Applebee’s Franchise FDD, Profits & Costs (2025)

Applebee’s, launched in 1980 in Decatur, Georgia, has grown from a local eatery to a global casual dining giant within Dine Brands Global’s portfolio. Known for its neighborhood grill concept, it offers a diverse menu appealing to a wide audience.

Applebee’s franchising, initiated soon after its inception, has been pivotal in its growth, inviting entrepreneurs to partake in its success story. The headquarters, now in Glendale, California, symbolizes its journey from a local favorite to an international dining destination.

Applebee’s differentiates itself in the highly competitive casual dining market through its commitment to serving classic bar and grill dishes crafted from high-quality ingredients. T

he brand prides itself on offering these culinary delights at reasonable prices, coupled with genuine hospitality and service that makes every visit memorable.

Initial Investment

How much does it cost to start a Applebee’s franchise? It costs on average between $1,767,000 – $5,823,000 to start a Applebee’s franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Organizational and Training Expenses | $75,000 – $82,688 |

| Purchase of Land | See Note |

| Building Costs – Tower II Prototype | $1,721,592 – $2,355,863 |

| Building Costs – Celebration Prototype | $1,254,046 – $1,716,062 |

| Site Work – Tower II Prototype | $168,274 – $230,269 |

| Site Work – Celebration Prototype | $118,108 – $161,621 |

| Professional Services – Tower II Prototype | $123,725 – $143,261 |

| Professional Services – Celebration Prototype | $97,820 – $133,858 |

| Permits/Fees | $26,000 – $28,900 |

| Furniture, Fixtures, Equipment and Signage – Tower II | $1,220,400 – $1,348,864 |

| Furniture, Fixtures, Equipment and Signage – Celebration | $835,298 – $923,224 |

| POS System (Applebee’s) | $12,000 – $17,000 |

| POS System (Dual Brands) | $30,000 – $60,000 |

| POS System License Fees | $850 – $4,000 |

| Kitchen Display System | $1,500 – $2,400 |

| Smallwares | $39,779 – $43,966 |

| Initial Inventory | $25,500 – $28,000 |

| Pre-Opening Expenses | $15,000 – $20,000 |

| Applicant’s Fee | $0 – $15,000 |

| Franchise Fee Deposit | $0 – $10,000 |

| Initial Franchise Fee | $25,000 – $35,000 |

| Initial Advertising Expense | $5,000 – $10,000 |

| Liquor License(s) | $500 – $1,000,000 |

| Apple Supply Chain Co-op Stock Purchase | $0 – $5 |

| On-Line Ordering (OLO) | $65 – $200 per month |

| EMV P2P Encryption Services | $1,350 – $4,200 |

| Wi-Fi Services | $100 – $300 per month |

| Wi-Fi Equipment | $1,200 – $2,000 |

| Digital Products Service Fee | $21 – $100 per month |

| Server Tablet Maintenance Fee | $500 per year |

| Implementation Fees | $800 – $3,500 |

| Menu Management Platform Fee | $90 – $180 per month per restaurant |

| CRM Fee | $0 – $150 per month |

| Gateway Processing Fee | $63 per month |

| Guest Waitlist Management | $23 – $75 per month |

| BOH Reporting Services | $200 setup; $75 – $400/month |

| Gamification ShiftOne | $30 – $60 per month |

| To Go Accuracy Printer | $550 – $650 |

| Campaign/Menu Training | $30 per year |

| Extra Manuals | $0 – $250 per set |

| Operating Expenses During First Three Months | $405,000 – $450,000 |

| POS MDM Fee | $50 – $60 per month |

| TOTAL – Tower II Prototype | $3,870,004 – $5,822,933 |

| TOTAL – Celebration Prototype | $2,941,348 – $4,679,442 |

| TOTAL – Dual Brand Restaurant Concept | $1,766,798 – $5,222,865 |

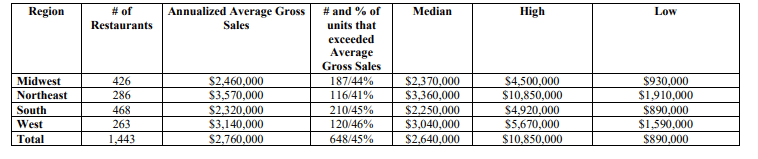

Average Revenue (AUV)

