KeyGlee Franchise FDD, Profits & Costs (2025)

KeyGlee is a leading name in the wholesale real estate sector, focusing on acquiring and selling investment properties. Established in 2019 in Arizona, the franchise began its rapid expansion the following year, launching its franchising efforts in 2020.

Based in Tempe, Arizona, KeyGlee has quickly risen to prominence as one of the nation’s fastest-growing real estate franchises. Franchisees benefit from a proven business model centered on wholesaling real estate.

This process includes identifying distressed properties, securing contracts, and reselling them to an established buyer network. KeyGlee stands out in the industry by prioritizing a streamlined approach and fostering a supportive environment for its franchisees.

Initial Investment

How much does it cost to start a KeyGlee franchise? It costs on average between $122,000 – $297,000 to start a KeyGlee franchised center.

This includes expenses for securing properties, marketing, operational tools, and initial business setup. The exact costs vary based on factors such as the local real estate market, the scale of operations, and whether the franchisee opts to lease or purchase office space.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $100,000 |

| Travel, Lodging, Meals, Etc. for Launch Training | $750 – $5,000 |

| 3 Months’ Lease/Rent | $0 – $6,000 |

| Utilities | $0 – $1,500 |

| Insurance | $250 – $1,000 |

| Professional Fees | $0 – $5,000 |

| Transportation | $600 – $2,000 |

| Office Furniture | $0 – $6,500 |

| Computer Equipment and Software | $500 – $6,500 |

| Telephone | $100 – $300 |

| Internet Service | $100 – $250 |

| Hiring Services | $0 – $7,500 |

| Additional Money for Earnest Deposits and Labor (3 months) | $20,000 – $155,000 |

| Total Estimated Initial Investment | $122,300 – $296,550 |

Average Revenue (AUV)

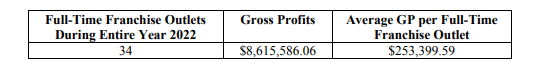

How much revenue can you make with a KeyGlee franchise? A KeyGlee franchised business makes on average $253,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

KeyGlee Franchise Disclosure Document

Frequently Asked Questions

How many KeyGlee locations are there?

As of the latest data, KeyGlee operates over 100 locations across more than 45 metropolitan markets in the United States. This includes both company-owned and franchised units, with the majority being franchise-owned.

What is the total investment required to open a KeyGlee franchise?

The total investment required to open a KeyGlee franchise ranges from $122,000 to $297,000.

What are the ongoing fees for a KeyGlee franchise?

KeyGlee franchisees pay a 9% royalty fee on monthly gross sales for access to systems, training, and support. They also contribute up to 1% of gross sales for advertising to support national and regional marketing efforts.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.