Puddle Pool Services Franchise FDD, Profits & Costs (2025)

Puddle Pool Services is an emerging franchise focused on pool, spa, and water feature maintenance within both residential and commercial markets. Established in 2018, the brand was created to deliver dependable pool care through standardized processes, professional presentation, and streamlined operations.

The business operates using a mobile service model, enabling franchise owners to run efficient service routes without the need for a physical storefront. This approach supports repeat service schedules and helps maintain consistent service quality across local territories.

Based in Orlando, Florida, Puddle Pool Services expanded into franchising in 2022. The company supports franchisees with centralized systems designed to simplify operations and support long-term growth.

Service offerings include routine pool and spa cleaning, water testing and chemical management, seasonal opening and closing services, and specialized water treatment solutions. A strong emphasis on recurring maintenance programs allows franchisees to generate stable, predictable revenue year-round.

Initial Investment

How much does it cost to start a Puddle Pool Services franchise? It costs on average between $98,000 – $123,000 to start a Puddle Pool Services franchised center.

This investment covers expenses related to service vehicle setup, equipment and tools, initial supplies, and early operating costs. The total investment can vary depending on factors such as local market conditions, route size, service mix, and whether the franchisee acquires new or pre-owned vehicles and equipment.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $49,500 |

| Training Expenses | $1,500 – $2,500 |

| Initial Marketing Launch | $10,800 – $15,000 |

| Initial Inventory of Tools, Equipment, and Chemicals | $7,500 – $9,000 |

| Business Licenses and Permits | $1,000 – $2,500 |

| Computer and Phone System | $1,000 – $3,000 |

| CRM Setup | $1,000 |

| Vehicle Lease | $1,800 – $4,000 |

| Vehicle Wrap | $3,500 – $6,800 |

| Professional Fees | $2,000 – $4,000 |

| Uniforms and Physical Marketing Materials | $2,000 |

| Liability Insurance | $1,500 – $3,500 |

| Operating Expenses and Additional Funds (3 months) | $15,000 – $20,000 |

| Total Estimated Initial Investment | $98,100 – $122,800 |

Average Revenue (AUV)

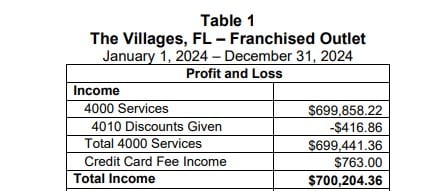

How much revenue can you make with a Puddle Pool Services franchise? A Puddle Pool Services franchised location makes on average $700,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Franchise Disclosure Document

Frequently Asked Questions

How many Puddle Pool Services locations are there?

As of the most recent available data, Puddle Pool Services has two locations open across North America.

What is the total investment required to open a Puddle Pool Services franchise?

The total investment required to open a Puddle Pool Services franchise ranges from $98,000 to $123,000.

What are the ongoing fees for a Puddle Pool Services franchise?

Puddle Pool Services franchisees pay an ongoing royalty fee equal to 7 % of gross revenue, which is paid regularly throughout the operation of the business as part of their agreement with the franchisor. On top of that, there is an advertising or brand fund contribution set at 2 % of gross revenue to support national and regional marketing initiatives that benefit the entire system.

Who owns Puddle Pool Services?

Puddle Pool Services franchise is owned by Mark Amery, who founded the pool, spa, and water feature maintenance brand and serves as its Chief Executive Officer.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.