Car Dealership Business Plan Template & PDF Example

Creating a comprehensive business plan is crucial for launching and running a successful car dealership. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your car dealership’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a car dealership business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the retail industry, this guide, complete with a business plan example, lays the groundwork for turning your car dealership business concept into reality. Let’s dive in!

The Plan

Our car dealership business plan is meticulously organized to encompass all key components necessary for a comprehensive strategic framework. It details our dealership’s operations, marketing strategies, market environment, competitors, leadership team, and financial outlook.

- Executive Summary: Offers an overview of your Car Dealership’s business concept, including the range of new and pre-owned vehicles, market analysis, management team, and financial strategy.

- Business Overview: Provides detailed information on what your Car Dealership offers and its operational model:

- Car Dealership & Location: Describes the dealership’s prime location, accessibility, and facility features, including the showroom and service area.

- Vehicles & Rates: Lists the types of vehicles offered, from economical compact cars to luxury SUVs, including pricing and financing options.

- Market Overview: Examines the car dealership industry landscape, identifying competitors and how your dealership stands out:

- Key Stats: Shares industry size, growth trends, and relevant statistics for the car dealership market.

- Key Trends: Highlights recent trends affecting the car dealership sector, such as the surge in Electric Vehicle (EV) sales and the shift towards Built-to-Order sales.

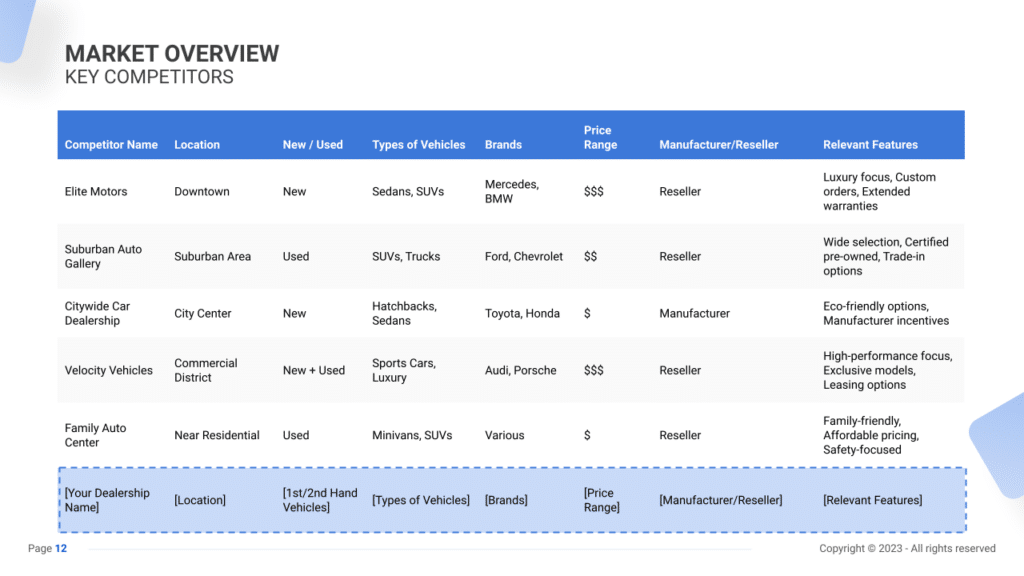

- Key Competitors: Analyzes main competitors in the area and how your dealership differentiates itself, focusing on vehicle selection, customer service, and additional services like maintenance and repairs.

- Strategy: Outlines how the Car Dealership intends to achieve growth and attract clients:

