Arby’s Franchise FDD, Profits & Costs (2025)

Arby’s stands as a significant player in the quick-service restaurant (QSR) industry, recognized for its unique positioning and innovative approach to fast food. Founded in 1964, Arby’s has grown to become the second-largest sandwich restaurant brand in the world.

The brand, which is part of the Inspire Brands family, operates from its headquarters in Atlanta, Georgia.

Arby’s differentiates itself through its Fast Crafted® restaurant services, blending the efficiency of quick-service with the quality and personalized care characteristic of fast-casual dining experiences.

Arby’s franchise opportunities offer a compelling investment for those looking to enter the QSR market. The brand’s franchise system benefits from its long-standing industry presence since 1965, capitalizing on proven operational efficiencies, a recognized brand name, and a menu that promises both quality and convenience.

Initial Investment

How much does it cost to start a Arby’s franchise? It costs on average between $645,000 – $2,451,000 to start a Arby’s franchised restaurant.

This includes costs for construction, equipment, inventory, and initial operating expenses. The exact amount depends on various factors, including the type of restaurant you choose, the location and whether the franchisee chooses to lease or purchase the property. Indeed, Arby’s offers 2 types of franchises:

| Location Type | Initial Investment |

|---|---|

| Free-Standing | $861,950 – $2,451,000 |

| Non-Free-Standing | $644,950 – $1,374,000 |

We are summarizing below the main costs associated with opening a Arby’s franchised restaurant. For more information on costs required to start an Arby’s franchise, refer to the Franchise Disclosure Document (Item 7).

| Type of Expenditure | Amount |

|---|---|

| Development Fee | $6,250 – $12,500 |

| Franchise Fee | $0 – $37,500 |

| Fees and Expenses During Training | $5,000 – $23,400 |

| Total Development & Franchise Fees / Training | $11,250 – $73,400 |

| Lease Deposits and Payments | $12,000 – $50,000 |

| Site Costs | $0 – $451,000 |

| Landscaping | $0 – $45,000 |

| Total Site and Real Estate | $12,000 – $546,000 |

| Civil & Architectural Drawings / Prof. Fees | $6,000 – $150,000 |

| Zoning / Permitting Costs | $1,000 – $112,000 |

| Building Costs | $236,000 – $850,000 |

| Equipment | $225,000 – $325,000 |

| Computer Hardware and Software / POS | $32,000 – $55,000 |

| Décor Package | $11,000 – $35,000 |

| Signage & Drive Thru | $25,000 – $88,000 |

| Total Building / Construction / Equipment | $536,000 – $1,615,000 |

| Pre-Opening Wages | $21,300 – $41,200 |

| Opening Inventory | $18,000 – $26,000 |

| Insurance | $8,400 – $14,400 |

| Working Capital / Additional Funds | $33,000 – $100,000 |

| Rent (one month) | $4,000 – $10,000 |

| Business Licenses, Permits, Utilities Deposits | $1,000 – $25,000 |

| Total Pre-Opening / Operating Deposits | $85,700 – $216,600 |

| Total Estimated Initial Investment | $861,950 – $2,451,000 |

Average Revenue (AUV)

How much revenue can you make with a Arby’s franchise? A Arby’s franchised restaurant makes on average $1,263,000 in revenue (AUV) per year.

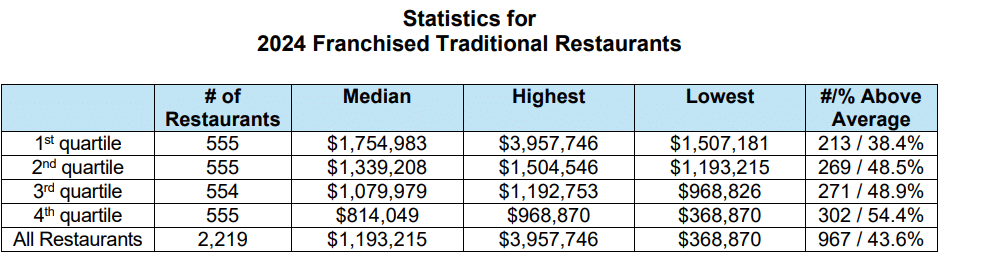

Here is the extract from the Franchise Disclosure Document:

