What Is Your Breakeven? When Will Your Startup Be Profitable?

40% of startups that went out of business cited lack of funds and running out of cash as the main reason behind their failure. Before you start raising funds, you must understand what is your breakeven point to know if and when when your startup will turn a profit.

As such, calculating your startup breakeven is a vital part of your financial plan and should not be overlooked.

Calculated with your financial projections, your startup breakeven will tell you whether to what extent your business is viable.

What is a breakeven point and how to calculate it

Breakeven point (or simply “breakeven”) is the number of units you need to sell in order to make a profit. The units can be any metric measuring the volume of your revenues (where revenues = volume x price). For instance, units can be the number of customers, subscriptions, orders, etc.

Break-even is easy to calculate. Use the following formula:

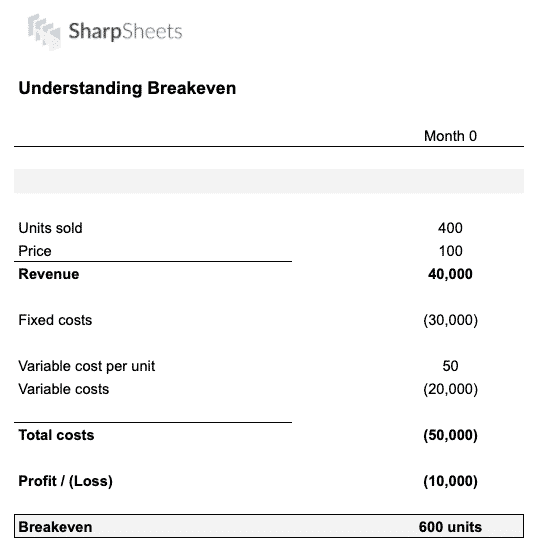

Using the same formula, we can calculate the break even point for any given business, as show below:

Fixed vs. variable costs

As shown in the formula above, in order to calculate the break-even point first we need to understand the difference between fixed and variable costs.

Fixed costs

Fixed costs are all expenses that aren’t a function of the number of products or services or customers you have. In other words, fixed costs aren’t a function of the units sold. Typically fixed costs include, among other things:

- Rent and utilities costs

- Insurance, bank and legal fees

- Some salaries such as: administrative and central operations (finance, HR, legal), management, marketing, engineering, etc.

Variable costs

Variable costs, in comparison, are any expenses which are directly linked to your revenues. A few examples of variable costs are:

- Unit costs. If you sell products online for instance, unit costs are the cost for you to supply these products

- Fulfilment costs (shipping, packaging, etc.). This is especially true for ecommerce businesses and online stores.

- Payment processing fees. They are by default a function of your revenues

- Some salaries such as: customer success, sales team, etc.

Salaries: fixed or variable costs?

By nature, the bigger your business is, the more people you will likely need to hire. As such, salaries aren’t truly fixed costs. Think about finance for instance: whilst you might be able to manage $1M revenue with 1 finance manager, surely you will need to hire some more when you get to $10M.

Yet you should consider any hire that isn’t directly a function of revenues as a fixed cost for your breakeven analysis. Else payroll, which is one of the largest expense category for most startups, would be considered as variable cost in your breakeven formula and increase significantly the result.

Whether a given team or a given role should be fixed or variable depends on your business. For instance:

- Sales: usually considered variable (especially for any B2B lead acquisition driven business such as Enterprise SaaS)

- Marketing: usually fixed cost. As with our finance example earlier, whilst you will likely need to hire more marketing professionals to increase your content and/or paid acquisition strategy, they aren’t necessarily a function of revenue.

- Customer Success: typically a variable cost. Indeed, the more customers you have and/or the more products you sell, the more customer success agents you will need. As such, customer success is a function of revenue.

- Engineering: typically a fixed cost. Still, be mindful that for some businesses, adding more customers means scaling up tech and/or adding more features which will require some hiring.

How to assess if your business is viable

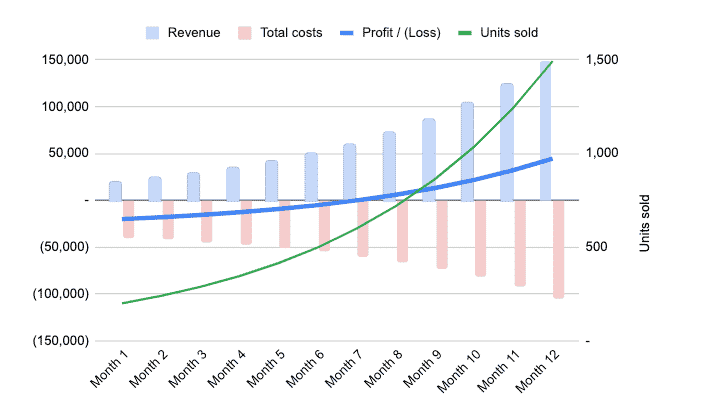

You should understanding what is your startup breakeven, even before you go and raise capital and/or start operations. Indeed, knowing you break-even point will tell you when you will be profitable: at what level of revenues or “units sold”.

As such, breakeven is key to understand whether your business is scalable, and more importantly viable.

Logically, the higher your fixed costs and / or the lower the net margin per product (the difference between price and variable costs per product), the higher your break-even point.

Be careful if your business has very low margins per product (e.g. dropshipping) and / or high fixed costs (you need 10 full-time engineers to maintain your software for instance).

Do you have a great food delivery business and you expect to turn a profit once you get to 100,000 orders per month? The risk to go bankrupt will be significantly higher vs. an online shop profitable after 100 sales per month for instance.

Finding the optimal pricing

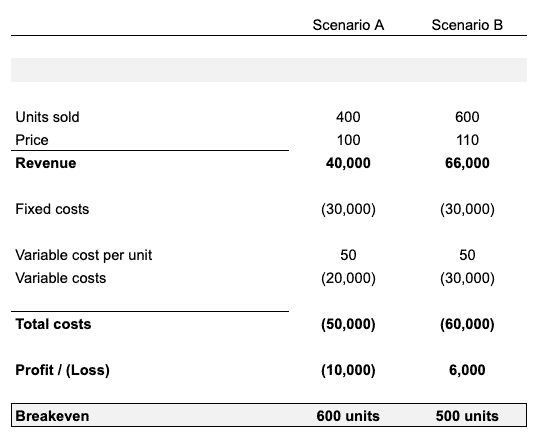

Breakeven is especially useful when setting a selling price for a product or service. You should run different scenarios with multiple price points to see the impact on your break-even.

For instance, using the same example above, if you increase your selling price by 10% from $100 to $110, break even reduces from 600 units to 500 instead.

When setting your sales price using factors such as competitive positioning, products alternatives and consumer price sensitivity, do take into account break-even analysis as well. This will allow you to understand whether your sales prices makes sense from a profitability standpoint.

5-year pro forma financial model

5-year pro forma financial model 20+ charts and business valuation

20+ charts and business valuation  Free support

Free support