GNC Franchise FDD, Profits & Costs (2025)

GNC, or General Nutrition Centers, is a well-established franchise in the health and wellness retail sector, founded in 1935. The company’s headquarters is located in Pittsburgh, Pennsylvania.

GNC began its franchising endeavors the same year it was founded, showcasing its long-standing commitment to expanding its reach through partnerships with franchisees.

The company operates as a specialty retailer of health and wellness products, including vitamins, supplements, minerals, herbs, sports nutrition, diet, and energy products. GNC distinguishes itself in the competitive market with its focus on quality and innovation in nutritional supplements.

Over the years, GNC has been recognized for its commitment to effective franchising and product excellence, which includes exclusive GNC brands and other nationally recognized third-party brands.

This combination offers a comprehensive approach to personal health that appeals to a broad customer base seeking to improve their health and wellness.

Initial Investment

How much does it cost to start a GNC franchise? It costs on average between $189,000 – $504,000 to start a GNC franchised business.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $20,000 |

| Security Deposit | $2,500 |

| Equipment (POS & Peripherals, POS Secure Payment Terminal/System, and Retail Tablet Computer) | $5,000 to $7,000 |

| Signage | $8,500 to $20,000 |

| Fixtures | $7,500 to $38,000 |

| Construction and Other Store Costs | $35,000 to $250,000 |

| Total | $189,000 to $504,000 |

Average Revenue (AUV)

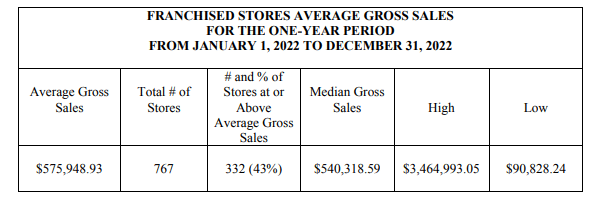

How much revenue can you make with a GNC franchise? A GNC franchised store makes on average $540,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

GNC Franchise Disclosure Document

Frequently Asked Questions

How many GNC locations are there?

As of the latest data, GNC operates a total of 2,267 locations across the United States. These include both franchise-owned and company-owned stores.

The majority of these locations are company-owned, but a significant portion are franchises, with approximately 800 franchised locations. This number reflects GNC’s strong presence in the health and wellness industry, despite closures and restructuring over the past few years.

What is the total investment required to open a GNC franchise?

The total investment required to open a GNC franchise ranges from $189,000 to $504,000.

What are the ongoing fees for a GNC franchise?

A GNC franchise requires ongoing fees including a 6% royalty fee on gross sales and a 3% marketing fee. These fees cover the use of the GNC brand, operational support, and contributions to national marketing efforts aimed at promoting the franchise network.

What are the financial requirements to become a GNC franchisee?

To become a GNC franchisee, prospective franchisees must meet certain financial requirements. The minimum net worth required is typically $350,000, ensuring that the franchisee has sufficient assets to support the business.

Additionally, applicants must have at least $125,000 in liquid capital available. This liquid capital is necessary to cover the initial startup costs, which include franchise fees, inventory, and other operational expenses.

Who owns GNC?

GNC is currently owned by Harbin Pharmaceutical Group Holding Co., a Chinese state-owned company. Harbin acquired a significant stake in GNC in 2018, purchasing about 40% of the company’s shares.

This acquisition was part of a broader effort to stabilize GNC after a period of financial difficulties, including its Chapter 11 bankruptcy filing in 2020. Harbin Pharmaceutical Group now plays a major role in GNC’s operations and decision-making, leveraging the company’s global presence in the health and wellness market.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.