InXpress Franchise FDD, Profits & Costs (2025)

InXpress is a well-established global franchise that specializes in shipping and logistics solutions, providing small and medium-sized businesses with cost-effective and efficient transportation services. Founded in 1999 and beginning its franchising operations in 2000, InXpress has grown to be a significant player in the logistics sector.

The company is headquartered in South Jordan, Utah, USA, which serves as a central hub supporting a network that spans multiple countries across various continents.

The franchise operates under a business-to-business model that leverages agreements with world-class carriers like DHL, FedEx, and UPS, allowing it to offer bulk buying discounts that individual businesses typically could not secure on their own.

Initial Investment

How much does it cost to start a InXpress franchise? It costs on average between $87,000 – $168,000 to start a InXpress franchised store.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $50,000 |

| Training Fee | $5,000 – $6,000 |

| Office Expenses | $0 – $3,000 |

| Licensing Fees and Surety Bonding | $0 – $10,000 |

| Insurance | $500 – $2,500 |

| Office Equipment & Supplies | $1,000 – $4,000 |

| Training Transportation and Expenses | $1,500 – $7,500 |

| Business Licenses & Permits | $100 – $2,000 |

| Computer Hardware & Software | $1,000 – $2,000 |

| MSP Fees – (12 Months) | $7,020 |

| Professional Fees | $0 – $2,000 |

| Start-Up Marketing Fee | $10,000 |

| Additional Funds – (12 Months) | $10,000 – $62,000 |

| Total Estimated Initial Investment | $87,000 – $168,000 |

Average Revenue (AUV)

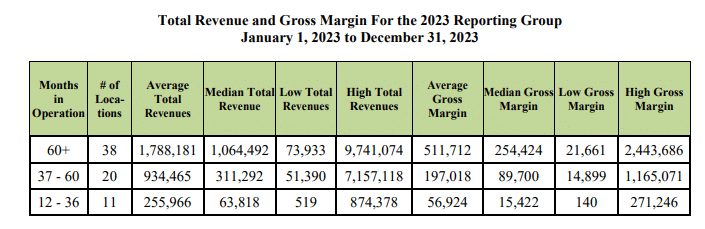

How much revenue can you make with a InXpress franchise? A InXpress franchised business makes on average $687,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $683,000 yearly revenue for similar shipping franchises. Below are 10 InXpress competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many InXpress locations are there?

As of the latest data, InXpress operates nearly 400 franchised locations across 14 countries, focusing entirely on a franchise model with no company-owned outlets. This global footprint includes approximately 109 franchise-owned locations in the United States and around 38 in Canada.

InXpress emphasizes B2B shipping and logistics solutions tailored for small to medium-sized businesses, leveraging strategic partnerships and a network of carriers to offer cost-effective shipping options to its clients.

What is the total investment required to open a InXpress franchise?

The total investment required to open a InXpress franchise ranges from $87,000 to $168,000.

What are the ongoing fees for a InXpress franchise?

InXpress franchisees pay a 30% royalty fee on gross sales, covering franchisor support and network benefits. Additionally, they contribute a 1% marketing fee to support brand-wide advertising and customer outreach efforts. These fees support operational assistance and brand growth.

What are the financial requirements to become a InXpress franchisee?

To become an InXpress franchisee, candidates are typically required to have a minimum net worth of $150,000 and at least $85,000 in liquid capital.

These financial requirements ensure that franchisees have the necessary resources to manage the initial investment and support ongoing operations, aligning with the brand’s standards for financial stability and operational capacity.

How much can a InXpress franchise owner expect to earn?

The average gross sales for a InXpress franchise are approximately $0.69 million per location. Assuming a 15% operating profit margin, $0.69 million yearly revenue can result in $103,500 EBITDA annually.

Who owns InXpress?

InXpress is currently owned by Hudson Hill Capital, a private equity firm based in New York. Hudson Hill Capital acquired InXpress in partnership with the company’s senior management team, including key leaders like Global CEO Mark Taylor.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.