Terrace Up Franchise FDD, Profits & Costs (2025)

Terrace Up is an innovative franchise brand dedicated to creating rooftop landscapes and building modern amenities. Launched in 2023, the company originated in Bridgewater Township, New Jersey, which also serves as its headquarters.

That same year, Terrace Up introduced its franchise program to prospective investors and today operates a single corporate-owned unit in the United States.

The business specializes in turning unused rooftop areas into lively, sustainable spaces. Its offerings include green roof installations, concrete and porcelain pavers, wood decking, synthetic turf, and other high-quality solutions.

With its exclusive focus on rooftop transformations, Terrace Up addresses the growing market for environmentally friendly and practical urban spaces.

Initial Investment

How much does it cost to start a Terrace Up franchise? It costs on average between $246,000 – $368,000 to start a Terrace Up franchised facility.

This includes expenses for construction, specialized equipment, materials, and initial operating costs. The total investment will vary based on several factors, such as the size of the rooftop project, the property location, and whether the franchisee decides to lease or own the space.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $59,500 |

| Construction and Leasehold Improvements | $0 – $6,000 |

| Storage Unit | $0 – $2,000 |

| Lease Deposits – Three Months | $0 – $3,700 |

| Utility Deposits | $0 – $200 |

| Furniture and Fixtures | $0 – $2,000 |

| Equipment | $13,600 – $25,400 |

| Signage | $0 – $500 |

| Initial Inventory | $500 – $700 |

| Computer, Software, and Business Management System | $4,600 – $6,400 |

| Estimating Services Fees | $7,000 – $10,000 |

| Service Vehicle | $12,900 – $25,800 |

| Start-Up Marketing | $10,000 – $15,000 |

| Insurance Deposits – Three Months | $600 – $2,200 |

| Travel for Initial Training | $1,300 – $3,600 |

| Professional Fees | $3,000 – $7,000 |

| Licenses and Permits | $500 – $1,500 |

| Additional Funds – Three Months | $132,400 – $196,600 |

| Total Estimate | $245,900 – $368,100 |

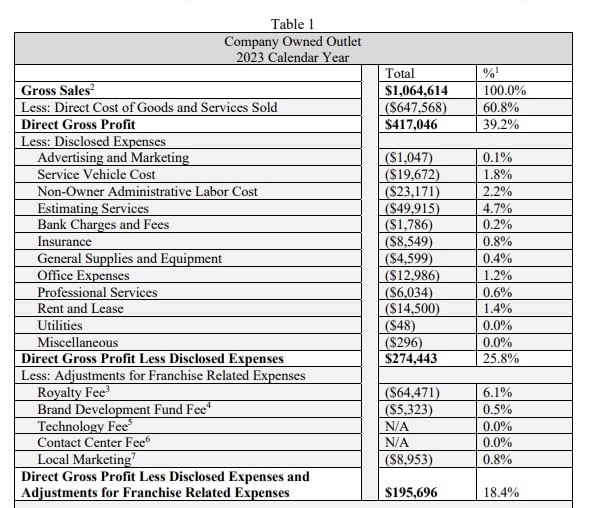

Average Revenue (AUV)

How much revenue can you make with a Terrace Up franchise? A Terrace Up franchised location makes on average $1,065,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Terrace Up locations are there?

As of the latest available data, Terrace Up has 1 location in the U.S., and that is company-owned. There are 0 franchised units operating.

What is the total investment required to open a Terrace Up franchise?

The total investment required to open a Terrace Up franchise ranges from $246,000 to $368,000.

What are the ongoing fees for a Terrace Up franchise?

A Terrace Up franchise requires ongoing payments that include a royalty fee of 6% of gross sales, which is paid to the franchisor for continued support and use of the brand. In addition, franchisees must contribute a marketing and advertising fee of 1% of gross sales, which is allocated to fund brand-wide promotional initiatives.

What are the financial requirements to become a Terrace Up franchisee?

To become a Terrace Up franchisee, you must have a minimum liquid capital of $250,000, ensuring you have sufficient readily available funds to cover startup and early operating costs. In addition, you must have a minimum net worth of $500,000, which demonstrates overall financial stability and the ability to sustain long-term investment in the business.

Who owns Terrace Up?

The Terrace Up franchise is owned by Terrace Up Franchising, LLC, a company based in Bridgewater Township, New Jersey, where the brand was founded and is headquartered.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.