ATAX Franchise FDD, Profits & Costs (2025)

ATAX is a full-service national tax preparation and business services franchise that began operations in 1986.

Founded in New York City, the company has grown to establish its corporate headquarters at 780 Lynnhaven Parkway, Virginia Beach, VA 23452. ATAX started offering franchise opportunities in 2007, enabling entrepreneurs to join its expanding network.

The franchise specializes in a comprehensive range of services, including personal and business tax preparation, bookkeeping, payroll, and incorporation assistance.

A key differentiator for ATAX is its bilingual service offerings, catering to both English and Spanish-speaking clients, which broadens its customer base and enhances accessibility.

As of 2024, ATAX operates over 105 locations across the United States, with plans for continued expansion. The company is actively seeking new franchisees within the U.S., providing opportunities for individuals interested in entering the tax preparation and business services industry.

Initial Investment

How much does it cost to start a ATAX franchise? It costs on average between $59,000 – $79,000 to start a ATAX franchised business.

This includes costs for office setup, equipment, software, and initial operating expenses. The exact amount depends on various factors, including the size and location of the office, the local market conditions, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $35,000 – $35,000 |

| Construction & Leasehold Improvements | $2,500 – $5,000 |

| Furniture, Fixtures, and Equipment | $4,000 – $6,000 |

| Interior & Exterior Signage | $2,000 – $4,000 |

| Rent and Security Deposit | $3,000 – $5,000 |

| Software and Software Support Services | $100 – $1,000 |

| Computer and Point of Sale Systems | $2,500 – $4,000 |

| Training Travel and Living Expenses | $1,000 – $2,000 |

| Opening Inventory & Supplies | $500 – $1,500 |

| Grand Opening Advertising | $1,500 – $5,000 |

| Permits and Licenses | $200 – $500 |

| Utilities | $450 – $1,000 |

| Initial Insurance Deposit/Advanced Premium | $400 – $500 |

| Professional Fees | $2,500 – $3,500 |

| Additional Funds – 3 months | $3,500 – $5,000 |

| Total | $59,150 – $79,000 |

Average Revenue (AUV)

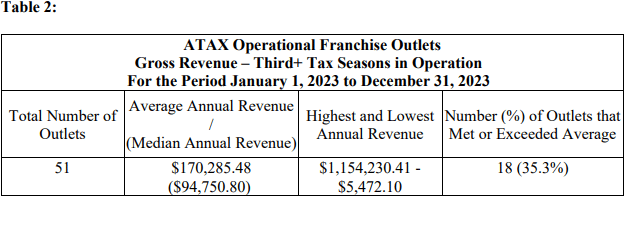

How much revenue can you make with a ATAX franchise? A ATAX franchised office makes on average $80,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $118,000 yearly revenue for similar tax franchises.

Download the Franchise Disclosure Document

Frequently Asked Questions

How many ATAX locations are there?

As of the latest data, ATAX operates over 105 franchise locations across the United States. The company primarily follows a franchise model, with the majority of its locations owned and operated by franchisees.

What is the total investment required to open a ATAX franchise?

The total investment required to open a ATAX franchise ranges from $59,000 to $79,000.

What are the ongoing fees for a ATAX franchise?

ATAX franchisees pay a 14% royalty fee on gross revenues, with a minimum annual fee starting at $5,000 in the first year, $7,500 in the second, and $10,000 from the third year onward. Additionally, there is a 3% marketing fee on gross revenues to support advertising efforts.

What are the financial requirements to become a ATAX franchisee?

To become an ATAX franchisee, you are required to have a minimum liquid capital of $40,000 and a net worth of at least $40,000.

How much can a ATAX franchise owner expect to earn?

The average gross sales for a ATAX franchise are approximately $0.08 million per location. Assuming a 15% operating profit margin, $0.08 million yearly revenue can result in $12,000 EBITDA annually.

Who owns ATAX?

ATAX is owned by Loyalty Brands, a business services franchise group founded by John T. Hewitt. In 2019, ATAX partnered with Loyalty Brands to expand its growth model beyond the East Coast and better serve the thriving Latino community.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.