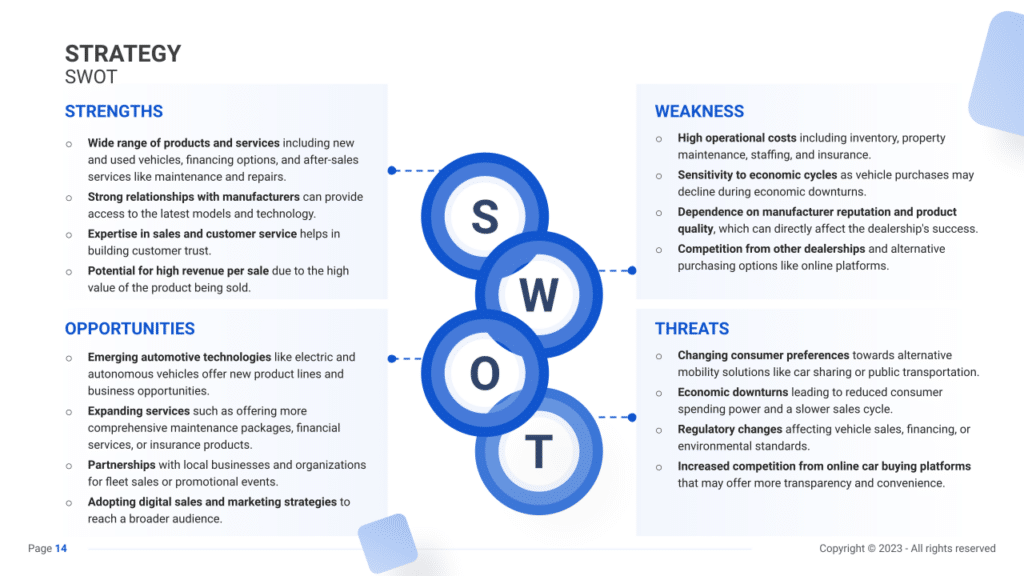

- SWOT: Strengths, weaknesses, opportunities, and threats analysis tailored to the car dealership business.

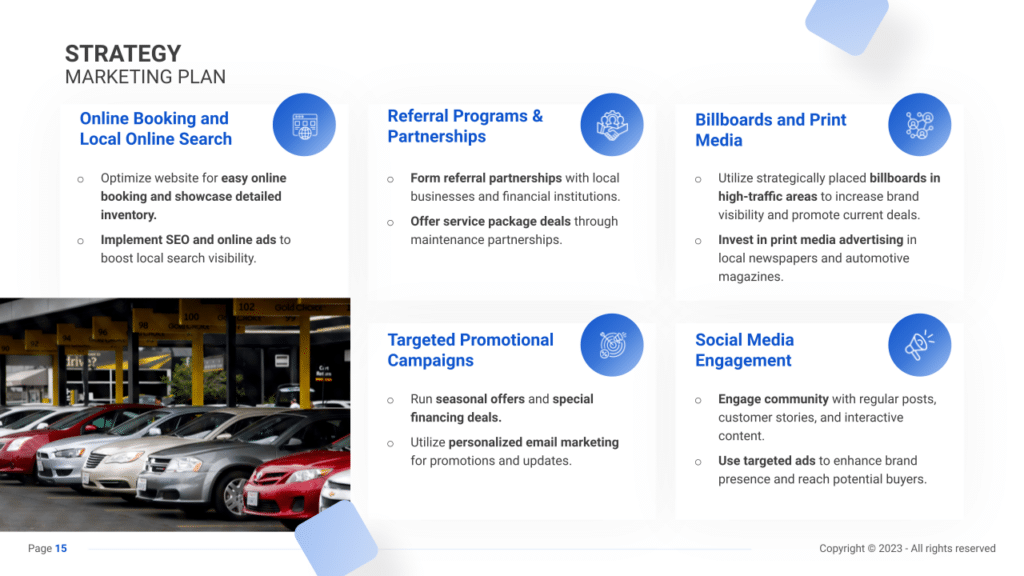

- Marketing Plan: Strategies for promoting your dealership and attracting customers, including online presence, targeted promotional campaigns, and community engagement.

- Timeline: Key milestones and objectives from the initial setup through the first year of operation and beyond.

- Management: Information on who manages the Car Dealership, detailing their roles, experience in the automotive industry, and business management.

- Financial Plan: Projects the dealership’s 5-year financial performance, including revenue from vehicle sales, profit and loss statements, cash flow analysis, and balance sheet.

