Pelican’s SnoBalls Franchise FDD, Profits & Costs (2025)

Pelican’s SnoBalls has redefined the shaved ice experience with its signature style and diverse range of flavors. The brand’s story began in 2001 in Garner, North Carolina, when 13-year-old Ansley Johnson, inspired by summers in Louisiana, set out to share the joy of SnoBalls with others.

Unlike standard snow cones, SnoBalls have a finer, fluffier texture that enhances the treat’s appeal. The name “Pelican’s” is a tribute to Louisiana’s state bird, reflecting the brand’s roots and inspiration. What sets Pelican’s SnoBalls apart is its ultra-soft ice combined with bold, vibrant flavors, offering a refreshing alternative to the crunchy snow cones commonly found at fairs.

Since its launch, the brand has expanded from a single location into a well-known franchise across the country. Pelican’s SnoBalls remains committed to delivering the “World’s Best SnoBall” while maintaining excellent customer service.

The franchise has proven its resilience, providing an affordable and high-quality frozen treat that has withstood economic downturns, including the 2008 financial crisis and the 2020 pandemic.

Initial Investment

How much does it cost to start a Pelican’s SnoBalls franchise? It costs on average between $71,000 – $210,000 to start a Pelican’s SnoBalls franchised business.

This includes expenses for build-out, equipment, initial inventory, and early operational costs. The total investment varies based on factors such as the location, store size, and whether the franchisee opts to lease or buy the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $20,000 |

| Lease/Rent | $1,500 – $18,000/month |

| Plans and Construction | $8,000 – $80,000 |

| Concept Building Drawing | $0 – $3,000 |

| Equipment | $20,000 – $40,000 |

| POS System | $2,100 – $3,000 |

| Inventory | $10,000 – $20,000 |

| Signs | $1,500 – $7,000 |

| Advertising | $100 – $2,000 |

| Insurance | $3,000 – $6,400 |

| Training Expenses | $1,000 – $4,000 |

| Business Licenses | $50 – $200 |

| Professional Fees | $3,000 – $10,000 |

| Additional Funds (6 mo.) | $0 – $3,000 |

| Security Deposits | $0 – $200 |

| Total Estimated Costs | $70,750 – $209,800 |

Average Revenue (AUV)

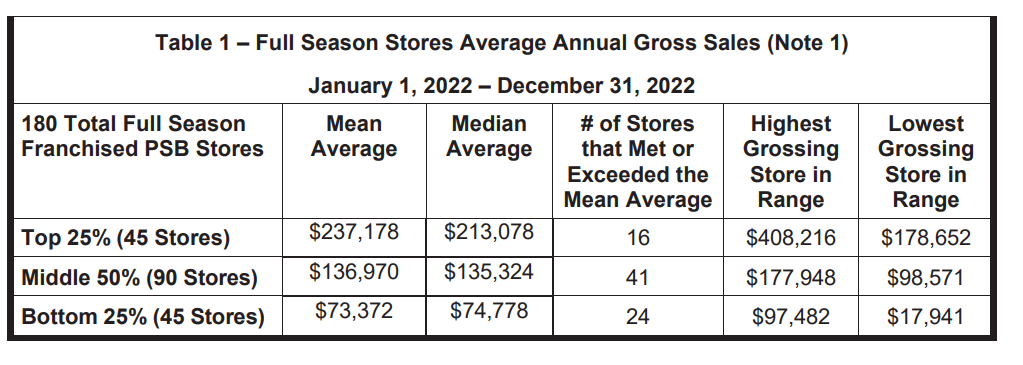

How much revenue can you make with a Pelican’s SnoBalls franchise? A Pelican’s SnoBalls franchised shop makes on average $135,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

