Jersey Mike’s Franchise FDD, Profits & Costs (2025)

Jersey Mike’s Subs, founded in 1956 in Point Pleasant, New Jersey, started as Mike’s Subs, gaining popularity for its fresh submarine sandwiches. Its coastal location attracted both locals and tourists, thanks to its high-quality food and friendly service.

In 1971, Peter Cancro, a high school employee, purchased the shop at just 17 with a loan from his football coach. By 1987, Peter began franchising the business, rebranding it as Jersey Mike’s Subs to emphasize its New Jersey roots. The company is now headquartered in Manasquan, New Jersey.

Known for premium ingredients and freshly baked bread, Jersey Mike’s prepares sandwiches in front of customers using the famous “Mike’s Way” method, with lettuce, onions, tomatoes, oil, vinegar, and spices.

Jersey Mike’s Franchise Initial Investment

How much does it cost to start a Jersey Mike’s franchise? It costs on average between $182,000 – $1,414,000 to start a Jersey Mike’s franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $18,500 |

| Real Estate and Construction Fee | $5,000 |

| Rent/Lease CAM/Taxes/Lease and Utility Security Deposits | $0 – $72,480 |

| Architectural Fees | $1,050 – $33,142 |

| Leasehold Improvements | $75,172 – $722,422 |

| Equipment/Furniture/Small Wares | $31,627 – $207,546 |

| Initial Inventory | $1,923 – $35,000 |

| Insurance | $1,000 – $24,780 |

| Training | $1,000 – $68,000 |

| Grand Opening Advertising | $12,500 |

| Exterior Signage | $1,121 – $40,073 |

| Interior Branding / Graphics | $1,610 – $11,208 |

| Uniforms, Office Equipment and Supplies, TVs/Stereo System/Security System | $900 – $65,507 |

| POS System | $8,250 – $27,509 |

| POS System Connection to Private Network | $4,500 |

| POS License Fee | $2,000 – $4,000 |

| Professional Fees (lawyer, accountant, etc.) | $250 – $21,425 |

| Business Licenses and Permits | $500 – $25,000 |

| Additional Funds for 3 Months | $15,000 |

| Total | $181,903 – $1,413,592 |

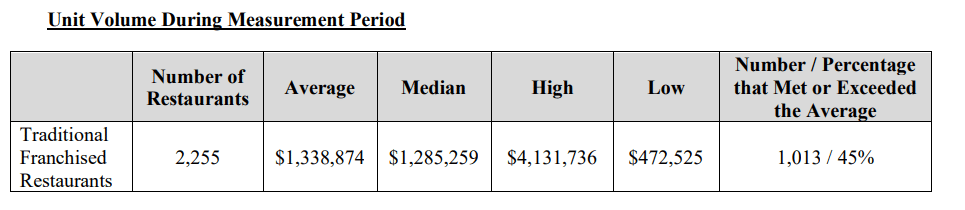

Jersey Mike’s Franchise Average Revenue (AUV)

How much revenue can you make with a Jersey Mike’s franchise? A Jersey Mike’s franchised restaurant makes on average $1,285,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