Executive Summary

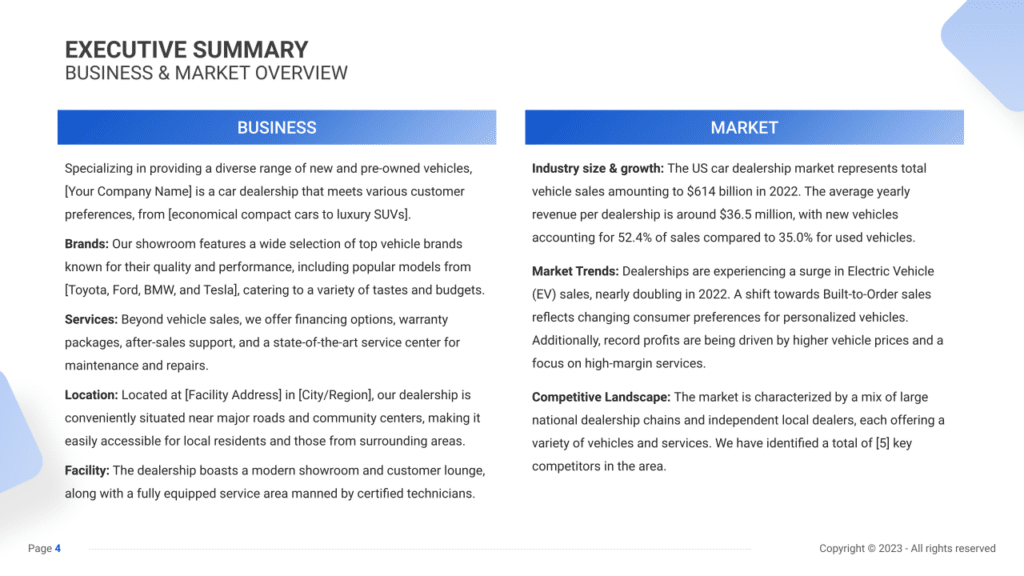

The Executive Summary introduces your car dealership’s business plan, providing a succinct overview of your dealership and its offerings. It should describe your market positioning, the range of vehicles you offer—including new and pre-owned cars, financing options, and after-sales services—its location, size, and an overview of daily operations.

This section should also delve into how your car dealership will establish itself within the local market, including the number of direct competitors in the area, identifying who they are, along with your dealership’s unique selling points that set it apart from these competitors.

Moreover, you should include information about the management and founding team, detailing their roles and contributions to the dealership’s success.

Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be included here to provide a clear picture of your dealership’s financial strategy.

Car Dealership Business Plan Executive Summary Example

Business Overview

An effective executive summary starts with a concise yet informative business overview. This includes spotlighting the dealership’s name, its prime location, and an insight into its daily operations.

Highlighting the unique selling proposition (USP) is vital. Whether it’s the dealership’s commitment to customer service excellence, a diverse inventory offering various vehicle brands, or personalized after-sales services, this distinct factor sets the dealership apart in a competitive automotive market.

Example:

“[Your Company Name],” situated in the heart of [City/Region], operates as a premier car dealership. Spanning a spacious facility, it offers various vehicles catering to diverse customer preferences, ranging from economical compact cars to luxury SUVs. Our dealership’s USP lies in delivering an extensive selection of top-tier vehicle brands such as Toyota, Ford, BMW, and Tesla, combined with a commitment to comprehensive after-sales support, financing options, and access to a state-of-the-art service center.

Market Overview

A compelling executive summary includes an insightful market overview. It should encompass market size, growth trends, and an analysis of the competitive landscape within the automotive dealership industry.

Example:

The US car dealership market represents $614 billion in total vehicle sales in 2022. Notably, the average yearly revenue per dealership stands at approximately $36.5 million, emphasizing the significance of each dealership’s role in the market. Recent trends illustrate a surge in Electric Vehicle (EV) sales, doubling in 2022, while a shift towards Built-to-Order sales aligns with evolving consumer preferences for personalized vehicles. The market is characterized by a mix of national dealership chains and independent local dealers, with [Your Company Name] poised to carve a niche by providing a diverse vehicle inventory and unparalleled customer service.

