👇 Check all our resources on Equipment rental businesses 👇

Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a financial model for the business plan of your equipment rental business, you’ve come the right way.

In this article we’ll explain you how to create powerful and accurate financial projections for a construction equipment rental business with a fleet of 35 vehicles. Note that the numbers, charts and financials come from our financial model template for equipment rental businesses.

1. Forecast Vehicles Acquisition & Lifespan

The first step of any equipment rental financial model is to forecast the actual number of units over time. Units can be vehicles, equipment, tools, etc.

In our example here, we are forecasting financials for a construction equipment rental business that leases heavy vehicles such as: bulldozers, forklifts, dump trucks, etc.

For each type of vehicle, we need to set:

- How many vehicles you will acquire over time, and when

- How much you pay for these vehicles

- How you finance the acquisition of vehicle (leasing, debt or equity)

- How long you expect to use these vehicles

- Whether you plan to sell the vehicles at a salvage value in the future (or not)

In order to do so, prepare a table like the one below, where you can list all the different vehicles, their category (forklift, bulldozer, backhoe, etc.), purchase price, and all the criteria listed above.

The different sections are as follows:

- The different types of vehicles and their category (each category will have a different pricing as we will see later on). For each type of vehicle:

- The number of vehicles acquired, the date of acquisition and the price paid per vehicle;

- The average rental lifespan (how many months do you use their vehicles?) and their salvage value (the value at which you will sell them back at the end of the rental lifespan;

- Debt assumptions: the % of the purchase price that’s covered by a loan (as you will likely have to pay some of it yourself), the interest rate per year and the term of the loan

That way, you will be able to forecast accurately how many vehicles are available. In other words, how many vehicles you can use to rent to customers before you need to sell them back at the end of their rental lifespan.

2. Forecast Revenue

Now that we have estimated the number of available vehicles over time, the next step in our equipment rental financial model is forecasting revenue.

Revenue is the function of:

- Number of available vehicles

- Utilization rate. Unfortunately not all vehicles will be rented at all times: it is practically impossible to reach 100% utilization rate as, for construction equipment and machinery especially, you will need to time between each customer to clean the vehicles and do some maintenance

- Rental price (per day or per month)

1. Number of available vehicles

We already have that (see section 1)

2. Utilization rate

Utilization rate can either be set at category level or for all vehicles. Make sure to set utilization rate month by month to take into account seasonality.

In the end, you’ll be able to forecast accurately the number of rented vehicles vs. the total number of available vehicles over time, as shown below.

3. Rental price

Pricing can be set by vehicle category. For example:

- Forklifts will have an average daily rental fee of $200 and a monthly rental fee of $4,200

- Excavators will have an average daily rental fee of $1,200 and a monthly rental fee of $20,000

- and so on..

Note: if you have both a daily and a monthly pricing, you will need to set an assumption on how many rentals are monthly vs. daily. For example, you could assume75% of your rentals are paid on a daily rate, and another 25% are long-term rentals with monthly rates.

Now that you have set all 3 parameters for each vehicle category, you should be able to easily calculate revenue for all vehicles as shown below.

3. Calculate Expenses

In addition to one-off startup costs, you must also budget for all the operating costs of running an equipment rental business.

We have laid out below a clear overview of all the key expenses you can expect to operate a construction equipment rental business with 35 vehicles. Yet, note that the amounts below are purely for illustrative purposes and depend on a number of factors which may not fully apply to you.

| Operating cost | Amount (per month) |

|---|---|

| Rent | $10,000 |

| Fleet maintenance (35 vehicles) | $12,000 – $20,000 |

| Staff | $80,000 |

| Marketing | $3,000 – $6,000 |

| Utility bills, other | $3,000 – $5,000 |

| Total | $108,000 – $121,000 |

Rent

Unless you acquired the real estate, you will need pay rent every month. Using our example above, you should set aside $10,000 per month for a 10,000 sq. ft. commercial space (at $10 per sq. ft. per month).

