Arthur Murray Dance Studio Franchise FDD, Profits & Costs (2025)

Arthur Murray Dance Studios is a renowned franchise specializing in social and ballroom dance instruction. Founded in 1912 by Arthur Murray in New York City, the company has grown into one of the largest and most recognized dance organizations worldwide.

The first franchised dance center was established in 1939 in Minneapolis, Minnesota, marking the beginning of its expansive franchise network. Today, Arthur Murray International, Inc. is headquartered in Coral Gables, Florida.

The franchise offers a comprehensive range of dance instruction services, catering to various dance styles and skill levels. Their programs are designed to make students feel comfortable on any dance floor and with any dance partner.

Initial Investment

How much does it cost to start a Arthur Murray Dance Studio franchise? It costs on average between $71,000 – $252,000 to start a Arthur Murray Dance Studio franchised business.

This includes costs for studio construction, dance floor installation, equipment, and initial operating expenses. The exact amount depends on various factors, including the size of the studio, its location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $25,000 – $100,000 |

| Leasehold Improvements | $30,000 – $75,000 |

| Furniture, Fixtures, and Equipment | $2,000 – $18,000 |

| Promotional Brochures and Step Charts | $120 |

| Signs | $2,000 – $10,000 |

| Three Months’ Rent | $12,000 – $24,000 |

| Additional Funds – 3 months | $0 – $20,000 |

| Training Expenses | $0 – $5,000 |

| TOTAL ESTIMATED INITIAL INVESTMENT | $71,120 – $252,120 |

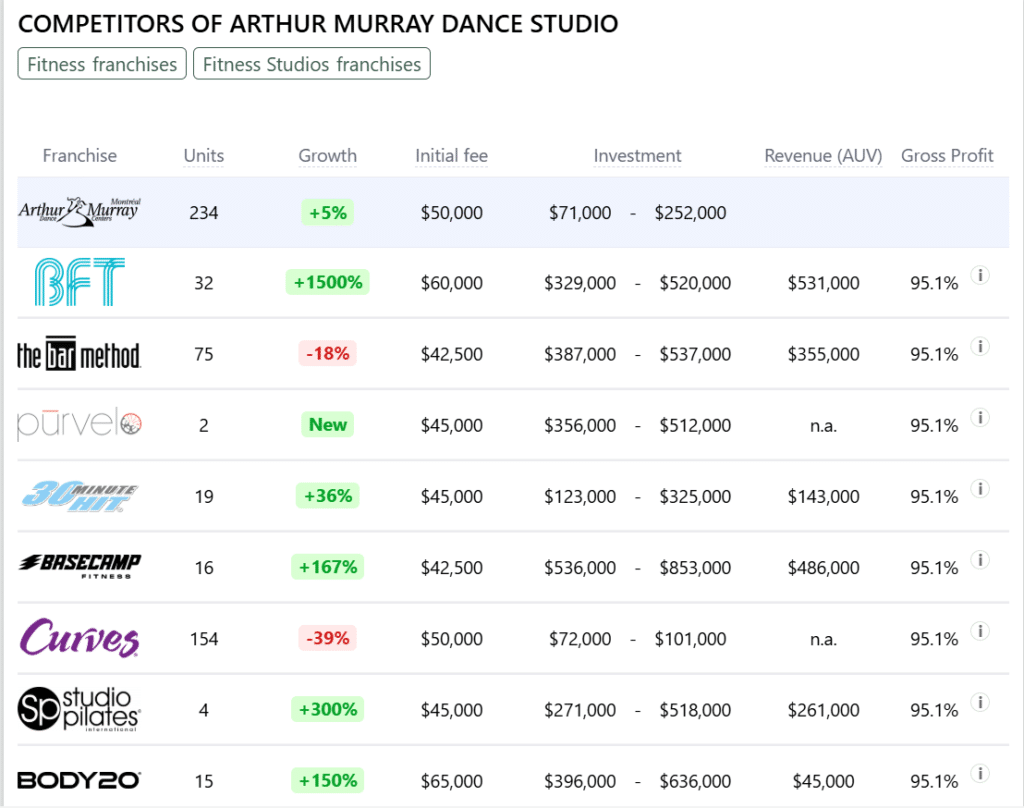

Competitors

Below are a few Arthur Murray Dance Studio competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Arthur Murray Dance Studio locations are there?

As of the latest data, Arthur Murray Dance Studios operates a total of 234 locations, all of which are franchised. This franchise-driven model has allowed Arthur Murray to expand its presence across multiple countries while maintaining a consistent brand and teaching methodology.

What is the total investment required to open a Arthur Murray Dance Studio franchise?

The total investment required to open a Arthur Murray Dance Studio franchise ranges from $71,000 to $252,000.

What are the ongoing fees for a Arthur Murray Dance Studio franchise?

Arthur Murray Dance Studio franchisees pay a royalty fee ranging from 5% to 10% of their weekly gross receipts. Additionally, they contribute up to 2% of their weekly gross receipts to the National Advertising Fund.

What are the financial requirements to become a Arthur Murray Dance Studio franchisee?

To become an Arthur Murray Dance Studio franchisee, the financial requirements include a minimum net worth of $500,000 and liquid capital of at least $100,000. These figures ensure that franchisees have the financial capacity to cover the initial investment and sustain operations during the early stages.

Who owns Arthur Murray Dance Studio?

Arthur Murray Dance Studio franchise is owned by Arthur Murray International, Inc., a privately held company.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.