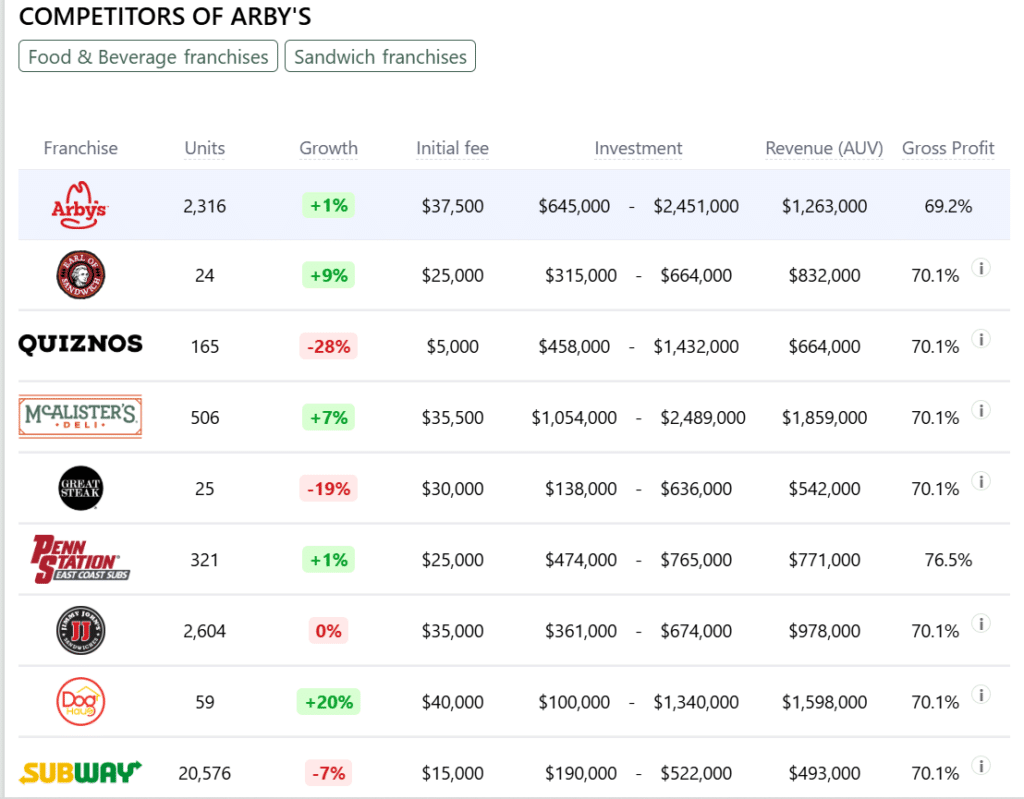

This compares to $838,000 yearly revenue for similar sandwich franchises. Below are a few Arby’s competitors as a comparison:

Download the Franchise Disclosure Document

Frequently Asked Questions

How many Arby’s locations are there?

As of the latest data, Arby’s operates 3,413 locations across the United States. This includes 2,316 franchise-owned outlets and 1,097 company-owned locations.

This extensive network of restaurants makes Arby’s one of the largest quick-service restaurant chains in the country, providing franchisees with a well-established brand presence and a broad customer base.

What is the total investment required to open an Arby’s franchise?

The total investment required to open an Arby’s franchise ranges from $645,000 to $2,451,000.

What are the ongoing fees for an Arby’s franchise?

Arby’s franchisees are required to pay a 4% royalty fee on gross sales for Traditional Restaurants and 6.2% for Non-Traditional Restaurants. Additionally, there is a minimum advertising and marketing service fee of 4.2% of gross sales for Traditional Restaurants, which includes local advertising efforts.

What are the financial requirements to become an Arby’s franchisee?

To qualify as an Arby’s franchisee, you need a minimum net worth of $1,000,000 and at least $500,000 in liquid assets. These financial requirements ensure that franchisees have the resources necessary to operate their business successfully.

How much can an Arby’s franchise owner expect to earn?

The average gross sales for a Arby’s franchise are approximately $1.26 million per location. Assuming a 15% operating profit margin, $1.26 million yearly revenue can result in $189,000 EBITDA annually.

Who owns Arby’s?

Arby’s is owned by Inspire Brands, a large restaurant company that also owns other well-known brands like Buffalo Wild Wings, Sonic Drive-In, Jimmy John’s, and Dunkin’.

Inspire Brands was formed in 2018, and its portfolio includes a variety of restaurant chains across different segments of the food industry.

Arby’s was one of the founding brands of Inspire Brands, having been acquired by the company’s predecessor, Roark Capital Group, in 2011 before Inspire Brands was established.

Disclaimer

Disclaimer: This content has been made for informational and educational purposes only. We do not make any representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the information presented in the article. You should not construe any such information or other material as legal, tax, investment, financial, or other professional advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any franchises, securities, or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the franchise and/or securities laws of such jurisdiction.

All content in this article is information of a general nature and does not address the detailed circumstances of any particular individual or entity. Nothing in the article constitutes professional and/or financial and/or legal advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this article before making any decisions based on such information or other content.