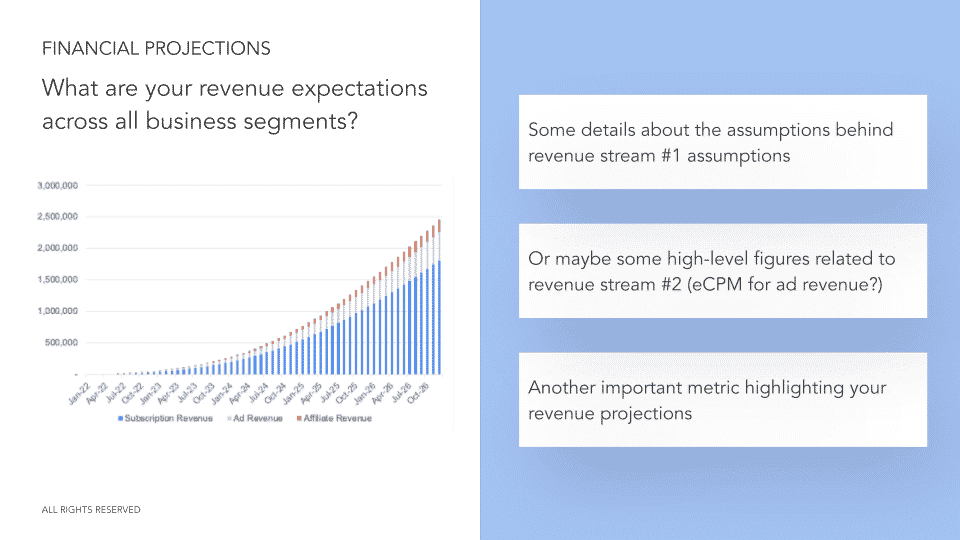

As rule of thumb, the more advanced your startup is, the more granularity you should include here. Pre-seed startups might keep it short (1 slide) yet we recommend seed and Series A+ startups to include 2 slides instead.

The financials and metrics you should include here depends on the type of business you have. Have a look at our article here for more details on what financials and metrics you should include.

And if your startup falls into one of the following categories, be sure to read our dedicated articles on the most important metrics you should know:

Should you present 3 or 5-year forecasts?

The number of years you should present in your pitch deck depends on the type of investors you are pitching, and indirectly on the stage your business is.

As a rule of thumb, the longer the projected period the better. It shows investors you have not just thought about the near future, but also your long term plan.

That being said, we all know startups have an inherent high level of risk, and as such their projections are likely not to be fully accurate. This is especially true for early stage businesses, and the outer years (years 3 to 5).

For that reason, early stage startups should have a 3-year financial plan in their pitch deck. Especially if you are pre-revenues and raising for Seed or pre-Seed funding, investors who will accept to fund your business will focus mostly on the near-term as they are taking a higher risk to invest early on. Still, there is no harm in preparing 5-year forecasts instead, as some investors might ask for it.

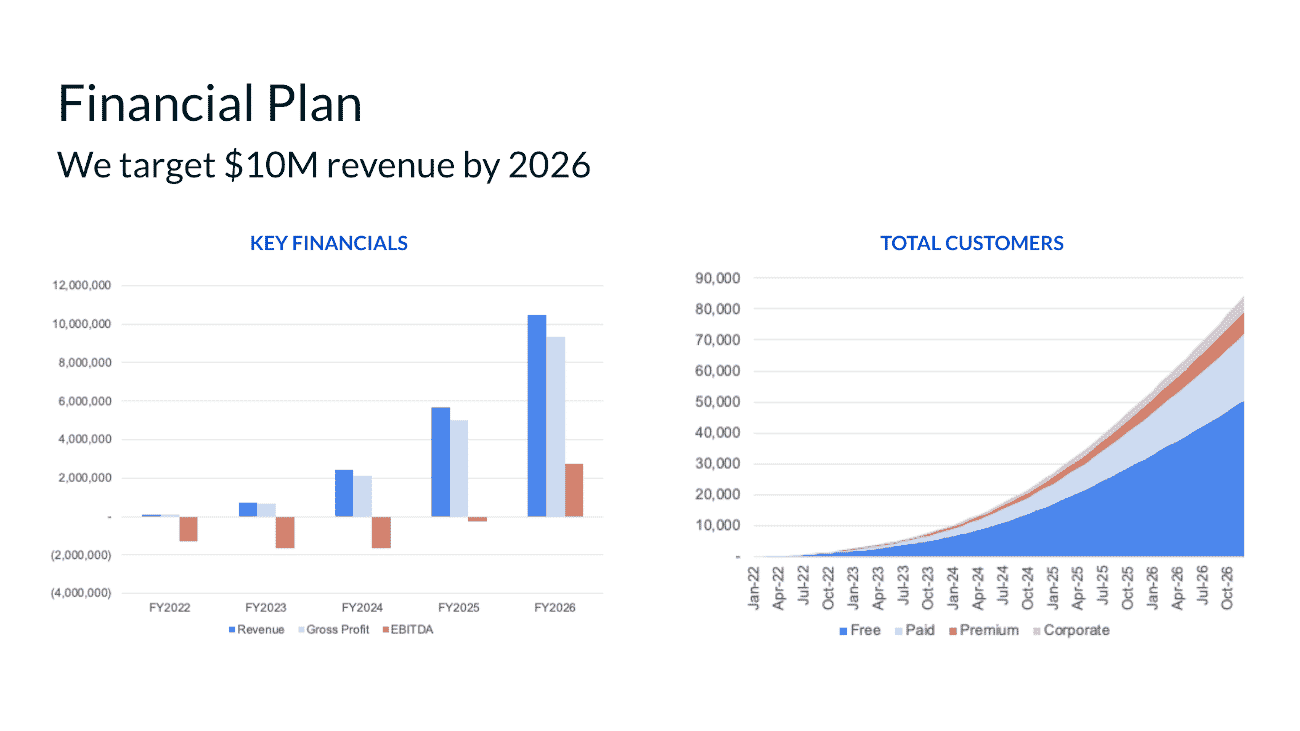

In comparison, later stage startups (post revenues, Series A or later) must include a 5-year financial model instead, as they already have decent financial and metrics, and as such, their financial projections are based on verified assumptions and therefore more reliable (so is the future).

Pitch Deck Financial plan slide examples