Camp Run-A-Mutt Franchise FDD, Profits & Costs (2025)

Camp Run-A-Mutt is a leading dog daycare and boarding franchise known for its cage-free environment. Established in 2008, the first facility opened in San Diego, California, under the leadership of founders Dennis Quaglia, Severn Crow, and Mikel Ross.

Headquartered at 2900 Fourth Avenue #206 in San Diego, the brand began franchising in 2010 after the original location quickly reached full capacity within just 18 months. Since then, Camp Run-A-Mutt has expanded nationwide, building a reputation for premium, cage-free pet care.

Each location provides a complete suite of services, including dog daycare, overnight boarding, grooming, retail products, and positive reinforcement training. The facilities feature large indoor and outdoor play zones with waterfalls, splash ponds, and the signature “Muttcams,” which let owners check in on their pets through live video feeds.

Camp Run-A-Mutt stands out for its commitment to safety and comfort through 24-hour human supervision and a fully cage-free setup.

Initial Investment

How much does it cost to start a Camp Run-A-Mutt franchise? It costs on average between $589,000 – $1,140,000 to start a Camp Run-A-Mutt franchised facility.

This includes expenses for facility build-out, play area equipment, grooming tools, initial supplies, and early operating costs. The total investment varies based on several factors, such as the size and design of the daycare and boarding facility, the local market, and whether the franchisee leases or buys the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $36,000 – $40,000 |

| Training Expenses | $0 – $4,000 |

| 3-Months’ Lease Rent | $16,500 – $45,000 |

| Lease and Security Deposits | $5,500 – $30,000 |

| Leasehold Improvements | $350,000 – $700,000 |

| Signage | $6,000 – $10,000 |

| Furniture, Fixtures, Yard Apparatus & Equipment | $40,000 – $65,000 |

| Initial Inventory and Supplies | $5,000 – $8,000 |

| Computer Hardware and Software | $1,500 – $3,000 |

| Office Equipment and Cleaning Materials | $4,000 – $5,000 |

| Security and Web Camera System | $1,900 – $3,000 |

| Initial Advertising Program | $4,000 – $6,000 |

| Business Licenses and Permits; Professional Fees | $15,000 – $40,000 |

| Insurance | $1,500 – $2,500 |

| Uniforms | $1,000 – $1,400 |

| Dues and Subscriptions | $1,000 – $2,000 |

| Additional Funds – 6 Months | $100,000 – $175,000 |

| Total Estimated Initial Investment | $588,900 – $1,139,900 |

Average Revenue (AUV)

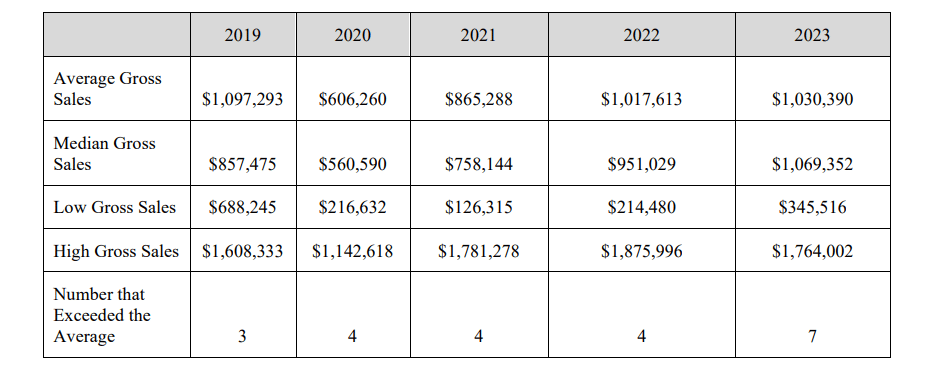

How much revenue can you make with a Camp Run-A-Mutt franchise? A Camp Run-A-Mutt franchised business makes on average $1,069,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Camp Run-A-Mutt Franchise Disclosure Document

Frequently Asked Questions

How many Camp Run-A-Mutt locations are there?

According to the latest data, Camp Run‑A‑Mutt has 12 operational locations across the United States.

What is the total investment required to open a Camp Run-A-Mutt franchise?

The total investment required to open a Camp Run-A-Mutt franchise ranges from $589,000 to $1,140,000.

What are the ongoing fees for a Camp Run-A-Mutt franchise?

The ongoing fees for a Camp Run‑A‑Mutt franchise include a royalty fee of 6% of gross revenue and a national branding/advertising fee of 1% of gross revenue.

Who owns Camp Run-A-Mutt?

Camp Run-A-Mutt is owned by its co-founders Dennis Quaglia, Severn Crow and Mikel Ross.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.