Taco Bell Franchise FDD, Profits & Costs (2025)

Taco Bell, a subsidiary of Yum! Brands, Inc., is a fast-food restaurant chain specializing in Mexican-inspired cuisine. Founded in 1962 by Glen Bell in Downey, California, Taco Bell has grown into a global fast-food giant.

The company, currently headquartered in Irvine, California, began franchising just three years later, in 1965, which has been a key driver of its exponential growth. Taco Bell differentiates itself from competitors by focusing on affordability and innovation.

Their menu boasts value offerings like dollar menus and craveable items like Doritos Locos Tacos, constantly pushing the boundaries of fast-food flavors.

This unique combination of affordability and trendy offerings has cemented Taco Bell’s position as a major player in the fast-food industry.

Initial Investment

How much does it cost to start a Taco Bell franchise? It costs on average between $835,000 – $1,815,000 to start a Taco Bell franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location, and whether the franchisee chooses to lease or purchase the property. Taco Bell offers 2 types of franchises:

| Type of Expenditure | Amount |

|---|---|

| Background Check Fee | $500 – $700 per person |

| Initial Franchise Fee | $25,000 |

| First Unit Construction Services | $27,250 |

| Optional Real Estate Services | $10,000 – $37,250 |

| Permits, Licenses, Security Deposits | $75,000 – $150,000 |

| Real Property | $45,000 – $150,000 |

| Building/Site Construction | $450,000 – $900,000 |

| Equipment / Signage / Decor / POS | $250,000 – $450,000 |

| Initial Inventory | $7,000 – $10,000 |

| Grand Opening Expense | $5,000 |

| Additional Funds – 3 months | $40,000 – $60,000 |

| Total Estimated Initial Investment | $934,750 – $1,815,200 |

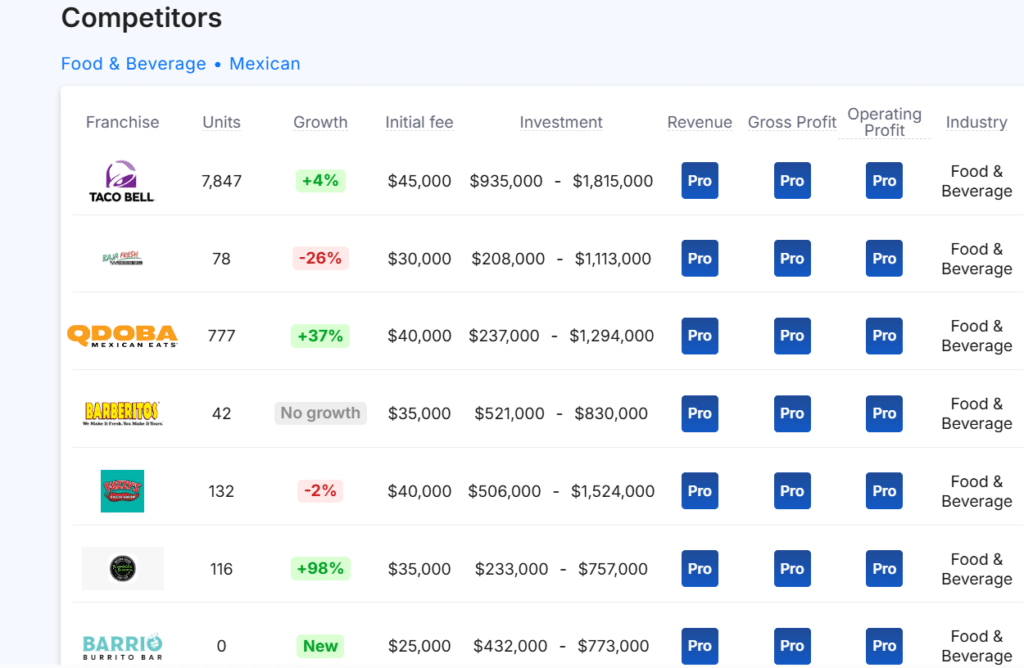

Competitors

Below are a few Taco Bell competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Taco Bell locations are there?

As of the latest data, Taco Bell operates 7,847 locations across the United States. This includes approximately 7,349 franchise-owned outlets and 498 company-owned locations.

With such a large number of franchised restaurants, Taco Bell remains a dominant force in the quick-service restaurant industry, offering franchisees access to a well-established brand and a broad customer base.

What is the total investment required to open a Taco Bell franchise?

The total investment required to open a Taco Bell franchise ranges from $935,000 to $1,815,000.

What are the ongoing fees for a Taco Bell franchise?

The ongoing fees for a Taco Bell franchise include a royalty fee of 5.5% of gross sales and a marketing fee of 4.25% of gross sales. These fees are typical for franchise operations and contribute to the franchisor’s support for brand development and advertising.

What are the financial requirements to become a Taco Bell franchisee?

To qualify as a Taco Bell franchisee, you need a minimum net worth of $1,500,000 and at least $750,000 in liquid assets. These financial requirements ensure that franchisees have the resources necessary to operate their business successfully.

Who owns Taco Bell?

Taco Bell is owned by Yum! Brands, Inc., a multinational fast-food corporation. Yum! Brands also owns other well-known fast-food chains, including KFC and Pizza Hut. Taco Bell became part of Yum! Brands in 1978, when it was sold to PepsiCo, which later spun off its restaurant division to form Yum! Brands in 1997.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.