Management Team

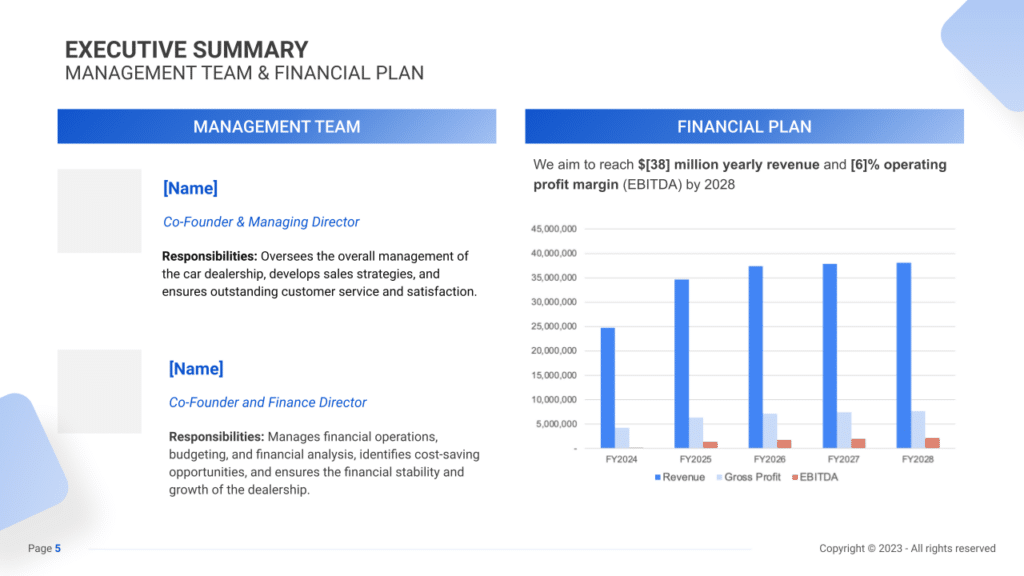

The proficiency and expertise of the management team are integral to the success of your car dealership. This section aims to spotlight the qualifications and experiences of key team members, emphasizing their pivotal roles in steering the dealership toward success.

Highlighting the team’s expertise in managing financial operations, budgeting, financial analysis, and ensuring the dealership’s financial stability and growth builds credibility and assures potential investors and partners of the dealership’s capability.

Example:

[Your Company Name] is led by a proficient management team with a wealth of experience in overseeing financial operations, budgeting, and analysis. Their expertise in identifying cost-saving opportunities, ensuring financial stability, and driving sustained growth for the dealership forms the backbone of our operations.

Financial Plan

The financial plan section encapsulates the strategic fiscal objectives and projections of your car dealership. It offers a concise overview of revenue targets and profit margins and outlines the trajectory guiding the dealership’s financial growth.

Example:

As part of our strategic growth plan, [Your Company Name] aims to attain a significant milestone by achieving $38 million in yearly revenue and a commendable operating profit margin (EBITDA) by 2028. This strategic trajectory involves maintaining competitive pricing structures, a relentless focus on operational efficiency, and an unwavering commitment to delivering unparalleled customer service. These strategies, coupled with the dedication of our adept team, aim to ensure consistent growth and profitability for the dealership in the years ahead.

Business Overview

For a Car Dealership, the Business Overview section can be effectively divided into 2 main categories:

Car Dealership & Location

Describe the dealership’s physical setup, focusing on its design, layout, and overall ambiance that welcomes customers. Mention features such as the showroom’s size, the display arrangement of vehicles, and any customer-friendly areas like waiting lounges or consultation spaces.

Next, highlight the dealership’s location, emphasizing its accessibility and the convenience it offers to customers, such as proximity to major roads or highways and the ease of parking. Also, explain why this location is strategically chosen to attract your target customer base, considering factors like local traffic flow, visibility, and the presence of nearby complementary businesses.

Vehicles & Rates

Detail the variety of vehicles offered, including new and pre-owned models, different brands, and vehicle types (such as sedans, SUVs, trucks, and electric vehicles). Emphasize any unique or highly sought-after models that could attract customers.

