Culver’s Franchise FDD, Profits & Costs (2025)

Culver’s, a fast-casual restaurant chain, was founded in 1984 by Craig Culver and his family in Sauk City, Wisconsin. The franchise started in 1990, offering a menu featuring ButterBurgers, fresh frozen custard, and Wisconsin cheese curds.

Headquartered in Prairie du Sac, Wisconsin, Culver’s stands out for its commitment to quality and using fresh, locally sourced ingredients. The brand combines fast-service convenience with the high-quality food of traditional restaurants.

Culver’s signature ButterBurger is made with fresh, never-frozen beef, and served on a buttered, toasted bun. Their fresh frozen custard is churned daily, offering a creamier, richer alternative to ice cream.

Culver’s Franchise Initial Investment

How much does it cost to start a Culver’s franchise? It costs on average between $2,643,000 – $8,573,000 to start a Culver’s franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $20,000 – $55,000 |

| Land | $240,000 – $2,700,000 |

| Site Work | $95,000 – $1,590,000 |

| Building | $1,507,000 – $2,946,000 |

| Travel, Living and Expenses during Training | $20,000 – $80,000 |

| Initial Inventory | $50,000 – $65,000 |

| Furniture, Fixtures, Equipment and Supplies | $467,000 – $590,000 |

| Sign Package | $120,000 – $336,000 |

| POS System | $38,500 – $51,000 |

| Miscellaneous Expenses | $20,000 – $40,000 |

| Additional Funds (working capital) – for 3 months | $65,000 – $120,000 |

| Total | $2,642,500 – $8,573,000 |

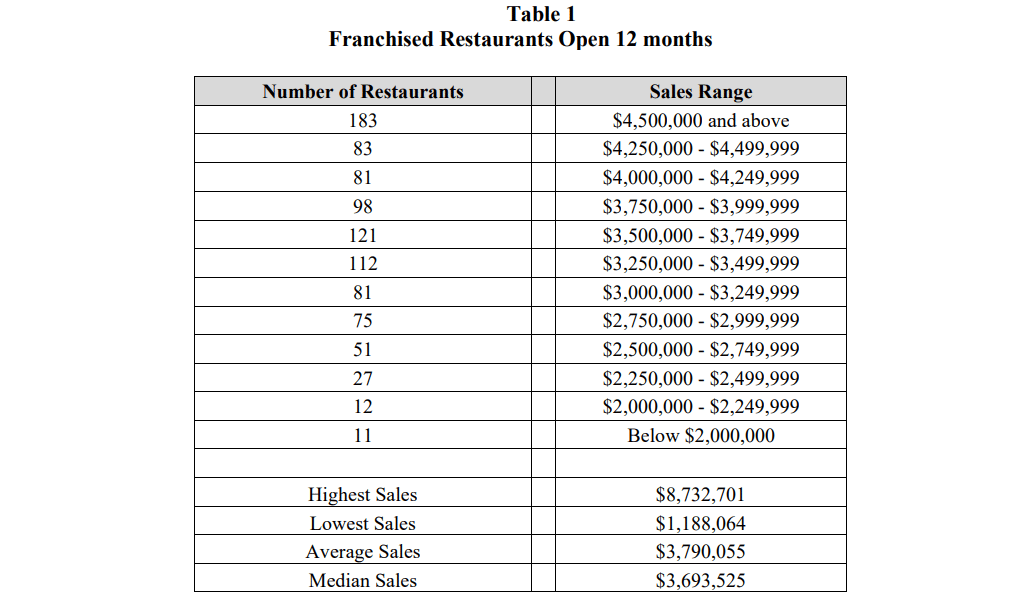

Culver’s Franchise Average Revenue (AUV)

How much revenue can you make with a Culver’s franchise? A Culver’s franchised restaurant makes on average $3,694,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Culver’s Franchise Disclosure Document

Frequently Asked Questions

How many Culver’s locations are there?

As of the latest data, there are 997 Culver’s locations across the United States. The majority of these locations are franchise-owned, while a smaller number are company-owned.

What is the total investment required to open a Culver’s franchise?

The total investment required to open a Culver’s franchise ranges from $2,643,000 – $8,573,000.

What are the ongoing fees for a Culver’s franchise?

Culver’s franchisees are required to pay an ongoing royalty fee of 4% of gross sales. Additionally, there is a marketing fee of 6.5% of gross sales, which goes toward both national and local advertising efforts.

These fees help support the overall brand and ensure that franchisees benefit from collective marketing strategies and operational support from the corporate team.

Who owns Culver’s?

Culver’s is primarily family-owned. The chain was founded in 1984 by Craig Culver, his wife Lea Culver, and Craig’s parents, George and Ruth Culver.

While the Culver family still plays a significant role in the company’s operations, they sold a minority stake in the company to Roark Capital Group in 2017.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.