Right at Home Franchise FDD, Profits & Costs (2025)

Right at Home, an esteemed name in the home care franchise industry, was founded by Allen Hager in 1995 in Omaha, Nebraska.

Hager’s background in hospital administration and witnessing the struggles of older patients transitioning back home after hospital stays led him to establish a service that provides ongoing assistance to aging adults or those with disabilities within the comfort of their own homes.

After refining the business model for five years, Right at Home began franchising in 2000, rapidly growing across multiple countries, serving tens of thousands of clients daily.

Headquartered in Omaha, Nebraska, Right at Home stands out in the crowded space of home care services by offering an extensive support system to its franchisees, including robust training and resources, and a unique business model focused on client-centered care.

Initial Investment

How much does it cost to start a Right at Home franchise? It costs on average between $92,000 – $165,000 to start a Right at Home franchised business.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of facility you choose, the location, and whether the franchisee chooses to lease or purchase the property.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $49,500 |

| Real Estate/Rent | $2,850 – $5,800 |

| Rent Deposits | $950 – $5,800 |

| Leasehold Improvements | $0 – $3,000 |

| Insurance | $6,000 – $10,000 |

| Furniture and Fixtures | $2,500 – $6,000 |

| Computer Hardware and Software | $3,750 – $9,250 |

| Other Office Equipment and Supplies | $1,000 – $6,359 |

| Right at Home Personal Care Policy and Procedure Manual | $1,200 – $1,700 |

| Technology and Training Set Up Fee | $1,000 – $2,500 |

| Home Care Operating Software Setup and Training Fee | $0 – $750 |

| Ongoing Technology Fee | $2,100 |

| Home Care Operating Software Fee (based on clients) | Based on your number of clients |

| Training | $3,000 – $8,000 |

| Transportation (Lines, Hotels, and Restaurants) | As incurred |

| Initial Opening Marketing | $750 – $4,350 |

| Permits and Licenses | $200 – $2,700 |

| Professional Fees | $300 – $3,500 |

| Signage | $0 – $4,000 |

| Additional Funds (Three Months) | $17,000 – $40,000 |

| TOTAL | $92,100 – $165,309 |

Average Revenue (AUV)

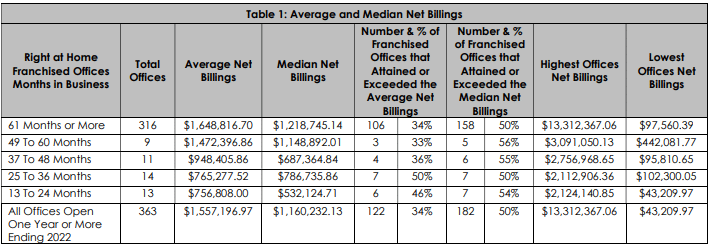

How much revenue can you make with a Right at Home franchise? A Right at Home franchised center makes on average $1,342,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

This compares to $784,000 yearly revenue for similar in-home care franchises.

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Right at Home locations are there?

As of the latest data, Right at Home operates over 551 locations. The majority of these are franchise-owned, while only a small portion are company-owned. This widespread network demonstrates the brand’s strong presence in the home care industry.

What is the total investment required to open a Right at Home franchise?

The total investment required to open a Right at Home franchise ranges from $92,000 to $165,000.

What are the ongoing fees for a Right at Home franchise?

For a Right at Home franchise, the ongoing fees include a royalty fee of 5% of gross sales. Additionally, franchisees are required to contribute a marketing fee of 2% of gross sales, which helps support national advertising efforts.

These fees are crucial for maintaining brand consistency, supporting franchisee success, and driving local and national marketing campaigns that benefit the entire franchise network.

What are the financial requirements to become a Right at Home franchisee?

To become a Right at Home franchisee, you need a minimum net worth of $750,000 and at least $150,000 in liquid capital. These financial requirements are set to ensure that franchisees have the resources necessary to establish and sustain the business effectively.

How much can a Right at Home franchise owner expect to earn?

The average gross sales for a Right at Home franchise are approximately $1.34 million per location. Assuming a 15% operating profit margin, $1.34 million yearly revenue can result in $201,000 EBITDA annually.

Who owns Right at Home?

Right at Home is owned by Right at Home, LLC, a private company. It was founded in 1995 by Allen Hager. The company provides in-home care and assistance for seniors and adults with disabilities, focusing on allowing individuals to maintain independence while receiving essential care.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.