GoDog Franchise FDD, Profits & Costs (2025)

GoDog is a leading pet hospitality franchise that was launched in 2018 by founders Jess and Ben Eberdt.

Based in Nashville, Tennessee, the brand provides a wide range of services for dogs, including daycare, overnight boarding, grooming, training, and its signature concept—GoDog: SOCIAL, a membership-driven dog park and bar.

The franchise began its expansion journey in May 2023 and is quickly growing its presence nationwide.

GoDog distinguishes itself through a focus on upscale care and state-of-the-art facilities. Each center is thoughtfully designed with premium amenities like saltwater swimming pools, slip-resistant flooring, soundproof boarding suites, and advanced climate control systems.

Initial Investment

How much does it cost to start a GoDog franchise? It costs on average between $1,987,000 – $3,696,000 to start a GoDog franchised facility.

This includes costs for construction, specialized equipment, facility setup, and initial operating expenses. The total investment can vary based on several factors, such as the size of the pet care facility, the local market, and whether the franchisee decides to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $80,000 |

| Development Oversight Fee | $25,000 |

| Rent | $35,000 – $105,000 |

| Security Deposit | $0 – $5,000 |

| Professional Fees | $10,000 – $25,000 |

| Insurance (3 Months) | $5,250 – $6,125 |

| Market Introduction Program | $25,000 – $60,000 |

| Training Expenses | $15,000 – $27,000 |

| Additional Funds – 3 Months | $20,000 – $40,000 |

| Initial Labor Costs | $0 – $104,000 |

| Site Survey | $3,000 – $9,000 |

| Architect & Engineering Fee | $65,000 – $110,000 |

| Utility Deposits | $0 – $5,000 |

| Business Licenses & Permits | $20,000 – $50,000 |

| Construction Management Services | $35,000 – $75,000 |

| Leasehold Improvements | $1,200,000 – $2,400,000 |

| Exterior and Interior Signage and Graphics | $25,000 – $50,000 |

| Direct Purchases | $360,000 – $420,000 |

| Furniture, Fixtures and Equipment (FFE) | $64,000 – $100,000 |

| Total | $1,987,250 – $3,696,125 |

Average Revenue (AUV)

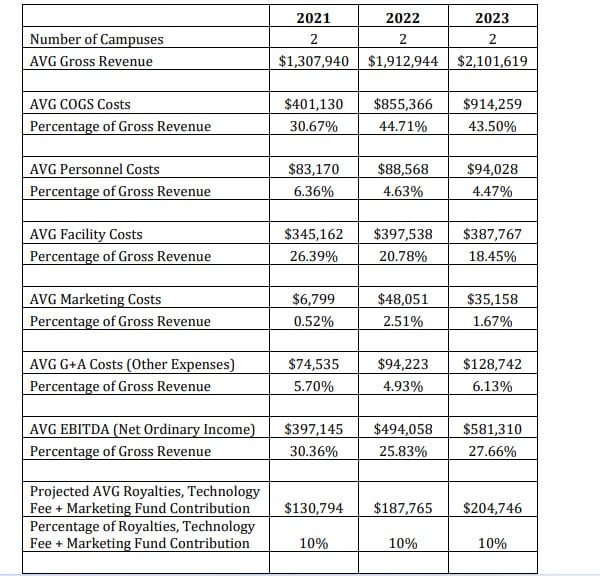

How much revenue can you make with a GoDog franchise? A GoDog franchised center makes on average $2,102,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

GoDog Franchise Disclosure Document

Frequently Asked Questions

How many GoDog locations are there?

As of the latest data, GoDog operates two company-owned locations and has no franchise-owned units.

What is the total investment required to open a GoDog franchise?

The total investment required to open a GoDog franchise ranges from $1,987,000 to $3,696,000.

What are the ongoing fees for a GoDog franchise?

GoDog franchisees are required to pay a royalty fee of 7% of gross sales, along with a marketing or brand advertising fee of 2%. These ongoing fees are collected for the duration of the franchise agreement.

Who owns GoDog?

GoDog franchise is owned by founders Jess and Ben Eberdt, who established the brand in 2018.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.