Great American Cookies Franchise FDD, Profits & Costs (2025)

Great American Cookies, known for its Original Cookie Cake, was founded in 1977 with a cherished family chocolate chip cookie recipe at its heart.

The franchise prides itself on being the largest U.S.-based retail cookie chain, boasting a unique position in the market through its proprietary cookie dough produced in its own Atlanta-based plant.

This not only allows for quality control but also gives the franchise a competitive edge in supply chain management, making it difficult for independent operators to match their offerings.

Over the years, Great American Cookies has maintained a strong commitment to innovation, continuously developing new products to keep the menu fresh and exciting for customers.

The franchise began expanding by offering franchise opportunities also in 1977. The franchise operates under the umbrella of FAT Brands, a global franchising company that manages several other notable brands.

Initial Investment

How much does it cost to start a Great American Cookies franchise? It costs on average between $110,000 – $512,000 to start a Great American Cookies franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property. Great American Cookies offers 4 types of franchises:

| Restaurant Type | Initial Investment Range |

|---|---|

| Traditional Restaurant | $282,500 to $412,150 |

| Non-Traditional Restaurant | $195,800 to $337,150 |

| Satellite | $110,350 to $211,811 |

| GREAT AMERICAN COOKIES-MARBLE SLAB CREAMERY Co-Brand Restaurant | $385,185 to $512,135 |

We are summarizing below the main costs associated with opening a Great American Cookies franchised traditional restaurant. For more information on the costs required to start an Great American Cookies franchise, refer to the Franchise Disclosure Document (Item 7).

| Type of Expenditure | Amount (Traditional Restaurant) |

|---|---|

| Franchise Fee | $25,000 |

| Grand Opening Marketing | $3,000 |

| Travel and Living Expenses While Training | $1,000 |

| Cookie Ingredients | $5,000 |

| Other Opening Inventory | $5,700 |

| Architectural Fees | $7,000 |

| Furniture, Fixtures, Equipment and Decor | $91,000 |

| Signs | $4,500 |

| Prepaid Rent and Security Deposit | $2,500 |

| Leasehold Improvements | $115,000 |

| Utility Deposits | $2,200 |

| Professional Fees | $1,000 |

| Point of Sale Systems (POS) and Related Technology | $7,600 |

| Business Licenses, Permits, etc. (for first 6 months) | $1,500 |

| Insurance (3 months) | $2,500 |

| Additional Funds (3 Months) | $8,000 |

| TOTALS | $282,500 – $412,150 |

Average Revenue (AUV)

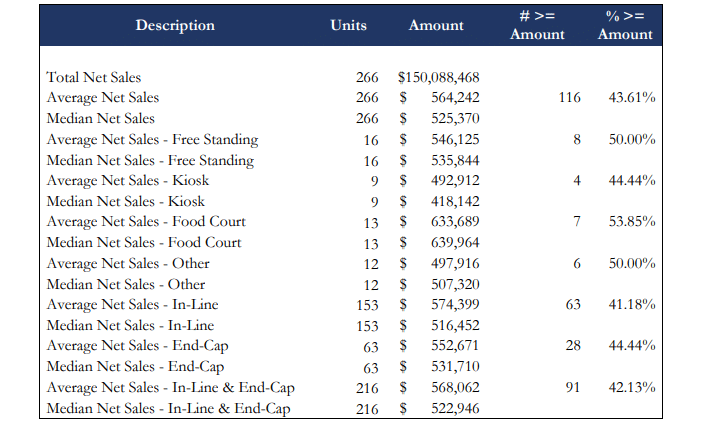

How much revenue can you make with a Great American Cookies franchise? A Great American Cookies franchised restaurant makes on average $525,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $788,000 yearly revenue for similar baked goods franchises. Below are 10 Great American Cookies competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Great American Cookies locations are there?

Great American Cookies operates over 360 locations across the U.S. as of the latest data, with a majority being franchise-owned. The company does not currently have any company-owned stores. Its growth continues to be driven through franchising, with many locations found in malls and shopping centers.

What is the total investment required to open a Great American Cookies franchise?

The total investment required to open a Great American Cookies franchise ranges from $110,000 to $512,000.

What are the ongoing fees for a Great American Cookies franchise?

For a Great American Cookies franchise, the royalty fee is 6% of gross sales. Additionally, there is a marketing fee of 4% of gross sales. These fees cover ongoing support, marketing efforts, and brand development provided by the franchisor.

What are the financial requirements to become a Great American Cookies franchisee?

To become a Great American Cookies franchisee, you need to have a minimum net worth requirement is $250,000, while you must also have at least $100,000 in liquid assets. These financial qualifications help ensure that potential franchisees can manage startup costs and maintain operations until the business becomes profitable.

How much can a Great American Cookies franchise owner expect to earn?

The average gross sales for a Great American Cookies franchise are approximately $0.53 million per location. Assuming a 15% operating profit margin, $0.53 million yearly revenue can result in $78,750 EBITDA annually.

Who owns Great American Cookies?

Great American Cookies is owned by FAT Brands, a global restaurant franchising company. FAT Brands acquired Great American Cookies as part of its acquisition of Global Franchise Group in 2021. Global Franchise Group previously owned Great American Cookies, along with other well-known brands like Marble Slab Creamery and Pretzelmaker.

FAT Brands owns a wide portfolio of franchised restaurants, making Great American Cookies part of a larger network of popular food brands.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.