Fleet Maintenance and Servicing

Whether you rent heavy machinery, vehicles or small equipment and tools, you will need to spend money on maintenance and servicing. Unfortunately, there is no average here. The cost depend on the type of equipment you rent, their quality as well as their usage.

Depending on the size of your business, you can employ on-site mechanics and technicians to help with frequent vehicle maintenance and servicing. Alternatively, you can frequently contact an external team to handle everything.

For example, a crane will cost between $4,000 to $6,000 per year in preventive maintenance. So assuming you rent 35 heavy machinery and vehicles, you can expect to spend the same ($4,000 to $6,000 in maintenance per unit per year).

Therefore, maintenance costs can range from $140,000 to $210,000 per year for such a business. This includes spare parts, technicians’ and mechanics’ salaries as well as any other 3rd party maintenance costs.

Staff costs

Assuming you run a fleet of 35 construction vehicles, you will require about 3 operators at all times onsite for the smooth running of business operations (handling deliveries, cleaning, etc.). This is in addition with other support staff (receptionists, finance & HR, etc.).

For a company leasing 35 heavy vehicles and equipment, here is an example of the number of employees you would need:

- 2-3 personnel dedicated to offering client support (booking, reception); and

- 2 on-site specialist mechanics to help with frequent servicing and preventive fleet maintenance ($56,000 average salary)

- 3-4 operators ($65,000 average salary)

- 2-3 sales reps ($115,000 average salary)

- 2 support staff (HR & finance)

- 2 management (CFO, CEO)

In total, you would incur around $80,000 per month to cover monthly wages of the 12-15 employees including management (including 20% taxes and benefits).

4. Calculate Lease / Debt Interest

Another important part of any equipment rental financial model is to forecast your balance sheet, and more especially:

- Your assets (if you own the equipment / vehicles); and

- The debt

Doing so will allow you to do 2 important things:

- Calculate debt interest expenses. Indeed, if you purchase some of the vehicles with debt, another important expense will be the financial interest on the loan which you must forecast accurately

- Forecast your cash flow statement. Indeed, as we will see in the next section, one of the most important impact on your cash flow are debt repayments (not the interest itself but the principal repayments instead).

Therefore, make sure you calculate, each mont:

- Any debt drawdown (if you acquire new vehicles with debt in the future)

- Debt repayment (the actual loan repayments)

- Debt interest (the interest expenses that will appear on your profit-and-loss)

In the end, you should be able to obtain something like the chart below:

5. Build your P&L And Cash flow

Once we have forecasted revenues and expenses, we can easily build the profit-and-loss (P&L) from revenues down to net profit. This will help you to visualise key financial metrics such as Gross Profit or EBITDA margin as shown below:

The cash flow statement, in comparison, needs to include all cash items from the P&L and other cash movements such as capital investments (also referred as “Capex”), fundraising, debt, etc.

Forecasting cash flow is vital as it will help you understand how much funding you should get, either from investors or the bank (SBA loan for example) to start and run your own equipment rental business, which we do in our financial model template with the use of funds chart (see below).

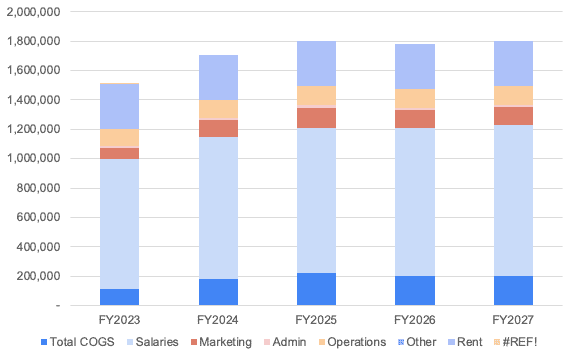

In this chart below, we’re showing you an example of a cost structure a 35-heavy vehicle equipment rental business. Unsurprisingly, 80% of total expenses are the actual cost of acquisition of the vehicles, of which the large part will be covered by debt, as well as salaries.