Outline your pricing strategy for the vehicles, ensuring it reflects the value offered and aligns with the market segment you’re targeting. Discuss any financing options, leasing deals, or special promotions that make purchasing more accessible and appealing to customers.

Market Overview

Industry Size & Growth

In the Market Overview of your car dealership business plan, begin by analyzing the size of the automotive industry and its growth potential. This examination is essential for grasping the market’s breadth and pinpointing opportunities for expansion.

Key Market Trends

Next, delve into current market trends, such as the growing consumer interest in electric and hybrid vehicles, advanced safety features, and digital sales platforms. Highlight the demand for vehicles that cater to evolving lifestyle needs and environmental concerns, along with the shift towards online purchasing and personalized buying experiences.

Competitive Landscape

A competitive analysis is not just a tool for gauging the position of your car dealership in the market and its key competitors; it’s also a fundamental component of your business plan. This analysis helps in identifying your car dealership’s unique selling points, essential for differentiating your business in a competitive market.

In addition, the competitive analysis is integral in laying a solid foundation for your business plan. By examining various operational aspects of your competitors, you gain valuable information that ensures your business plan is robust, informed, and tailored to succeed in the current market environment.

Identifying Your Competitors in the Car Dealership Industry

The initial step towards understanding your dealership’s position involves identifying and analyzing the key competitors within the automotive market. Start by mapping out local car dealerships, both independent and franchised, specializing in similar vehicle types or brands.

For instance, if your dealership specializes in luxury vehicles, your direct competitors might include other luxury dealerships within your vicinity, as well as larger franchised dealerships offering similar high-end car models. Additionally, consider indirect competitors such as online car sales platforms or used car dealerships, as they may cater to overlapping customer segments.

Leverage online tools and platforms such as dealership locators on automotive brand websites, Google Maps, and industry-specific platforms like Edmunds or Cars.com to gain insights into competitor locations and their inventory offerings.

Analyzing customer reviews and ratings on platforms like Yelp or DealerRater can provide valuable information about competitor strengths and weaknesses. For instance, positive reviews praising the customer service or wide vehicle selection at a rival dealership highlight aspects crucial for comparison.

Car Dealership Competitors’ Strategies

An in-depth analysis of your competitors’ strategies involves scrutinizing various facets of their operations:

- Vehicle Inventory: Evaluate the range and variety of vehicles offered by competitors. If a nearby dealership gains traction with electric or hybrid models, it signifies an emerging market trend towards eco-friendly vehicles that might influence consumer preferences.

- Sales and Financing Approach: Consider the sales tactics and financing options employed by competitors. A dealership offering flexible financing plans or exclusive warranty packages may attract customers seeking added value.

- Customer Service and Support: Assess the quality of customer service and post-sale support provided by competitors. A dealership known for its responsive customer service or efficient maintenance services may have a competitive edge.

- Marketing and Promotion: Study competitors’ marketing strategies, whether they rely on digital marketing, traditional advertising, or exclusive promotional events. A dealership leveraging social media influencers or hosting test-drive events could have a unique marketing approach.

- Technological Integration: Observe if competitors embrace innovative technologies in their operations, such as virtual showrooms or online vehicle customization tools. A dealership utilizing augmented reality for virtual car tours might stand out in enhancing the customer experience.

What’s Your Car Dealership’s Value Proposition?

Reflect on your dealership’s distinct value proposition. Perhaps your dealership specializes in rare vintage car collections or offers personalized concierge services for clients. Identifying gaps in the market through customer feedback and emerging industry trends is crucial.

For instance, the increasing demand for electric vehicles or the emphasis on contactless transactions could signify opportunities for differentiation if competitors have yet to fully cater to these preferences.

Consider your dealership’s location and target demographic. A dealership situated in a bustling urban area might prioritize convenience and streamlined services, while one in a suburban setting might emphasize family-oriented vehicle options and comprehensive safety features.

