Ben & Jerry’s Franchise FDD, Profits & Costs (2025)

Ben & Jerry’s is a well-known ice cream brand with a strong commitment to social responsibility. Founded in 1978 by Ben Cohen and Jerry Greenfield in Burlington, Vermont, where its headquarters remain, the company began franchising in 1981.

It offers entrepreneurs the chance to open a Scoop Shop and become part of its mission of spreading “Peace, Love, & Ice Cream.” Renowned for its quirky and creative ice cream flavors, Ben & Jerry’s also stands out due to its activism.

The brand focuses on fair trade sourcing, supporting small farmers, and using sustainable practices. This unique social mission, integrated into its business model, helps differentiate Ben & Jerry’s from its competitors.

With over 600 Scoop Shops worldwide, the brand continues to expand its franchise presence in the U.S., inviting franchisees who are community-oriented and aligned with the company’s ethical principles.

Initial Investment

How much does it cost to start a Ben & Jerry’s franchise? It costs on average between $157,000 and $551,000 to start a Ben & Jerry’s franchised ice cream shop.

This includes costs for construction, equipment, inventory, and initial operating expenses. These costs are influenced by factors such as location, shop size, and build-out requirements. Indeed, Ben & Jerry’s offers 3 types of franchises:

| Shop Type | Initial Investment Range |

|---|---|

| Full-Sized Shop | $238,800 to $550,800 |

| In-Line Shop | $206,800 to $386,300 |

| Kiosk Scoop Shop | $156,900 to $333,300 |

We are summarizing below the main costs associated with opening a Ben & Jerry’s franchised Full-Sized Shop. For more information on costs required to start a Ben & Jerry’s franchise, refer to the Franchise Disclosure Document (Item 7).

| Type of Expenditure | Amount |

|---|---|

| Preliminary Agreement Deposit | $5,000 – $10,000 |

| Initial Franchise Fee | $8,000 (Satellite); $19,750 to $39,500 (Franchise) |

| Plans, Development & Permits | $3,500 to $12,000 |

| Leasehold Improvements & Construction | $85,000 to $230,000 |

| Furniture, Fixtures, Equipment, Casework, and Smallwares | $65,000 to $135,000 |

| Signage | $5,000 to $17,500 |

| Professional Fees | $3,000 to $6,000 |

| POS | $1,800 to $2,300 |

| Online Ordering System Hardware | $1,000 to $1,500 |

| Internet Connectivity, and Telephone | $1,000 to $1,500 |

| Deposits | $3,000 to $8,000 |

| Initial Training | $1,000 to $3,000 |

| Inventory | $8,000 to $14,000 |

| Insurance | $500 to $2,500 |

| Grand Opening Advertising | $3,000 |

| Additional Funds (3 months) | $50,000 to $75,000 |

| TOTAL | $238,800 to $550,800 |

Average Revenue (AUV)

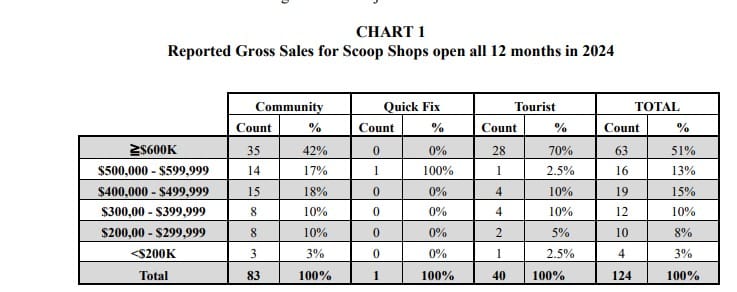

How much revenue can you make with a Ben & Jerry’s franchise? A Ben & Jerry’s franchised business makes on average $612,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $506,000 yearly revenue for similar ice cream franchises.

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Ben & Jerry’s locations are there?

As of the latest available data, Ben & Jerry’s has approximately 154 locations worldwide. These include both company-owned and franchise-owned Scoop Shops. The majority of these locations are franchise-owned, with a significant presence in the United States and internationally.

What is the total investment required to open a Ben & Jerry’s franchise?

The total investment required to open a Ben & Jerry’s franchise ranges from $157,000 to $551,000.

What are the ongoing fees for a Ben & Jerry’s franchise?

For a Ben & Jerry’s franchise, ongoing fees include a royalty fee of up to 5% of gross sales. This fee covers the use of the Ben & Jerry’s brand, systems, and ongoing support provided to franchisees.

Additionally, franchisees are required to contribute 2% of gross sales towards national marketing efforts, which fund broad-scale advertising campaigns for the brand. There is also a local marketing commitment of 2%, which is allocated towards promoting the individual franchise location within its market.

What are the financial requirements to become a Ben & Jerry’s franchisee?

To become a Ben & Jerry’s franchisee, you need a minimum net worth of $350,000 and $100,000 in liquid capital. These financial requirements ensure that prospective franchisees have sufficient resources to cover the initial investment and operational costs.

How much can a Ben & Jerry’s franchise owner expect to earn?

The average gross sales for a Ben & Jerry’s franchise are approximately $0.61 million per location. Assuming a 15% operating profit margin, $0.61 million yearly revenue can result in $92,000 EBITDA annually.

Who owns Ben & Jerry’s?

Ben & Jerry’s is owned by Unilever, a multinational consumer goods company. Unilever acquired Ben & Jerry’s in 2000 as part of a merger agreement. Despite being owned by Unilever, Ben & Jerry’s operates with a degree of autonomy, particularly in matters related to its social mission and brand integrity, which are overseen by an independent board of directors.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.