Smoothie King Franchise FDD, Profits & Costs (2025)

Smoothie King was founded in 1973 and is headquartered in Dallas, Texas. It began franchising in 1989 and has grown into the largest smoothie and smoothie bowl brand worldwide, with over 1,350 locations. The franchise’s mission is to inspire healthier lifestyles by offering smoothies tailored to specific health goals.

The menu features a variety of smoothies designed for fitness, wellness, and meal replacements. Smoothie King’s focus on customization and high-quality ingredients distinguishes it from competitors. The brand regularly updates its offerings to keep up with trends and customer preferences.

Franchisees benefit from strong support, including top-tier training, marketing services, and ongoing operational help. Smoothie King’s proven business model and market strength make it an appealing opportunity for investors.

Initial Investment

How much does it cost to start a Smoothie King franchise? It costs on average between $346,000 – $1,278,000 to start a Smoothie King franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property. Smoothie King offers 2 types of franchises:

| Location Type | Initial Investment |

|---|---|

| Traditional end-cap or in-line location | $346,350 – $679,465 |

| Free-standing drive-thru location | $661,150 – $1,277,650 |

We are summarizing below the main costs associated with opening a Smoothie King Free-standing drive-thru location. For more information on costs required to start a Smoothie King franchise, refer to the Franchise Disclosure Document (Item 7).

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $25,000 – $30,000 |

| Three Months’ Rental & Deposit | $5,000 – $30,000 |

| Technology Systems | $12,000 – $14,500 |

| Grand Opening Marketing | $7,500 – $15,000 |

| Travel and Training Expenses | $2,700 – $6,000 |

| Insurance (First Year’s Premium) | $3,500 – $7,500 |

| Other Prepaid Expenses | $14,700 – $29,400 |

| Start-Up Supplies, Inventory | $24,750 – $25,500 |

| Furniture, Fixtures & Equipment, Millwork | $109,000 – $139,000 |

| Architectural & Engineering Services | $30,000 – $50,000 |

| Signage | $28,000 – $38,000 |

| Leasehold Improvements | $350,000 – $825,000 |

| Legal, Accounting & Organizational Costs | $500 – $4,000 |

| Miscellaneous Costs | $1,000 – $5,000 |

| Drive-Thru | $25,000 – $33,750 |

| Additional Funds — 3 Months | $15,000 – $25,000 |

| TOTAL | $661,150 – $1,277,650 |

Average Revenue (AUV)

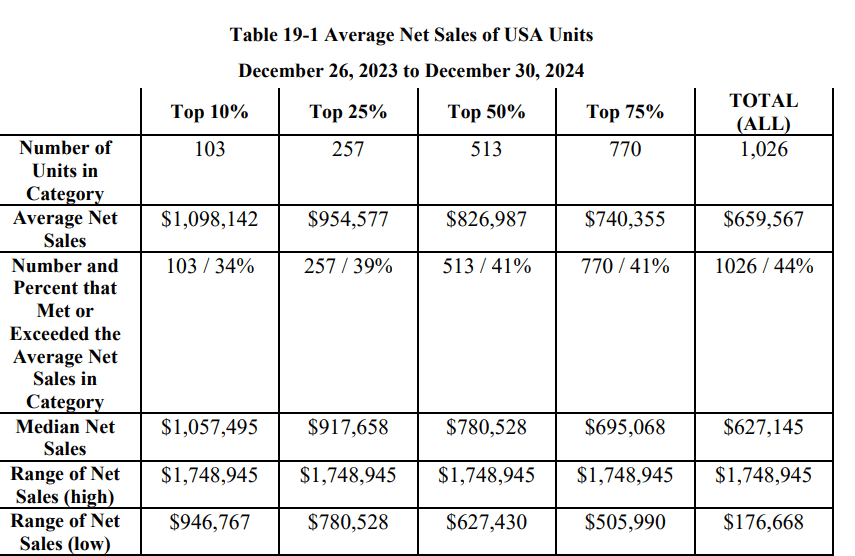

How much revenue can you make with a Smoothie King franchise? A Smoothie King franchised restaurant makes on average $627,000 in revenue (AUV) per year.

Here is the extract from the Franchise Disclosure Document:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Smoothie King locations are there?

As of the latest data, Smoothie King operates a total of 1,201 locations worldwide. Of these, approximately 1,149 units are franchised and 52 are company-owned. The majority of Smoothie King’s presence is franchise-driven, with most stores being independently operated by franchisees.

What is the total investment required to open a Smoothie King franchise?

The total investment required to open a Smoothie King franchise ranges from $346,000 to $1,278,000.

What are the ongoing fees for a Smoothie King franchise?

For a Smoothie King franchise, the ongoing fees include a royalty fee of 6% of gross sales or a minimum of $500 per month, whichever is higher. This fee grants franchisees the right to use the brand’s name and operational systems.

Additionally, franchisees must contribute 3% of their gross sales to national marketing efforts. In regions with an established regional marketing fund, the marketing fee can increase to 2% of gross sales. These fees help maintain brand consistency and support marketing efforts across all franchise locations.

What are the financial requirements to become a Smoothie King franchisee?

To become a Smoothie King franchisee, there are specific financial requirements that must be met. Prospective franchisees need to have a minimum net worth between $300,000 and $500,000. This requirement ensures that they possess the financial stability to support the business, including initial investments and any operational costs that arise.

Additionally, franchisees are required to have liquid assets of $100,000 to $150,000. These liquid assets are essential for covering upfront costs, such as franchise fees, equipment purchases, and initial operating expenses.

How much can a Smoothie King franchise owner expect to earn?

The average gross sales for a Smoothie King franchise are approximately $0.63 million per location. Assuming a 15% operating profit margin, $0.63 million yearly revenue can result in $95,000 EBITDA annually.

Who owns Smoothie King?

Smoothie King is owned by Wan Kim, a South Korean entrepreneur who acquired the company in 2012. Before purchasing Smoothie King, Wan Kim had been a franchisee of the brand since 2002. Under his leadership, the company has focused on expanding both domestically and internationally, particularly in South Korea.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.