Strategy

SWOT

Begin with a SWOT analysis for the car dealership, identifying Strengths (such as a diverse vehicle inventory and strong customer service), Weaknesses (like limited market presence or competitive pressure), Opportunities (for instance, the growing demand for electric vehicles and online sales channels), and Threats (such as economic fluctuations affecting consumer spending on big-ticket items).

Marketing Plan

Then, craft a marketing plan that details strategies to attract and retain customers through targeted advertising campaigns, promotional financing offers, a dynamic online presence, and community engagement events.

Marketing Channels

Marketing channels for a car dealership serve as pathways to communicate your brand and vehicle offerings to potential buyers. These channels are vital for establishing brand awareness, engaging with customers, and driving foot traffic to your showroom.

Digital Marketing

In today’s digital era, a robust online presence is imperative. This includes:

- Social Media: Utilize platforms like Instagram and Facebook to showcase your inventory, share informative car-related content, and engage with users through comments and direct messages.

- Website and SEO: Develop a user-friendly website displaying your inventory, customer testimonials, and blog posts about car buying tips and industry updates. Implement SEO strategies to enhance your dealership’s online visibility.

- Email Marketing: Build an email list by offering incentives like exclusive previews of new vehicle arrivals or maintenance tips. Send regular newsletters with updates on promotions, vehicle features, and industry news.

Local Advertising

Connecting with your local community can yield substantial results:

- Radio and TV Ads: Utilize local radio stations or television channels to broadcast ads highlighting special deals, seasonal promotions, or unique vehicle models.

- Community Involvement: Sponsor local events, charity drives, or sports teams to boost brand visibility and forge community connections.

- Partnerships: Collaborate with complementary businesses like insurance agencies or car maintenance centers to offer bundled services or joint promotional deals.

Promotional Activities

Captivate potential buyers with compelling offers:

- Special Promotions: Launch seasonal sales events such as ‘Year-End Clearance’ or ‘Summer Road Trip Deals.’ Offer discounts or incentives for test drives.

- Referral Programs: Incentivize existing customers to refer friends and family by offering discounts on services or accessories for successful referrals.

- Customer Appreciation Events: Organize exclusive events or workshops showcasing vehicle features, safety tips, or new technological advancements.

Sales Channels

Sales channels are instrumental in selling vehicles and additional services to customers. These channels optimize revenue and ensure customer satisfaction.

In-Showroom Upselling

Maximize sales opportunities during customer visits:

- Additional Features: During test drives or vehicle selection, highlight premium features or upgrades available for specific models.

- Service Packages: Offer bundled maintenance packages or extended warranties to add value to the purchase.

- Finance and Insurance Services: Educate customers about financing options and insurance packages available through the dealership.

Online Sales and Services

Leverage technology for efficient sales processes:

- Online Inventory Access: Enable customers to browse your inventory, check vehicle specifications, and schedule test drives through your website or dedicated mobile application.

- Virtual Showroom Experience: Offer virtual tours or interactive presentations of vehicles, providing a comprehensive experience for online buyers.

- E-Commerce: Facilitate online transactions for accessories, spare parts, or merchandise associated with the vehicles you sell.

Customer Retention Programs

Encourage repeat business and foster loyalty:

- Maintenance Plans: Offer subscription-based maintenance plans for regular servicing and upkeep of purchased vehicles.

- Customer Support and Engagement: Establish a customer service department for addressing queries, and feedback, and providing ongoing support post-purchase.

- Exclusive Benefits: Implement membership or loyalty programs offering discounts on future purchases, priority servicing, or VIP events. These programs foster a sense of belonging and incentivize customers to continue their relationship with your dealership.

Strategy Timeline

Lastly, establish a comprehensive timeline that marks key milestones for the dealership’s launch, marketing initiatives, customer base development, and growth goals, ensuring the business progresses with clarity and focus.

Management

The Management section focuses on the car dealership business’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the car dealership toward its financial and operational goals.

For your car dealership business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

Financial Plan

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your car dealership’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs, and capital expenditures.

For your car dealership business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here

_ Profit and Loss

_ Cash Flow Statement

_ Balance Sheet

_ Use of Funds