Chick-Fil-A Franchise FDD, Profits & Costs (2025)

Chick-fil-A, founded by S. Truett Cathy, began as The Dwarf Grill in 1946 in Atlanta, Georgia. In 1967, Cathy opened the first Chick-fil-A restaurant in Atlanta’s Greenbriar Shopping Center.

Now, Chick-fil-A is one of the largest quick-service chicken chains in the U.S., with over 2,000 locations across 48 states, Washington D.C., Puerto Rico, and Canada. The headquarters remains in Atlanta.

Franchising started in 1986, with Chick-fil-A using a unique single-unit model. This approach requires Operators to be fully committed to their restaurant, ensuring deep community involvement and responsibility.

The brand is famous for its signature chicken sandwich, served on a buttered bun with dill pickle chips. Chick-fil-A also offers waffle fries, salads, and dipping sauces. It stands out for its quality ingredients, top-tier customer service, and strong community ties.

Initial Investment

How much does it cost to start a Chick-fil-A franchise? It costs on average between $427,000 – $2,340,000 to start a Chick-fil-A franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $10,000 |

| Opening Inventory | $22,000 to $84,000 |

| First Month’s Rental of Equipment | $750 to $5,000 |

| First Month’s Lease/Sublease of Premises | $2,725 to $96,285 |

| First Month’s Insurance Expense | $260 to $10,240 |

| Additional Funds | $391,000 to $2,134,000 |

| Total Estimate of Initial Investment | $426,735 to $2,339,525 |

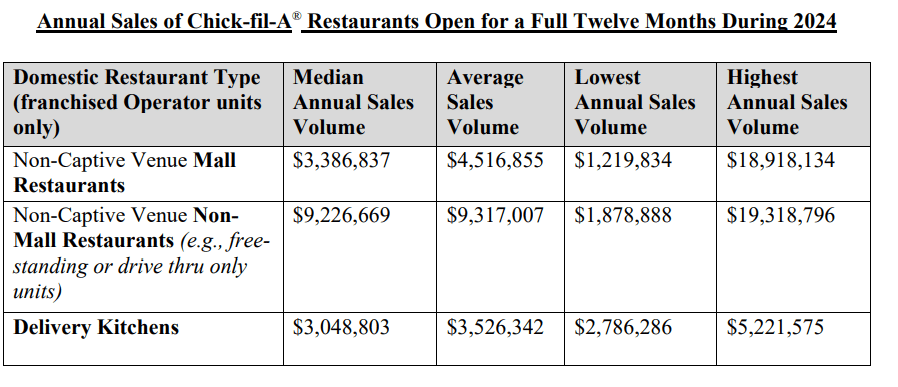

Average Revenue (AUV)

How much revenue can you make with a Chick-fil-A franchise? A Chick-fil-A franchised restaurant makes on average $8,742,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

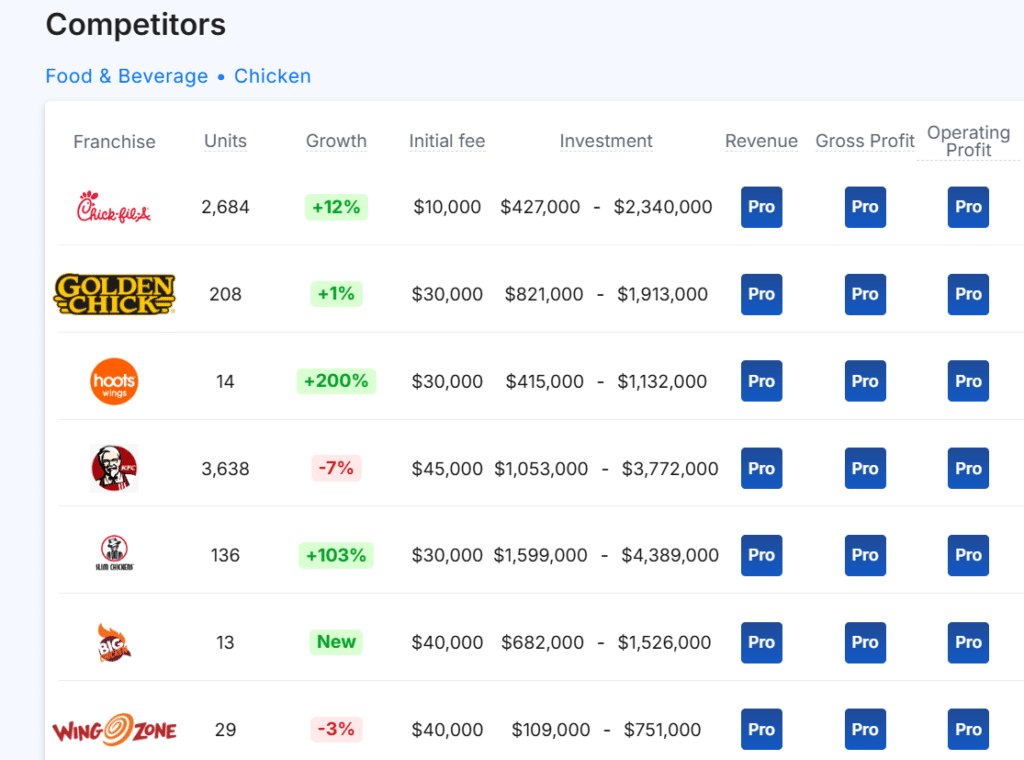

This compares to $1,662,000 yearly revenue for similar restaurant chicken franchises. Below are a few Chick-fil-A competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Chick-fil-A locations are there?

As of the latest data, Chick-fil-A operates over 2,684 locations across the United States and internationally. This includes 2,624 franchise-operated restaurants and 55 company-owned.

Chick-fil-A’s extensive network of restaurants, coupled with its strong brand recognition and loyal customer base, makes it one of the most successful fast-food chains in the country.

What is the total investment required to open a Chick-fil-A franchise?

The total investment required to open a Chick-fil-A franchise ranges from $427,000 – $2,340,000 for a franchised Chick-fil-A Restaurant business.

What are the ongoing fees for a Chick-fil-A franchise?

Chick-fil-A franchisees (referred to as operators) are required to pay a 15% royalty fee on gross sales. Additionally, there is an ongoing service fee of 50% of the restaurant’s pre-tax profit, which covers various operational costs, including marketing and advertising efforts.

However, there is some information suggesting that operators may contribute around 3.25% of gross sales toward local and national marketing efforts, although the exact structure can vary.

What are the financial requirements to become a Chick-fil-A franchisee?

To become a Chick-fil-A franchisee, the financial requirements are quite different from most other franchises:

- Net worth: Chick-fil-A does not have a formal net worth requirement for its franchisees.

- Liquid Capital: There is no specific liquid capital requirement either.

Instead of emphasizing personal financial metrics like net worth and liquid capital, Chick-fil-A focuses more on selecting operators who align with their values and leadership qualities.

How much can a Chick-fil-A franchise owner expect to earn?

The average gross sales for a Chick-fil-A franchise are approximately $8.74 million per location. Assuming a 15% operating profit margin, $8.74 million yearly revenue can result in $1,311,000 EBITDA annually.

Who owns Chick-fil-A?

Chick-fil-A franchise is owned by Chick-fil-A, Inc., a privately held company founded by S. Truett Cathy in 1946. The company remains family-owned, with leadership currently under Dan T. Cathy and Andrew Cathy, the founder’s son and grandson respectively

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.