How much revenue can you make with a Applebee’s franchise? A Applebee’s franchised restaurant makes on average $2,640,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

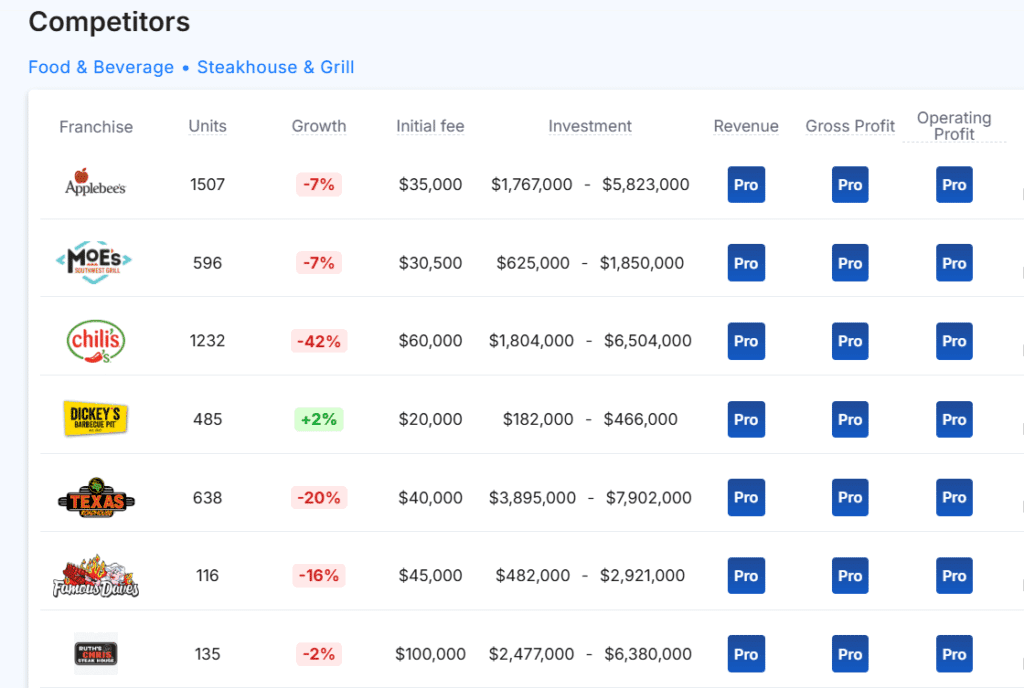

This compares to $2,680,000 yearly revenue for similar steakhouse & grill franchises. Below are 10 Applebee’s competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Applebee’s locations are there?

As of the latest available data, Applebee’s operates approximately 1,507 locations worldwide. Of these, the vast majority are franchise-owned, with about 1,460 locations run by franchisees. The remaining 47or so are company-owned. This reflects Applebee’s strategy of predominantly relying on a franchising model for its growth and operations.

What is the total investment required to open a Applebee’s franchise?

The total investment required to open a Applebee’s franchise ranges from $1,767,000 to $5,823,000.

What are the ongoing fees for a Applebee’s franchise?

Applebee’s franchisees pay an ongoing royalty fee of 4% of gross sales, along with a marketing fee that is typically 3.5% of gross sales. These fees cover the use of the brand and support national and local marketing initiatives.

What are the financial requirements to become a Applebee’s franchisee?

To become an Applebee’s franchisee, the financial requirements include a minimum net worth of $2 million and at least $500,000 in liquid capital.

These requirements ensure that potential franchisees have the financial stability and resources to support the costs associated with opening and operating a franchise, including initial investment and ongoing operational expenses.

How much can a Applebee’s franchise owner expect to earn?

The average gross sales for a Applebee’s franchise are approximately $2.64 million per location. Assuming a 15% operating profit margin, $2.64 million yearly revenue can result in $396,000 EBITDA annually.

Who owns Applebee’s?

Applebee’s is owned by Dine Brands Global, Inc., which also owns IHOP. Dine Brands Global, formerly known as DineEquity, acquired Applebee’s in 2007. The company operates as a franchisor, with most of its Applebee’s locations being run by franchisees rather than directly owned by the corporation.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.