Owl Be There Franchise FDD, Profits & Costs (2025)

Owl Be There is a senior care placement franchise founded in 2013 by David and Laura Greenwood. The company is based in Springfield, Virginia, and began franchising in 2020.

The brand helps seniors and their families find the right care and housing options. Services include referrals for assisted living, memory care, home care, respite care, and independent or continuing care communities.

Seniors and families never pay for the service—Owl Be There is paid by its network of care providers.

What sets the brand apart is its “White Glove” service. Local experts offer personalized guidance, backed by deep knowledge of senior care communities.

Initial Investment

How much does it cost to start a Owl Be There franchise? It costs on average between $89,000 – $105,000 to start a Owl Be There franchised center.

This includes costs for setting up the business, including equipment, initial inventory, and initial operating expenses. The total investment can vary based on factors such as the type of services offered, the location, and whether the franchisee opts to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $54,400 |

| Onboarding and Training Fee | $10,000 |

| Travel & Expenses During Training | $2,000 to $3,900 |

| Start-Up Kit Fee | $4,000 |

| CSA Certification | $990 |

| NPRA Membership | $399 |

| Computer System | $1,800 to $2,500 |

| General Supplies | $100 to $300 |

| Insurance | $1,800 to $2,600 |

| Professional Fees, Business Licenses, Legal Fees | $1,500 to $3,500 |

| Rent and Utilities | $0 |

| Additional Funds – 3 Months | $12,000 to $22,000 |

| TOTAL | $88,989 to $104,589 |

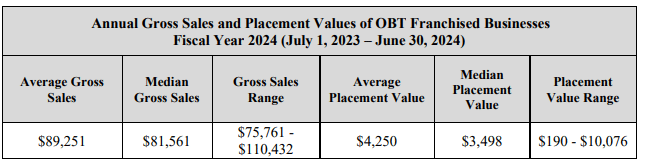

Average Revenue (AUV)

How much revenue can you make with a Owl Be There franchise? A Owl Be There franchised location makes on average $82,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Owl Be There locations are there?

As of the latest data, Owl Be There has a total of six units, consisting of five franchised units and one company-owned unit.

What is the total investment required to open a Owl Be There franchise?

The total investment required to open a Owl Be There franchise ranges from $89,000 to $105,000.

What are the ongoing fees for a Owl Be There franchise?

Owl Be There franchisees are required to pay an ongoing royalty fee, which starts at 6% of gross sales in the first two years, increasing to 7% in years three and four, and 8% from year five onwards. The minimum monthly royalty fee begins at $500 and increases over time.

Additionally, franchisees contribute $500 per month for local marketing. While there is no national brand fund fee, Owl Be There may implement a fee up to 3% of gross sales in the future.

What are the financial requirements to become a Owl Be There franchisee?

To become an Owl Be There franchisee, candidates must have a minimum of $70,000 in liquid capital and a net worth of at least $150,000.

Who owns Owl Be There?

The Owl Be There franchise is owned by David and Laura Greenwood, who co-founded the company in 2013.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.