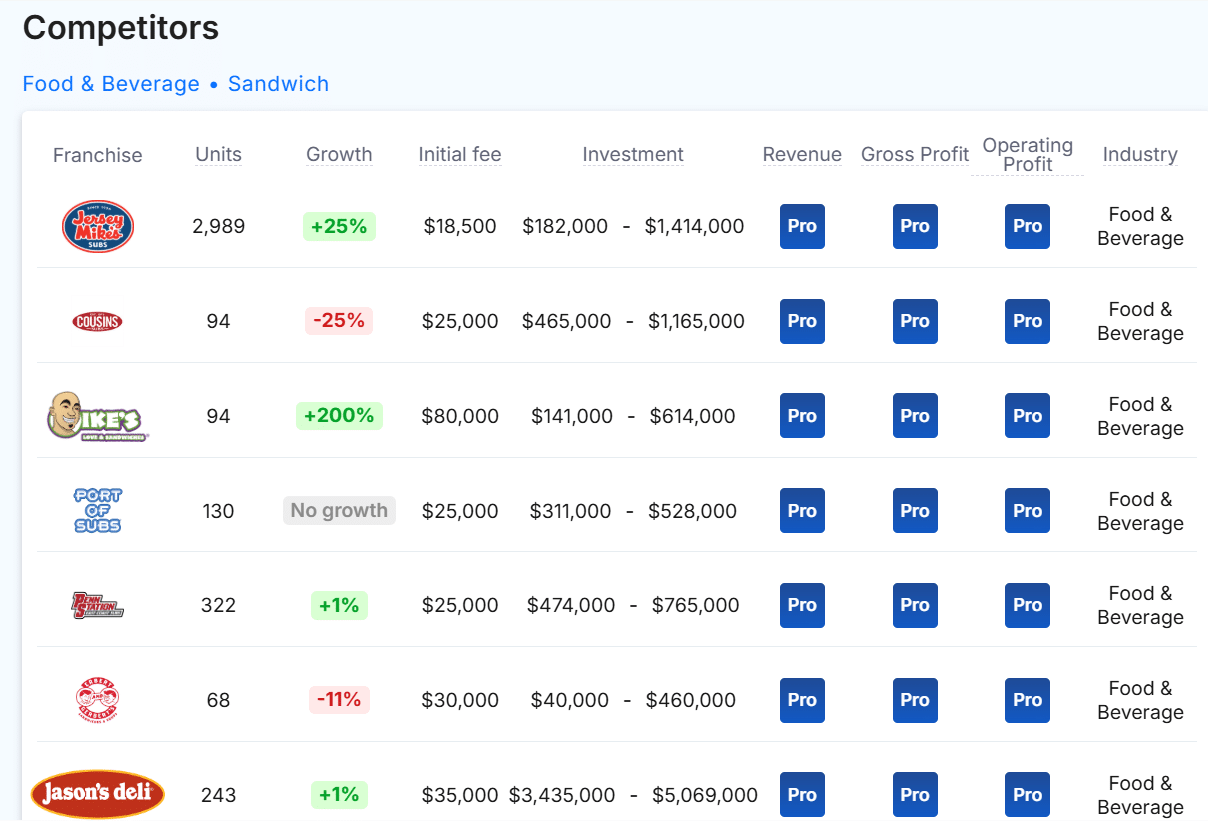

This compares to $838,000 yearly revenue for similar restaurant sandwich franchises. Below are a few Jersey Mike’s competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Jersey Mike’s locations are there?

As of the latest data, Jersey Mike’s has a total of 2,989 locations, of which 2,955 are franchise-owned and 34 are company-owned.

What is the total investment required to open a Jersey Mike’s franchise?

The total investment required to open a Jersey Mike’s franchise ranges from $182,000 – $1,414,000.

What are the ongoing fees for a Jersey Mike’s franchise?

Jersey Mike’s franchisees are required to pay a 6.5% royalty fee on gross receipts for all locations. Additionally, there is a 5.0% advertising fee on gross receipts, which includes both national and local marketing efforts.

What are the financial requirements to become a Jersey Mike’s franchisee?

To become a Jersey Mike’s franchisee, you must meet the following financial requirements: Minimum Net Worth of $300,000 and at least $100,000 in Liquid assets.

How much can a Jersey Mike’s franchise owner expect to earn?

The average gross sales for a Jersey Mike’s franchise are approximately $1.29 million per location. Assuming a 15% operating profit margin, $1.29 million yearly revenue can result in $194,000 EBITDA annually.

Who owns Jersey Mike’s?

Jersey Mike’s is owned by Peter Cancro, who purchased the original Mike’s Subs in Point Pleasant, New Jersey, in 1975 when he was just 17 years old. He used a loan, backed by his high school football coach, to buy the shop where he had worked since he was 14. Cancro transformed Mike’s Subs into Jersey Mike’s Subs and has since grown the brand into a national franchise.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.