Supporting Strategies Franchise FDD, Profits & Costs (2025)

Supporting Strategies was established in 2004 by Leslie Jorgensen in the Greater Boston, Massachusetts area with the goal of delivering outsourced bookkeeping and back-office support to small and mid-sized businesses. As the need for reliable and flexible financial services grew, the brand expanded its reach by introducing franchising in 2013.

The company is now based in Beverly, MA, and has grown into a nationwide network with more than 100 franchise locations, each independently owned and operated.

Supporting Strategies provides a wide range of professional services that cover bookkeeping, accounts payable and receivable, payroll management, financial reporting, and controller-level guidance.

All solutions are carried out by experienced financial professionals who leverage secure cloud-based tools along with the brand’s proprietary workflow platform, WorkPlace™, to ensure streamlined processes and scalable support for clients.

Initial Investment

How much does it cost to start a Supporting Strategies franchise? It costs on average between $75,000 – $98,000 to start a Supporting Strategies franchised facility.

This investment covers expenses such as technology, software, office setup, training, and initial working capital. The total amount can vary based on several factors, including the size of the territory, local market conditions, and whether the franchisee operates from a home office or leases a separate workspace.

| Type of Expenditure | Amount |

|---|---|

| Initial Franchise Fee | $60,000 |

| Real Estate | See Note |

| Equipment and Furniture | $0 to $500 |

| Supplies & Misc. Expense | $0 to $250 |

| Insurance | $2,850 to $3,000 |

| Virtual Cloud or Virtual Key (2 users for first 3 months) | $600 to $1,200 |

| Internet Access | $120 to $240 |

| Legal | $1,000 to $3,000 |

| Additional Funds (first 6 months) | $10,000 to $30,000 |

| TOTAL | $74,570 to $98,190 (Does Not Include Real Estate Costs) |

Average Revenue (AUV)

How much revenue can you make with a Supporting Strategies franchise? A Supporting Strategies franchised business makes on average $434,000 in revenue (AUV) per year.

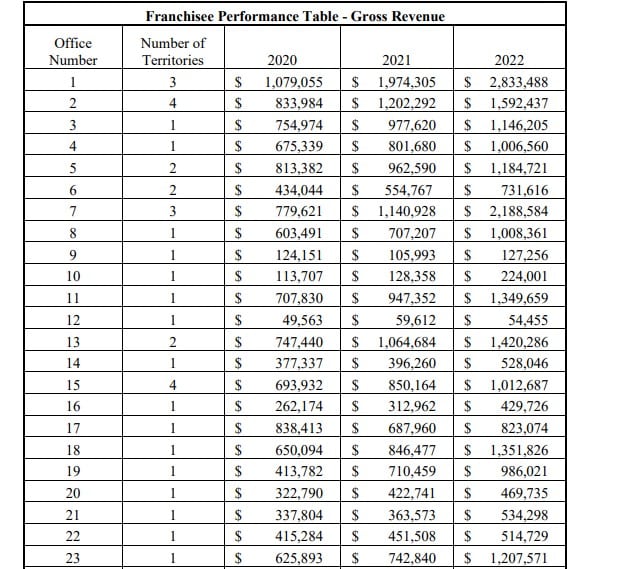

Here is the extract from the Franchise Disclosure Document:

Supporting Strategies Franchise Disclosure Document

Frequently Asked Questions

How many Supporting Strategies locations are there?

As of the latest available data, Supporting Strategies has 107 franchised locations.

What is the total investment required to open a Supporting Strategies franchise?

The total investment required to open a Supporting Strategies franchise ranges from $75,000 to $98,000.

What are the ongoing fees for a Supporting Strategies franchise?

A Supporting Strategies franchise requires franchisees to pay ongoing fees that include a royalty fee of 10% of gross sales. In addition, franchisees must contribute a marketing and advertising fee of 2% of gross sales, which supports the brand’s promotional efforts and system-wide marketing initiatives.

What are the financial requirements to become a Supporting Strategies franchisee?

To become a Supporting Strategies franchisee, you must meet certain financial thresholds. Specifically, you need a minimum net worth of $250,000 and liquid capital of $100,000.

Who owns Supporting Strategies?

The Supporting Strategies franchise is owned by Outliers Capital, a private equity firm that acquired the brand to support its continued growth and expansion in the outsourced bookkeeping and business support services sector.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. SharpSheets is an independent educational resource and is not affiliated with, endorsed by, or representing any franchisor mentioned on this website. Where noted, figures are taken from the franchisor’s Franchise Disclosure Document (FDD). In some cases, we may provide independent calculations or estimates based on publicly available information. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.