SWOT Analysis for an Office Equipment Leasing Business (Example)

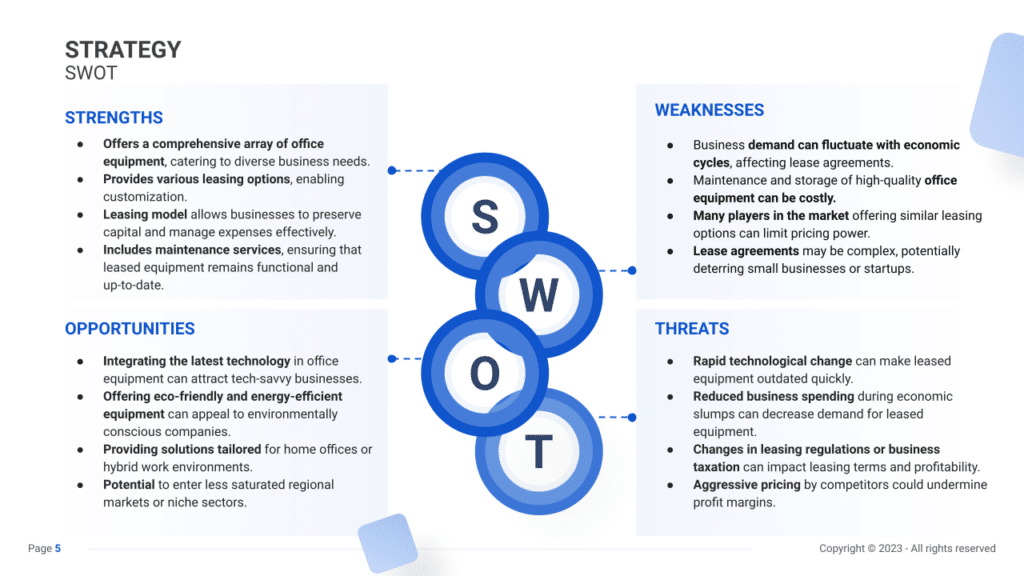

A SWOT analysis is essential for developing a business plan for an office equipment leasing business. This analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats, helps understand internal and external factors that can impact your business. Strengths and weaknesses are internal, while opportunities and threats are external.

In this article, we will explore various examples of strengths, weaknesses, opportunities, and threats, aiding office equipment leasing owners in strategic planning and decision-making.’

Strengths

Highlight the strengths that set your office equipment leasing business apart, ensuring a competitive edge and customer loyalty.

- Comprehensive Equipment Catalog: Offering a wide spectrum of office equipment, from necessities like printers and copiers to advanced technological solutions, catering to a diverse array of client needs.

- Example: Highlight the breadth and depth of the equipment catalog through engaging and informative online showcases and personalized consultations.

- Flexible Lease Arrangements: Providing adaptable and customized leasing plans tailored to suit various business sizes and financial capabilities.

- Example: Advertise flexible lease terms and payment options to appeal to a wide spectrum of potential clients.

- Expert Consultation Services: Offering expert advice and consultation on maximizing office efficiency through the selection of appropriate equipment.

- Example: Share success stories or case studies showcasing improved productivity for businesses using your leased equipment.

- Strong Supplier Relationships: Cultivating robust partnerships with equipment manufacturers to ensure access to the latest technology and competitive pricing.

- Example: Leverage these partnerships to negotiate exclusive deals and pass on benefits to clients.

Weaknesses

Address weaknesses to fortify your office equipment leasing business for sustainable success.

- Limited Brand Recognition: Insufficient visibility of the brand compared to more established competitors.

- Example: Concentrate marketing efforts on targeted campaigns highlighting outstanding service and personalized attention to overcome brand recognition challenges.

- Technological Obsolescence: Vulnerability to technology becoming quickly outdated, impacting the appeal of leased equipment.

- Example: Invest in regular upgrades or incentivize clients to upgrade to newer technology to mitigate this weakness.

- High Initial Capital Investment: Acquiring new equipment for leasing purposes necessitates substantial upfront capital.

- Example: Explore financial partnerships or leasing agreements with manufacturers to ease the burden of acquiring new inventory.

- Geographical Limitations: Operating within restricted regions might limit market reach and growth potential.

- Example: Strategically expand operations or establish partnerships to penetrate new markets and diversify the customer base.

Opportunities

Seize opportunities to expand and innovate in your office equipment leasing business.

- Remote Work Trends: The growing demand for remote work solutions offers an opportunity to lease home office equipment.

- Example: Introduce tailored packages for remote work setups and aggressively market these solutions.

- Sustainability Focus: The increasing emphasis on eco-friendly practices creates opportunities for offering energy-efficient office equipment.

- Example: Promote environmentally conscious technology leases and incentives for businesses aiming to reduce their carbon footprint.

- Service Expansion: Diversifying services beyond equipment leasing to encompass maintenance, repairs, or tech support.

- Example: Introduce service packages ensuring equipment maintenance and swift troubleshooting, enhancing customer loyalty.

- SME Partnerships: Collaborating with small and medium-sized enterprises (SMEs) to become their preferred equipment provider.

- Example: Forge partnerships with local SME networks and offers exclusive deals or discounts to their members.

Threats

Prepare for potential threats to ensure the resilience of your Office Equipment Leasing business.

- Economic Volatility: Economic uncertainties leading to reduced business spending may impact lease demand.

- Example: Offer flexible payment options or discounted packages during economic downturns to retain clients.

- Rapid Technological Advancements: Swift technology advancements can render existing leased equipment obsolete.

- Example: Develop upgrade programs or negotiate manufacturer agreements for trade-in options to address technological obsolescence.

- Competitive Landscape: Established competitors or new entrants with aggressive pricing strategies can pose a threat.

- Example: Focus on superior customer service, customized solutions, and after-sales support to differentiate from price-centric competitors.

- Regulatory Changes: Adjustments in leasing regulations or tax policies affecting equipment leasing operations.

- Example: Maintain close compliance with regulatory updates and adapt lease agreements accordingly to remain compliant.