Best Choice Roofing Franchise FDD, Profits & Costs (2025)

Best Choice Roofing, founded in 2009 by Wayne Holloway, is a leading national roofing contractor. It specializes in roof repair and replacement services. Based in Hendersonville, Tennessee, the company operates over 85 locations in 24 states.

It is recognized as a Top 1% Performer by Owens Corning and has completed more than 60,000 projects. The company began franchising in 2022. Franchisees receive comprehensive training, ongoing support, and access to proprietary products.

This ensures success in the competitive roofing market. Best Choice Roofing stands out for its customer-first service and quick project completion, often in one day. It offers lifetime warranties and has earned thousands of five-star reviews.

Best Choice Roofing is currently growing its franchise network across the U.S. It seeks driven individuals to uphold its high standards of quality and service.

Initial Investment

How much does it cost to start a Best Choice Roofing franchise? It costs on average between $117,000 and $202,000 to start a Best Choice Roofing franchised outlet.

This includes costs for office setup, equipment, marketing materials, and initial operating expenses. The exact amount depends on various factors, including the size and location of the territory and whether the franchisee opts to lease or purchase office space.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $59,500 – $59,500 |

| Travel & Living Expenses While Attending Initial Training | $5,000 – $10,000 |

| Rent & Security Deposit (3 Months) | $3,000 – $7,000 |

| Leasehold Improvements | $0 – $15,000 |

| Equipment | $0 – $1,000 |

| Furniture, Office Equipment & Software | $3,500 – $9,000 |

| Vehicle | $0 – $12,500 |

| Signs | $500 – $1,000 |

| Licenses | $200 – $3,000 |

| Grand Opening Marketing | $5,000 – $10,000 |

| Insurance | $2,500 – $3,500 |

| Owens Corning Membership | $2,500 – $2,500 |

| Professional Fees (Legal and Accounting) | $1,000 – $3,000 |

| Initial Marketing Materials | $11,000 – $11,000 |

| New Hire Kits and Uniforms | $200 – $500 |

| Call Center Fee | $3,300 – $3,300 |

| 101K TV Fee | $210 – $210 |

| Additional Funds (for first 3 months) | $20,000 – $50,000 |

| Total | $117,410 – $202,010 |

Average Revenue (AUV)

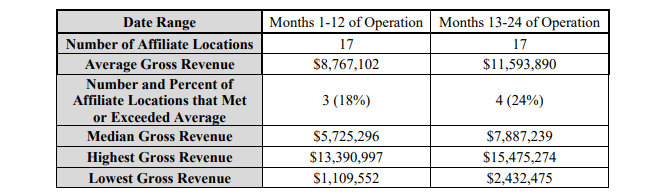

How much revenue can you make with a Best Choice Roofing franchise? A Best Choice Roofing franchised business makes on average $7,880,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $1,917,000 yearly revenue for similar roofing/siding franchises.

Below are a few competitors in comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Best Choice Roofing locations are there?

As of the latest data, Best Choice Roofing operates over 85 locations across the United States, encompassing both company-owned and franchise-owned branches.

What is the total investment required to open a Best Choice Roofing franchise?

The total investment required to open a Best Choice Roofing franchise ranges from $117,000 to $202,000.

What are the ongoing fees for a Best Choice Roofing franchise?

Best Choice Roofing franchisees pay a 6% royalty fee on gross sales. There is also a Brand Fund Contribution of up to 3%, though it is currently not collected. Once a local market cooperative is established, franchisees contribute at least 1% of gross sales to local marketing efforts.

What are the financial requirements to become a Best Choice Roofing franchisee?

To become a Best Choice Roofing franchisee, you need a minimum net worth of $300,000 and at least $100,000 in liquid capital. These financial prerequisites ensure you have the necessary resources to establish and operate the franchise effectively.

How much can a Best Choice Roofing franchise owner expect to earn?

The average gross sales for a Best Choice Roofing franchise are approximately $7.88 million per location. Assuming a 15% operating profit margin, $7.88 million yearly revenue can result in $1,182,000 EBITDA annually.

Who owns Best Choice Roofing?

Best Choice Roofing is owned by Brightstar Capital Partners, a middle-market private equity firm. Founded in 2009, the company was acquired by Brightstar Capital Partners in August 2024 to support its growth and expansion strategy.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.