Gong Cha Franchise FDD, Profits & Costs (2025)

Gong Cha, an international beverage franchise, is famous for its premium teas, bubble teas, and coffee. Founded in 2006 in Kaohsiung, Taiwan, its name, “Gong Cha,” means “tribute tea for the emperor,” symbolizing the brand’s dedication to quality.

The idea for Gong Cha began in 1996 with founders Huang and Wu, who wanted to offer personalized tea service with innovative flavors. By 2006, the first Gong Cha store opened in Kaohsiung, marking the brand’s rise to global recognition.

Gong Cha is best known for its signature Milk Foam, a creamy, sweet, and savory topping that enhances its freshly brewed teas. This hand-crafted foam, made from the finest ingredients, is a defining element of the Gong Cha experience.

Gong Cha Franchise Initial Investment

How much does it cost to start a Gong Cha franchise? It costs on average between $185,000 – $627,000 to start a Gong Cha franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount Range |

|---|---|

| Initial Franchise Fee | $34,500 |

| Training Expenses | $3,600 to $7,200 |

| Architect and Engineering Fees | $5,150 to $13,000 |

| Leasehold Improvements | $51,500 to $270,500 |

| Furniture, Fixtures, and Equipment | $30,250 to $62,300 |

| Technology Systems | $5,850 to $6,610 |

| Exterior Signage | $2,050 to $5,400 |

| Security and Utility Deposits and Rent | $5,150 to $32,500 |

| Professional Fees and Business Permits | $1,250 to $29,000 |

| Initial Supplies and Inventory | $25,750 to $61,800 |

| Grand Opening Advertising | $4,000 to $5,400 |

| Insurance | $5,400 to $12,350 |

| Additional Funds – 3 Months | $10,300 to $86,500 |

| Total Initial Investment | $184,500 to $627,060 |

Gong Cha Franchise Average Revenue (AUV)

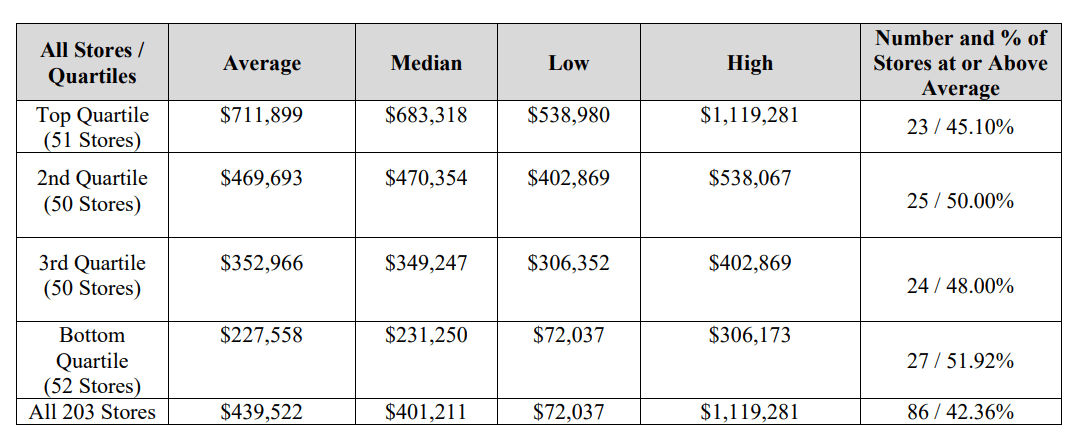

How much revenue can you make with a Gong Cha franchise? A Gong Cha franchised restaurant makes on average $683,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $557,000 yearly revenue for similar restaurant coffee and tea franchises.

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Gong Cha locations are there?

As of the latest data, Gong Cha operates 6 locations, 4 of which are franchise-owned and 2 of which are company-owned.

What is the total investment required to open a Gong Cha franchise?

The total investment required to open a Gong Cha franchise ranges from $185,000 – $627,000.

What are the ongoing fees for a Gong Cha franchise?

For a Gong Cha franchise, the ongoing fees include a 6% royalty fee on weekly net sales, which is due on the third business day of each week. Additionally, there is a brand marketing fee of 1% of weekly net sales, although this fee may be increased up to 2% with 90 days’ prior written notice.

These fees are standard for maintaining franchise operations and contributing to the brand’s national and local marketing efforts.

What are the financial requirements to become a Gong Cha franchisee?

To become a Gong Cha franchisee, the financial requirements typically include a minimum net worth ranging between $300,000 and $500,000 and liquid assets of at least $100,000 to $200,000. These financial thresholds ensure that prospective franchisees have the necessary resources to cover initial costs, operational expenses, and ongoing franchise fees.

How much can a Gong Cha franchise owner expect to earn?

The average gross sales for a Gong Cha franchise are approximately $0.68 million per location. Assuming a 15% operating profit margin, $0.68 million yearly revenue can result in $102,000 EBITDA annually.

Who owns Gong Cha?

Gong Cha is owned by TA Associates, a private equity firm that acquired a majority stake in the company in 2019. This acquisition has helped Gong Cha expand its global footprint and continue growing in markets across the world.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.