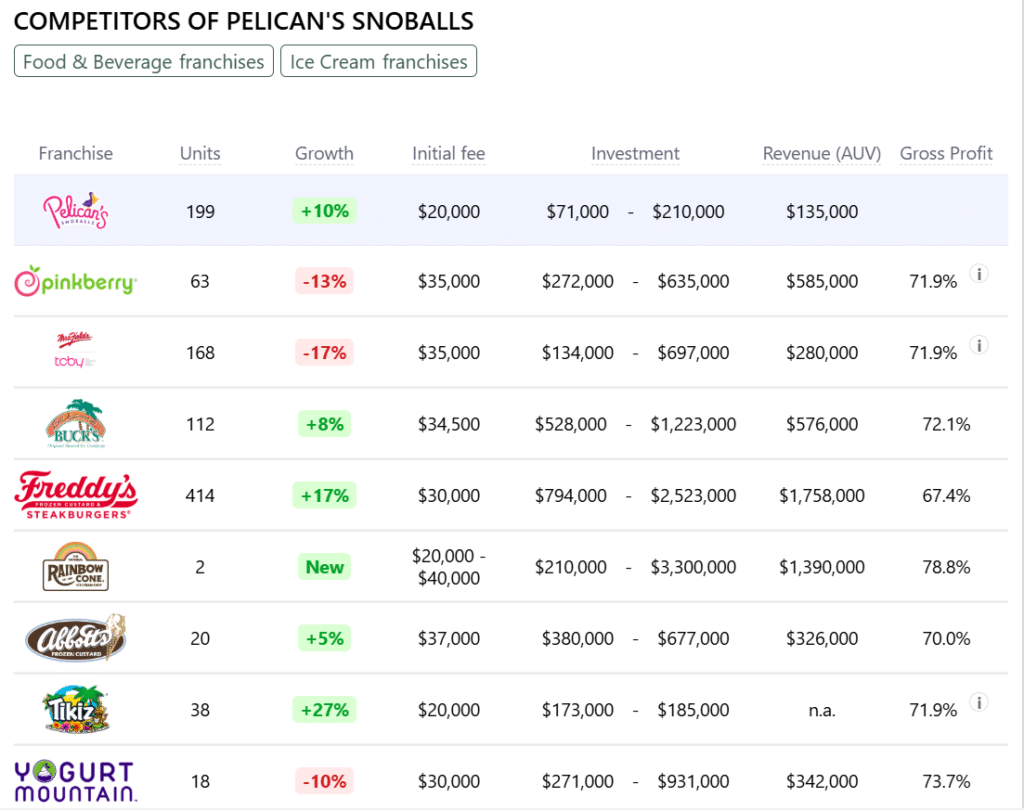

This compares to $524,000 yearly revenue for similar ice cream franchises. Below are a few Pelican’s SnoBalls competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Pelican’s SnoBalls locations are there?

As of the latest data, Pelican’s SnoBalls operates over 200 locations across more than ten states. The company began franchising in 2011 and has experienced significant growth since then. Each location is individually owned and operated by franchisees; there are no company-owned stores

What is the total investment required to open a Pelican’s SnoBalls franchise?

The total investment required to open a Pelican’s SnoBalls franchise ranges from $71,000 to $210,000.

What are the ongoing fees for a Pelican’s SnoBalls franchise?

Pelican’s SnoBalls requires franchisees to pay an ongoing royalty fee of 8% of their monthly gross sales. This fee supports the continuous development and support provided by the franchisor. Notably, Pelican’s SnoBalls does not mandate a separate marketing or advertising fee, allowing franchisees more flexibility in their local promotional efforts.

What are the financial requirements to become a Pelican’s SnoBalls franchisee?

How much can a Pelican’s SnoBalls franchise owner expect to earn?

The average gross sales for a Pelican’s SnoBalls franchise are approximately $0.14 million per location. Assuming a 15% operating profit margin, $0.14 million yearly revenue can result in $23,000 EBITDA annually.

Who owns Pelican’s SnoBalls?

Pelican’s SnoBalls is owned by co-CEOs Gregg Fatool and Randall Wright, who acquired the business from founder Adrian Johnson in 2017.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.