Restore Hyper Wellness Franchise FDD, Profits & Costs (2025)

Restore Hyper Wellness, founded in 2015 by Jim Donnelly and Steve Welch in Austin, Texas, focuses on proactive health solutions. Their innovative Hyper Wellness® concept includes services like cryotherapy, IV drip therapy, infrared saunas, and red light therapy.

The company started franchising in 2017, with initial locations in Texas, Virginia, and Connecticut. By 2024, Restore aims to have over 235 locations nationwide, driven by strategic growth and investments.

What sets Restore apart is its integrated wellness approach. By offering multiple therapies under one roof, it provides tailored, holistic care. This model enhances customer satisfaction and supports their mission to make wellness affordable and accessible.

Initial Investment

How much does it cost to start a Restore Hyper Wellness franchise? It costs on average between $777,000 – $1,323,000 to start a Restore Hyper Wellness franchised facility.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of studio you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $44,500 |

| Architect Fees | $15,000 – $30,000 |

| Permitting Fees | $3,000 – $10,000 |

| Leasehold Improvements | $325,000 – $600,000 |

| Equipment | $168,674 – $269,925 |

| Frontage Sign | $7,000 – $15,000 |

| Furnishings & Fixtures | $13,000 – $30,000 |

| Travel Costs for Launch Training | $4,500 – $6,000 |

| Grand Opening Marketing Expenses | $25,000 |

| Three Months’ Rent | $9,000 – $44,000 |

| Security Deposit | $3,000 – $16,000 |

| Materials and General Supplies | $10,500 – $15,000 |

| Technology System | $6,000 – $16,000 |

| Medical Supplies | $10,000 – $13,000 |

| Esthetician Supplies | $10,000 – $11,000 |

| Shipping & Handling Costs | $8,000 – $15,000 |

| Equipment Installation Costs | $22,000 – $32,000 |

| Professional Fees | $5,000 – $10,000 |

| Commercial Surety Bond | $500 – $2,000 |

| Insurance Cost | $12,500 – $19,000 |

| Additional Funds – Three Months | $75,000 – $100,000 |

| Total Estimated Initial Investment | $777,174 – $1,323,425 |

Average Revenue (AUV)

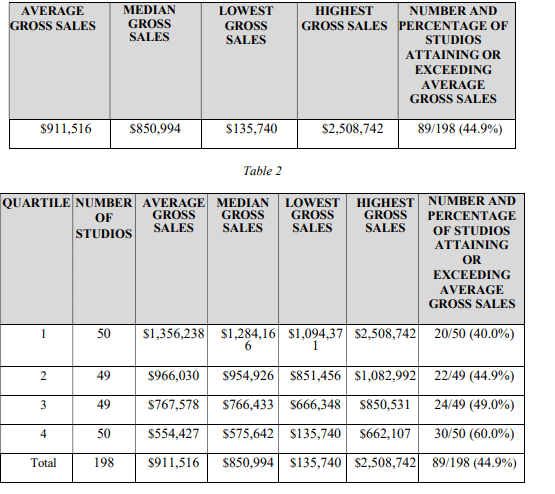

How much revenue can you make with a Restore Hyper Wellness franchise? A Restore Hyper Wellness franchised studio makes on average $851,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Restore Hyper Wellness locations are there?

Restore Hyper Wellness operates 209 locations across the U.S. These include both franchise-owned and company-owned locations, with the majority being franchise operations.

What is the total investment required to open a Restore Hyper Wellness franchise?

The total investment required to open a Restore Hyper Wellness franchise ranges from $777,000 to $1,323,000.

What are the ongoing fees for a Restore Hyper Wellness franchise?

Restore Hyper Wellness franchisees are required to pay a royalty fee of 7-8% of gross sales and a marketing fee of 2% of gross revenues. Additionally, franchisees are required to pay a minimum monthly royalty of $3,500 starting in the second year of operation.

These fees cover support from the franchisor, including brand management and marketing efforts to help maintain consistency across locations.

What are the financial requirements to become a Restore Hyper Wellness franchisee?

To become a Restore Hyper Wellness franchisee, you must meet certain financial requirements. These include having a minimum net worth of $1 million and at least $300,000 in liquid assets.

These financial thresholds are necessary to ensure that franchisees have the capital to cover startup costs, operational expenses, and any unexpected challenges during the early stages of the business.

How much can a Restore Hyper Wellness franchise owner expect to earn?

The average gross sales for a Restore Hyper Wellness franchise are approximately $0.85 million per location. Assuming a 15% operating profit margin, $0.85 million yearly revenue can result in $128,000 EBITDA annually.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.