Pronto Franchise FDD, Profits & Costs (2025)

Founded in 1997 in Brownsville, Texas, Pronto Insurance began as a retail insurance agency aimed at offering value-oriented, accessible insurance and financial services for underserved consumers. The company is headquartered at 805 Media Luna Street, Brownsville, Texas.

Having grown steadily in its native Texas market, Pronto expanded its reach into additional states such as California and Florida, with more than 200 locations in operation.

Pronto began franchising in the U.S. market in 2009, bringing its retail-insurance model to franchisees who could operate their own local outlets under the Pronto brand.

What sets Pronto apart from many traditional insurance agencies is its retail-store format—often featuring a drive-thru service window—and its focus on non-standard and value-oriented insurance products. Pronto offers auto, home, mobile home, RV, and motorcycle insurance, often targeting customers in the U.S. Hispanic market and other underserved segments.

Initial Investment

How much does it cost to start a Pronto franchise? It costs on average between $27,000 – $115,000 to start a Pronto franchised business.

This includes costs for leasehold improvements, office equipment, furnishings, signage, and initial operating expenses. The exact amount depends on various factors, including the size and layout of the insurance office, the market area selected, and whether the franchisee chooses to lease or purchase the property. Pronto offers 2 types of franchises:

| Type of Pronto Business | Initial Investment Range |

|---|---|

| Conversion Pronto Business | $26,600 – $91,800 |

| New Pronto Business | $45,325 – $114,750 |

We are summarizing below the main costs associated with opening a New Pronto Business. For more information on costs required to start a Pronto franchise, refer to the Franchise Disclosure Document (Item 7).

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $10,000 to $30,000 per location |

| Business Licenses & Permits | $0 to $3,000 |

| Leasehold Improvements | $5,000 to $15,000 |

| Fixtures, Furnishings & Equipment | $10,850 to $32,600 |

| Computer System | $1,000 to $2,500 |

| Architect/Engineering Fees | $0 to $250 |

| Rent, Security Deposits and Utility Deposits | $3,000 to $5,000 |

| Professional Fees and Real Estate Broker Fee | $2,500 to $4,000 |

| Insurance Deposit | $225 to $400 |

| Initial Inventory of Operating Supplies | $250 to $500 |

| Training Expenses | $0 to $1,500 |

| Grand Opening Advertising | $2,500 to $5,000 |

| Additional Funds (for initial period of operations) | $10,000 to $15,000 |

| Total Estimated Initial Investment | $45,325 to $114,750 |

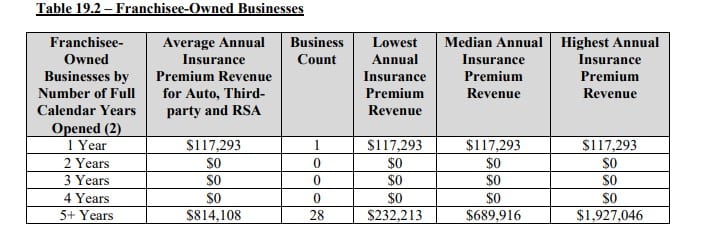

Average Revenue (AUV)

How much revenue can you make with a Pronto franchise? A Pronto franchised location makes on average $690,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Pronto Franchise Disclosure Document

Frequently Asked Questions

How many Pronto locations are there?

As of the latest available data, Pronto Insurance operates over 200 retail locations across the United States.

What is the total investment required to open a Pronto franchise?

The total investment required to open a Pronto franchise ranges from $27,000 to $115,000.

What are the ongoing fees for a Pronto franchise?

Pronto franchisees pay a royalty fee of 15% of gross revenue each month. In addition, they contribute 2% of gross revenue to a marketing and advertising fund that supports national and regional brand awareness efforts.

Who owns Pronto?

Pronto Insurance franchise is owned by RPS, a division of Arthur J. Gallagher & Co.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.